The Best Core Equity Holding For Your ETF Portfolio Vanguard Total Stock Market ETF (NYSEARCA VTI)

Post on: 16 Март, 2015 No Comment

Summary

- Compares 5 low cost core equity ETF holdings.

- Schwab U.S. Broad Market ETF has the lowest expense ratio in this category.

- The best core equity ETF may vary depending on your scenario.

Your core equity holding in a low cost ETF portfolio is like the first round draft pick. It should be a long-term consistent performer that you can build the rest of your team around. Your core equity position should be low cost, but also encompass a large breadth of stocks. This article addresses which core fund is best for your portfolio.

The Contenders

Vanguard Total Stock Market ETF (NYSEARCA:VTI ) — VTI covers the entire U.S. stock market for a very low 0.05% expense ratio. It covers essentially every U.S. stock (close to 3,500) with a market cap over $10 million. Which means it covers a larger amount of small and micro cap companies than many total stock market funds. This has resulted in slightly higher returns and volatility than funds that only cover large cap funds and funds that cover less small and micro cap companies.

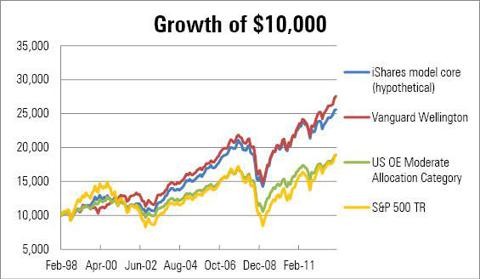

iShares Core S&P Total US Stock Mkt (NYSEARCA:ITOT ) - ITOT covers the S&P 1500 index, which encompasses about 90% of the U.S. stock market. Unlike the Vanguard Total Stock Market Index, it doesn’t cover all small and microcap companies, which results in slightly less returns and volatility. It also has a very low expense ratio at 0.07% and can trade commission free if you are a Fidelity client.

iShares Russell 3000 (NYSEARCA:IWV ) - As the name implies IWV covers 3000 stocks, which is like the Vanguard Total Stock Market Index. It covers many small and micro cap companies. Unlike VTI, it has a much higher expense ratio of 0.20% but Fidelity clients can trade it commission free.

Schwab US Broad Market ETF (NYSEARCA:SCHB ) - Schwab has designed their ETFs to have the lowest expense ratios and SCHB is no exception with a category lowest 0.04%. SCHB covers about 2500 stocks, which is more than ITOT but less than VTI and IWV. Schwab clients can also trade this ETF commission free.

Vanguard S&P 500 ETF (NYSEARCA:VOO ) - Warren Buffett has instructed in his will that his assets be put in the Vanguard S&P 500 Fund. That seems good enough for us. It has the lowest expense ratio that tracks the S&P 500 index at 0.05%, but it only covers large cap companies. It tends to have less volatility and returns than the other ETFs listed because of the exclusion of small and micro cap companies.