The Best Mutual Funds for 2013 Top ETFs for 2013

Post on: 16 Март, 2015 No Comment

The AlphaProfit Focus and Core model portfolios are reconstituted with the best mutual funds for 2013 and top ETFs for 2013.

U. S. stocks are on a roll in 2013.

Popular U. S. stock market benchmarks like the Dow Jones Industrial Average ($DJI) and the S&P 500 ($SPX) have hit new all-time highs.

The Fidelity Spartan 500 Index Fund (FUSEX) that tracks the S&P 500 index is up 17% since the middle of November 2012.

Small-cap stocks have done better. The Fidelity Spartan Small Cap Index Fund (FSSPX) and the iShares Russell 2000 Index ETF (IWM) that track the Russell 2000 Index have risen 24% since mid-November.

While developed and emerging markets have also advanced since mid-November, they have generally lagged the U. S. markets.

The Fidelity Spartan International Index Fund (FSIIX) that tracks the MSCI EAFE developed market stock index is up nearly 14%.

The Vanguard FTSE Emerging Markets ETF (VWO) that invests exclusively in emerging markets is up 7%.

Commenting on global stock markets, Dr. Sam Subramanian, Editor of AlphaProfit’s Premium Service Investment Newsletter said, ‘While concerns over rising European debt and slowing growth in emerging markets have restrained gains in the Continent and emerging markets, respectively, strong economic data from the housing sector have helped to alleviate these concerns in the U. S.’

‘In the U. S. stock prices rebounded across a broad group of sectors after Congress acted to avoid the feared fiscal-cliff. Stocks in the finance and consumer discretionary sectors have notably benefited from falling foreclosure rates and rising home prices. Additionally, defensive sectors like health care and utilities have come into favor off-late as European debt worries have escalated’, Dr. Subramanian added.

Within Fidelity sector funds, Fidelity Select Health Care (FSPHX) and Fidelity Select Utilities (FSUTX) are among the best mutual funds for 2013, gaining over 14% each. The S&P 500 benchmark is up 11% in comparison.

Within Select Sector SPDRs, Health Care Select Sector SPDR (XLV) and Consumer Staples Select Sector SPDR (XLP) are among the top ETFs for 2013, gaining over 14% each.

Gold and gold mining stocks found the going tough in this favorable milieu for stocks.

SPDR Gold Shares (GLD) is down 5% this year while Fidelity Select Gold (FSAGX) and Market Vectors Gold Miners (GDX) are both down over 17%.

AlphaProfit’s Premium Service subscribers have reaped rich rewards from recommendations of best mutual funds for 2013 like Fidelity Select Biotechnology (FBIOX) and top ETFs for 2013 like SPDR S&P Capital Markets (KCE) that have gained 20% and 16%, respectively, in the first quarter.

These timely selections have enabled the AlphaProfit Fidelity and ETF model portfolios to gain between 11% and 14% in 2013 .

Subscribers also fattened their wallets in 2013 from AlphaProfit stock recommendations like Newpark Resources (NR), Patterson-UTI Energy (PTEN), and Questcor Pharmaceuticals (QCOR) that gained 19%, 16%, and 23%, respectively.

Headwinds and Tailwinds for the Best Mutual Funds for 2013 and Top ETFs for 2013

Helped by ample monetary stimulus from the Federal Reserve and rising corporate profits, stocks have recovered from their March 2009 lows. Gaining 153%, the S&P 500 has set a new all-time high.

Strong money inflow has helped stocks avoid a measurable corrective phase in 2013. Several technical measures are now overbought and a correction could be just around the corner.

Dr. Subramanian views the European credit crisis, Federal Reserve’s stance on continued stimulus, and EPS growth expectations as headwinds in the near-term for best mutual funds and top ETFs.

Cyprus’s financial system is being rescued at the expense of bank creditors. This raises risks that banks in Portugal, Spain and Italy could come under funding pressure.

The Federal Reserve has already indicated that some members are reluctant to continue stimulus measures. Higher levels of sustained economic growth would raise odds of the Fed reining stimulus measures.

As for corporate earnings, analysts currently expect EPS for S&P 500 member firms to rise rapidly in the second-half of 2013 with EPS growing over 15% in the fourth-quarter. The jury is still out on corporations meeting or exceeding these expectations when they provide 2013 EPS guidance.

Dr. Subramanian is however more constructive in his longer-term outlook for stocks.

‘Modest valuation and low interest rates can serve as powerful tailwinds that can propel the best mutual funds for 2013 and top ETFs for 2013 to new highs after the corrective phase runs its course in the near-term,’ says Dr. Subramanian.

Stocks trade at modest valuation metrics from a historical perspective with S&P 500 stocks yielding 26 basis points more than the 10-year Treasury bond.

Strategy for Investing in the Best Mutual Funds for 2013 and Top ETFs for 2013

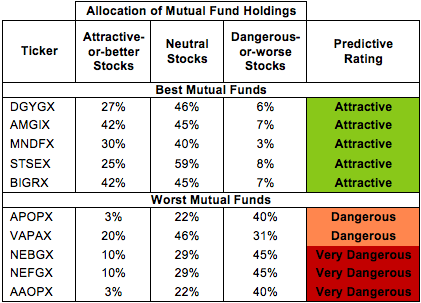

Given the possibility of a roller-coaster ride, it is prudent for investors to employ a flexible and adaptive system like AlphaProfit’s ValuM investment process. This process combines fundamental and technical factors to consistently choose the best Fidelity Select funds and the best sector ETFs .

Compounding at an annual rate of 20.5%. a dollar invested in AlphaProfit’s selection process in 1994 is now worth $36.53 while a comparable investment in the S&P 500 is worth just $4.88 .

Consistent selection of winning mutual fund picks has enabled AlphaProfit’s Premium Service to rank #1 in Hulbert Financial’s investment newsletter rankings 12 times .

AlphaProfit’s Fidelity and ETF model portfolios are repositioned with the best mutual funds for 2013 and top ETFs for 2013.

‘We endeavor to provide AlphaProfit’s Premium Service investment newsletter subscribers the right market timing advice along with recommendations of best mutual funds, ETFs, and stocks. Our objective is to help subscribers invest in the best mutual funds for 2013 and top ETFs for 2013 at the right allocation levels,’ concluded Dr. Subramanian.