The Best ETF Strategies for Japan

Post on: 30 Март, 2015 No Comment

Error.

February 23, 2013

Investors are anticipating a historic shift in Japan’s monetary policy—a shift they expect to finally shake Japanese stocks out of a 20-year slumber. Prime Minister Shinzo Abe had signaled his intent for aggressive monetary stimulus even prior to his election in December. Since then, the yen has slumped and the Nikkei Stock Average has surged, topped off by a 9.5% rise in 2013, the biggest rise among all major developed stock markets.

Little wonder, then, that an eight-week flood of $3.1 billion in new cash has moved into the relatively small niche of exchange-traded funds tied to Japan’s stock market. The ETF money is trying to find the central bank that’s going to ease the most aggressively, says Dave Lutz, head of ETF trading at brokerage Stifel Nicolaus. Right now, that’s Japan. The trend is pronounced enough that one of the Japan funds is the No. 2 asset gatherer in the entire U.S. ETF market this year, trailing only a popular emerging-markets fund.

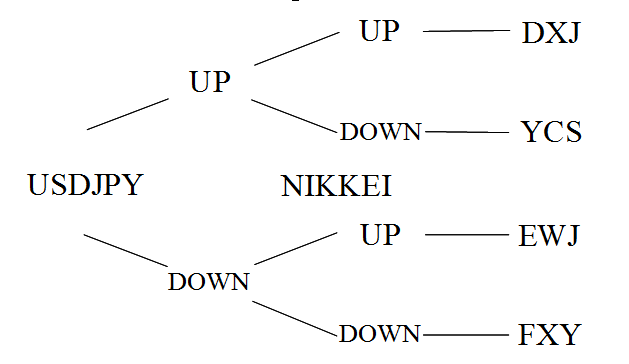

If you’re among the Japan optimists, be aware that currency issues are just as important as your stock-market forecast. As Japanese stocks have risen and the yen fallen, currency-hedged funds have kept better pace, which helps explain investors’ preference lately for a hedged fund over an unhedged one. The WisdomTree Japan Hedged Equity fund (ticker: DXJ), the biggest asset gatherer, has risen 9.6% for the year through Jan. 31, well ahead of the unhedged iShares MSCI Japan Index fund (EWJ), up just 3.6%. That’s due much less to stock selection than to currency impact. The yen-neutral DB X-trackers MSCI Japan Hedged Equity ETF (DBJP) tracks the same index as the iShares but gained 8.8%.

Watch for the difference between hedged and unhedged funds to shrink in the event that the yen stabilizes, or even reverse if the yen manages to move higher.

AS IF KEEPING TRACK OF currency issues wasn’t complicated enough, it’s worth noting that the WisdomTree fund is heavy with export-oriented companies’ stocks such as Honda Motor (HMC). Since those stocks are natural allies of a weak yen—a stronger dollar means Japanese exports are cheaper—they can be expected to drive the WisdomTree fund higher than the DB X-trackers when the currency is weak. The same factor could cause it to trail when the yen strengthens.

A bigger question for buy-and-hold investors is whether it even makes sense to take this single-country plunge at all, after a 2013 gain of 10% or so already. If you fear you’ve missed the run-up, buying a broad international stock fund with a healthy slug of Japan is an attractive middle ground. Two ways to carry out this idea with ETFs: iShares Core MSCI EAFE ETF (IEFA), which bears a 21% Japan weighting, a cheap 0.14% expense ratio, and more small-company stocks than the standard EAFE index. Or there’s the Vanguard FTSE All-World ex-US ETF (VEU), charging a similar 0.18%, with 13% invested in Japan.

That middle ground idea looks more enticing in light of some recent Leuthold Group research. The firm notes that investors who buy last year’s second-best performer among seven widely held assets—real estate investment trusts, the Standard & Poor’s 500, the Russell 2000, gold, Treasury bonds, the GSCI commodity index, and the EAFE international-stock index—have enjoyed an annualized 15.6% return since 1973. The theory is that the No. 2 asset tends to have more room to run than the top performer. This year’s pick is the EAFE global stock index, with its 20% Japan weighting.

Optimists were given a new number last week—$9 trillion (or close to it), the amount Japanese households are thought to have saved over the past two decades. If even a fraction of that goes into Japan’s stock market, investors will benefit. But if too much optimism makes you nervous, there are still funds built to exclude Japan. iShares MSCI Pacific ex-Japan (EPP), a developed-market fund that is the most widely owned ex-Japan Asian stock ETF, gained 5.1% in January, just a hair behind the MSCI EAFE’s 5.2%. Shareholders aren’t yet regretting the absence of Japan.

THE CRAZE FOR LOW-VOLATILITY INVESTING —or investing in new funds to capitalize on it—continues. Four new ETFs launched this month on the theme. First came the PowerShares S&P 400 Low Volatility (XMLV) and PowerShares S&P 600 Low Volatility (XSLV), which aim to track the least volatile stocks in the S&P MidCap 400 Index and the S&P SmallCap 600 Index, respectively. Then, last week, State Street unveiled the SPDR Russell 1000 Low Volatility ETF (LGLV) and SPDR Russell 2000 Low Volatility ETF (SMLV). The trend amounts to a bet that investors will give up some bull-market returns for the hope of fewer wild price swings. They did it last year with the most popular one: PowerShares S&P 500 Low Volatility Portfolio (SPLV) saw a rush of new investors despite undershooting the plain-vanilla S&P 500’s total return by six percentage points.