The capital asset pricing model – part 2

Post on: 16 Март, 2015 No Comment

Related Links

Relevant to ACCA Qualification Paper F9

Project-specific discount rates

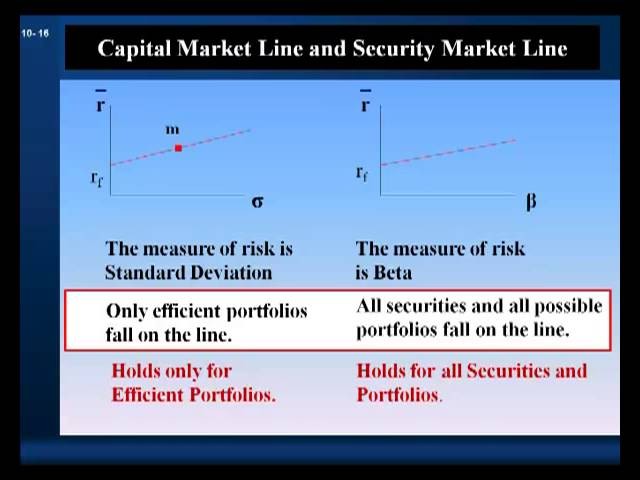

Section E of the Study Guide for Paper F9 contains several references to the capital asset pricing model (CAPM). This article, the second in a series of three, looks at how to apply the CAPM when calculating a project-specific discount rate to use in investment appraisal. The first article in the series introduced the CAPM and its components, showed how the model could be used to estimate the cost of equity, and introduced the asset beta formula. The third and final article will look at the theory, advantages, and disadvantages of the CAPM.

As mentioned in the first article, the CAPM is a method of calculating the return required on an investment, based on an assessment of its risk. When the business risk of an investment project differs from the business risk of the investing company, the return required on the investment project is different from the average return required on the investing company’s existing business operations. This means that it is not appropriate to use the investing company’s existing cost of capital as the discount rate for the investment project. Instead, the CAPM can be used to calculate a project-specific discount rate that reflects the business risk of the investment project.

PROXY COMPANIES AND PROXY BETAS

The first step in using the CAPM to calculate a project-specific discount rate is to obtain information on companies with business operations similar to those of the proposed investment project. For example, if a food processing company was looking at an investment in coal mining, it would need to obtain information on some coal mining companies; these companies are referred to as ‘proxy companies’. Since their equity betas represent the business risk of the proxy companies’ business operations, they are referred to as ‘proxy equity betas’ or ‘proxy betas’.

From a CAPM point of view, these proxy betas can be used to represent the business risk of the proposed investment project. For example, the proxy betas from several coal mining companies ought to represent the business risk of an investment in coal mining.

BUSINESS RISK AND FINANCIAL RISK

If you were to look at the equity betas of several coal mining companies, however, it is very unlikely that they would all have the same value. The reason for this is that equity betas reflect not only the business risk of a company’s operations, but also the financial risk of a company. The systematic risk represented by equity betas, therefore, includes both business risk and financial risk.

In the first article in this series, we introduced the idea of the asset beta, which is linked to the equity beta by the asset beta formula. This formula is included in the Paper F9 formulae sheet and is as follows:

To proceed further with calculating a project-specific discount rate, it is necessary to remove the effect of the financial risk or gearing from each of the proxy equity betas in order to find their asset betas, which are betas that reflect business risk alone. If a company has no gearing, and hence no financial risk, its equity beta and its asset beta are identical.