The Best Way to Invest Fundamental or Technical Analysis

Post on: 6 Апрель, 2015 No Comment

Ralph Seger once said, One way to end up with $1 million is to start with $2 million and use technical analysis. I find this quote amusing. A lot of people feel very strongly that technical analysis is about as useful as voodoo for helping you figure out the best investments for your money. I happen to disagree, but before I tell you why, lets take a look at some of the differences between fundamental and technical analysis of investments.

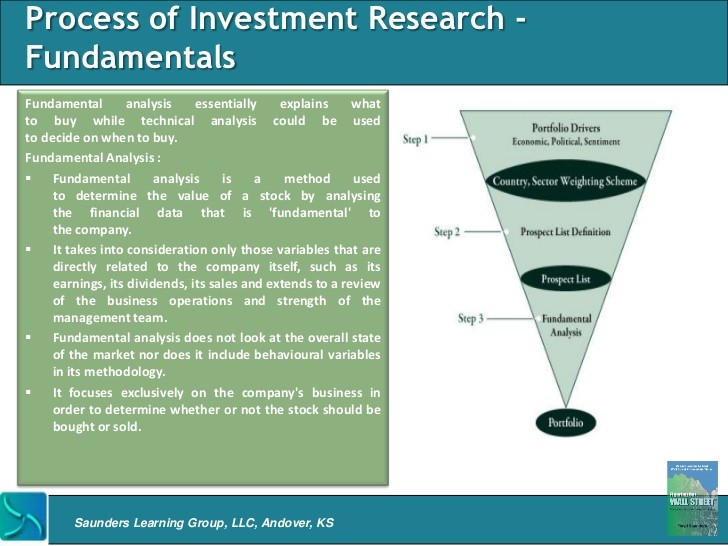

In a nutshell, you can think about fundamental analysis as the more logical, pragmatic part of investing in which you are looking at the financial soundness of a company and its business prospects. Technical analysis, on the other hand, can tell us a lot about the psychological aspects of the market by analyzing past market movements in the companys stock to forecast future movement. You can buy a position in a fundamentally sound company, but if its shares have already run up a lot, you could still find yourself in a losing position on a pullback, something you could have potentially avoided through the use of technical analysis.

Fundamental Analysis

If you use fundamental analysis to decide where to invest your money, there are many different metrics you can use. Here are a few of the basics:

This is just the amount of sales a company has taken in over a set period of time, usually reported on a quarterly and annual basis. The key here is to look at the direction of revenues. Obviously, rising sales are a good thing. If sales have fallen, its important to note why that might be. Does it look like the drop is a one-time glitch, or is it possible that sales could continue to fall due to the success of a competitor, or decreasing demand for the companys products? Does a rise in sales in the fourth quarter necessarily mean the companys prospects are looking up, or is it simply a seasonal uptick due to the holiday season.

Earnings Per Share (EPS)

While revenue is important, earnings are really the bread and butter of corporate success. If a companys sales are increasing, but they are not able to retain those revenues due to excessive expenses or poor management, thats a red flag. You want to invest in companies with rising margins, and therefore rising EPS. You can find historical EPS for most companies as well as EPS estimates for future quarters on most investing websites.

The price to earnings ratio of a company is simply the current stock price divided by its annual earnings per share. So if company XYZ is trading at $27 and it earned $1.50 per share during the past 12 months, its P/E ratio would be 18. That means its trading at 18 times its annual earnings.

When analysts refer to a companys valuation. they are often referring to its P/E ratio. Whats a good P/E ratio? That can depend on who you ask, and it can also vary by sector. For example, high growth stocks like those of technology companies often trade at much higher P/E ratios whereas stable, lower growth companies trade at lower valuations. This should make sense intuitively because if a company has huge growth prospects, then one should be willing to pay a much higher price relative to its current earnings. Analysts often disagree on what constitutes a cheap stock because there is so much debate about what a specific P/E ratio actually means for a given company or industry. There is no one size fits all when it comes to P/E ratios.

Sector Fundamentals

A single companys performance can be heavily influenced by the sector in which it operates. During economic slowdowns, for example, defensive sectors like consumer staples and utilities tend to do better, whereas technology, transportation and financials do better when the economy is on an upswing.

The Big Picture

Its always a good idea to keep the macroeconomic climate in mind when choosing your asset allocation as well as your specific investments. Where are we in the economic cycle? Are we at the beginning, middle, or end of a recession or boom? I like to think about the macro view like the weather; it may not change what you need to do, but it should affect how you do it.

Technical Analysis

While fundamental analysis is much more qualitative and involves more subjectivity, charts are the main tool of technicians. Here are a few chart-watching basics:

Is the price of the stock moving higher or lower? How long has it been doing so? Many chartists will only buy securities that are in uptrends. They may wait for a short-term downtrend to enter, but wont even consider the stock if the longer-term trend is lower.

Ive often said that charts are like a Rorschach (ink blot) test for the market, but volume is its lie detector. Volume can tell us how strong the prevailing trend might be. Decreasing volume can be a sign that the trend might be on the verge of a reversal.

Moving Averages

Adding moving average lines to a chart can help determine the overall trend direction. A moving average line simply plots the average price of a security over a set period of time. For example, the 50-day moving average indicates the average price over the past 50 days. Technicians like to buy when the moving average is trending upward and the price pulls back a touch to allow for a good entry point into the stock.

You will often see a variety of technical indicators above or below a chart. These can indicate whether a security is overbought or oversold as well as the strength of its momentum. There are too many indicators out there to follow all of them. A few of the most common are: stochastics, Moving Average Convergence-Divergence (MACD), and Relative Strength Index (RSI).

Which Is Better?

For decades, fundamental analysis was the only investment method that was given any credibility. That has changed as the advent of high-speed computing has made technical analysis easier and more widely available. Many large investment firms use black box trading, or computer modeling, to determine their entry and exit points.

That means that many of the largest market players are making their trading decisions based on computer algorithms. In fact, some estimate that computerized trading represents up to 70% of the volume on exchanges today. Like it or not, your investments are moving based on technical factors as much as fundamental ones. The markets have changed, and we need to change our strategies with them.

The best approach to investing likely involves some combination of fundamental and technical analysis. I like to choose stocks or sectors that have strong fundamentals and then use technical analysis to help me decide when to buy or sell them.

Which investment method do you prefer?