The Capital Asset Pricing Model_1

Post on: 23 Сентябрь, 2015 No Comment

Investors looking to benchmark against an index or a basket of stocks might consider relative valuation as a method of stock selection. A form of fundamental analysis, relative value models enable an investor to assess current valuations, measure those against similar companies, and factor in certain assumptions (for example forward earnings growth rates).

A relative value model will compare a large number of similar companies, and calculate an average value for the group of assets. For example, the price to earnings ratios of a group of companies could be averaged and compared. In this way, a list of stocks below the average (relatively undervalued) will be compiled, and also a list of stocks above the average valuation (relatively overvalued).

Of course, just because a stock is considered undervalued by such a method does not mean that it will not fall in price: if the whole market is overvalued, then relatively undervalued stocks may still fall in price as the market corrects. However, such models are geared toward momentum traders and give a clearly defined basis for long and short trades.

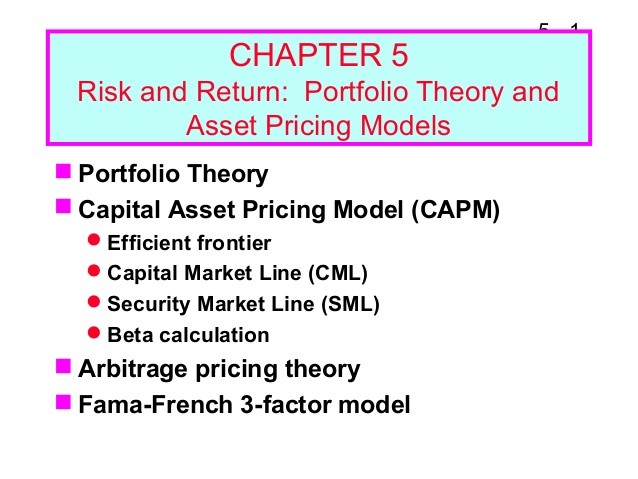

The Capital Asset Pricing Model (CAPM)

Theoretical Basis

For accepting risk to investment capital, an investor would expect a higher potential return, and the higher the risk, the higher the return. It can be assumed that investment in a risk free asset would require the lowest return for investor contentment.

The CAPM was developed in the early 1960’s by William Sharpe, and was the first model to quantify the relationship between risk and anticipated return. Sharpe considered risk to be unavoidable because of the market itself, but also to be able to be diversified. Diversification of risk means that there would be a lowering of risk, and therefore of expected investment return. In other words, investors will only achieve higher returns by accepting market risk.

The CAPM says that if the expected return on an investment with inherent risk is less than the return available on a risk free investment plus a suitable risk premium, then the investment should be ignored. Whilst CAPM’s validity in valuing private companies is obvious, the model is also widely used in the valuation of stocks and as a selection process for portfolio investors.

By looking back at historical data, a stock’s trading relationship (its correlation) to the market can be calculated. Fortunately for investors, this value, called the beta, is widely available: for example by navigating to the section titled ‘technical data’ on yahoo finance. If the beta of a stock has a value of 1, then on historic data it has been shown to move with the market and would be assumed to continue to do so. A beta greater than 1 would indicate greater volatility, while a value less than 1 would indicate lower volatility relative to the market.

For a stock to be considered a good investment in relation to its risk, under the CAPM it would need to satisfy an expected return calculation. This can be done using the expected overall return of the market, the rate of return available on a risk free asset, and the beta of the stock being considered for investment. The formula for this calculation is:

Expected Return = Risk Free Rate + ((Market Return – Risk Free Rate) x Asset Beta)

The generally accepted risk free rate is the rate available on the 90-day treasury bill. If this rate is 5%, and the S&P500 is expected to return 10% over the next twelve months, and the beta of XYZ shares is 1.5, then the expected return on an investment in XYZ shares would be:

5% + ((10% 5%) x 1.5) = 12.5%

CAPM theory assumes that markets work perfectly, and correct to mean over time. Calculations under CAPM also need to be revised for investment horizons of more than one year. Despite these disadvantages, CAPM gives the investor a basis of stock selection that is widely followed by relative value investors. Within such longer-term investment horizons, active traders might seek to augment profits by using technical analysis methods to take advantage of shorter-term trend reversals.