The Best Dividend Capture Strategy Guide on the Web

Post on: 10 Июнь, 2015 No Comment

How the Dividend Capture Strategy Works

Theoretically, a stocks price should reflect the expected dividend payment prior to the ex-dividend date. Because investors purchasing the stock on the ex-dividend date do not receive the dividend, the price of the stock should theoretically fall by the dividend amount.

For example, Lets say XYZ Corp pays a $1 dividend. Prior to the ex-dividend date, XYZ trades at $100 per share. On the ex-dividend date, XYZ should theoretically be trading at $99.

In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy.

Lets now say that XYZ Corp is trading at $100 per share prior to the ex-dividend date. An investors purchases XYZ during this time, then sells the stock on the ex-dividend date when it is trading at $99.50. The investor collects the $1 dividend a few weeks later, resulting in a total return of $0.50.

Essentially, the dividend capture strategy aims to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates.

Advantages of the Dividend Capture Strategy

Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. An experienced capture strategist can find a stock with an ex-dividend date for every day of the month.

By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. Obviously, this could lead to big profits if the dividend payouts are reasonably high. This strategy also does not require much in the way of fundamental or technical analysis.

A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. See our complete Ex-Dividend Calendar .

Limitations of the Dividend Capture Strategy

Although capturing dividends can be an easy way to make quick income, it comes with several drawbacks. A list of the major disadvantages includes:

Negative Price Adjustment on the Ex-Dividend Date

Companies don’t just allow investors to hold their stock for one day, collect the dividend that is meant to reward long-term shareholders, and sell it immediately. The stock exchanges automatically negatively adjust the stock’s price on the ex-dividend date to reflect the upcoming payout. So if stock XYZ will pay a $1 dividend, its share price will open up on the ex-dividend date about $1 lower. This fact makes capturing dividends a much more difficult process than many people initially believe. Precise timing is needed to buy the stock at an appropriate level, hold it for a short time, collect the dividend, and actually make money on the transaction (if you collect $1 dividend but sell the stock at a price $1 lower than you bought it, it’s nothing but a wash).

Market Action

Most capture strategists are counting on the stock price to not fall by the entire amount of the dividend due to external market forces. For example, a stock that closes at $30.00 the day prior to the ex-date of a $1 payout should theoretically open at $29.00 on the ex-dividend date. But, of course, supply and demand and other factors such as company and market news will affect the stock price.

While the capture strategist hopes that the adjustment is less than the dividend, these forces can often push the price in the wrong direction and more than offset the dividend payment with a capital loss. For example, if bad news came out the morning of the ex-dividend date, then the aforementioned stock might drop to $28 a share, leaving the strategist with a net loss of $1.50, unless the shares are held until the price rises back to the breakeven level. This issue is further exacerbated by institutions and day traders seeking to profit from the inevitable reactionary price movements that occur when dividends are declared and paid. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases.

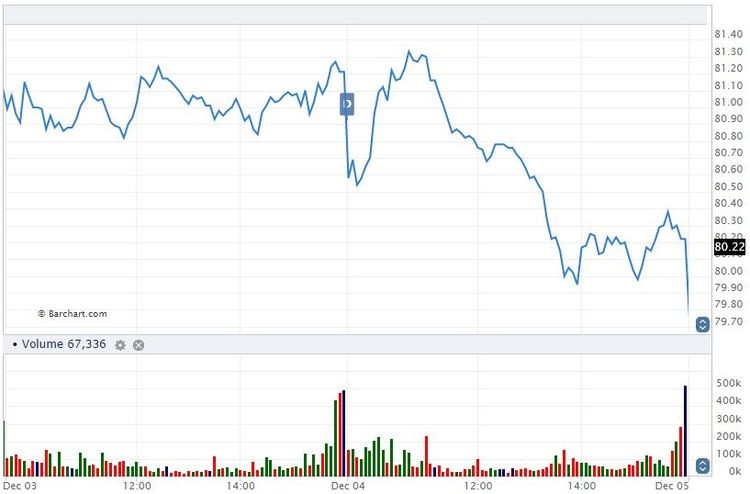

An example of this disadvantage can be seen with Walmart (WMT ):

On December 3, 2013 a day before WMTs ex-dividend date, the stock closed at $81.21. Lets say you purchased the stock at this price on that day. On the ex-dividend day, the stock traded lower (as it theoretically should have), but you sold the stock at the close at $80.22.

WMTs dividend was at $0.47, which means on the trade you lost $0.52. Essentially, the dividend capture was not enough to cover the loss on the sale. The only time an investor could have made a profit on this trade was when the stock traded above $80.75 on the ex-dividend date, which only happened between 10:00 AM and 12:00 PM. This is a great example of how precise timing is crucial.

Brokerage Fees

The dividend capture strategy is probably not a smart one to use with a full-commission broker. A large amount of principal is required to begin with, and trading large blocks of shares on a daily basis can easily result in commissions being paid that far outweigh the dividends received. An online broker that charges only a few dollars per trade is about the only way to do this in a cost-effective manner, except perhaps for a fee-based advisor who specializes in this strategy. Traders who buy on margin also need to be aware of how much interest they are paying to get a larger dividend.

The Bottom Line

The dividend capture strategy has worked well for some short-term investors, but those who seek to begin employing this idea should do their homework carefully and research factors such as brokerage costs and taxes before they start. For more information on dividend capture strategies, consult your financial advisor.