The best Australian stocks

Post on: 16 Март, 2015 No Comment

More to the story with Australias most popular shares

These large companies have many shareholders, it follows, but that’s not just because they have such huge market caps. There’s another factor.

Australia’s truly enormous shareholder bases are the result not just of large market capitalisations but also of being previously government owned, whereby Australian citizens got the first opportunity to invest in the companies.

A quick glance at the table below shows that Commonwealthand Telstra, both of which in their former lives were large government-owned entities, boast the largest shareholder numbers in the country. (Smaller government floats such as Qantas and CSL have smaller shareholder bases. In Qantas’ and CSL’s case the number of shareholders is 124,000 and 94,800 respectively.)

Number of shareholders (as of this writing)

Commonwealth Bank (ASX: CBA) = 786,000

National Australia Bank (ASX: NAB) = 483,000

Telstra (ASX: TLS) = 1.4 million

BHP Billiton (ASX: BHP) = 585,000

It’s not surprising the most widely held stocks are also the most widely followed and popular stocks ! It’s difficult for any investor to open a newspaper to the business pages, or click on their favourite business news site, and not hear about the latest developments and share price moves of the these 10 companies.

Here’s the kicker: it’s not the most widely owned or most widely followed stocks which necessarily provide the greatest returns to shareholders. Being extremely popular doesn’t equate to extreme wealth creation. In fact, often it is quite the opposite! ‘Undiscovered’ growth stocks can provide the greatest long-term returns.

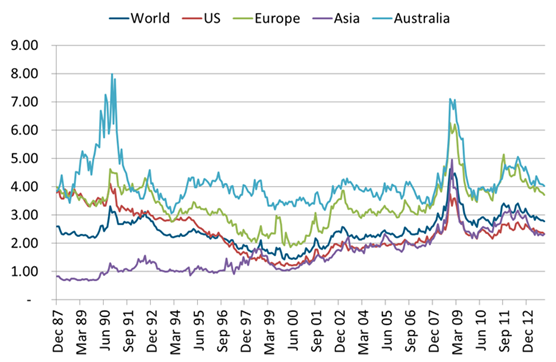

Consider this. While the returns for investors who invested in Commonwealth Bank when it was first floated in 1991 (through a partial sell-down by the Commonwealth Government at $5.40 per share) probably still smile at their purchase, over the past 10 years CBA’s share price has increased a much more muted 175%.

Let’s not kid around: That’s still good when you consider the S&P/ASX 200 Index (Index: ^AXJO ) (ASX: XJO) has increased by only about 66% over the past decade.

Yet Australia’s very best stocks the true star performers – have mostly been lesser-known small cap stocks that have grown into the large, market leaders of today. These stocks in particular have produced truly mouth-watering returns for shareholders.

How youll find your next big winner

Interesting, no single sector really stands out as creating the ‘winning stocks’ or ‘top stocks’. For example, the following three stocks which boast some of the most phenomenal shareholder returns in the past decade all come from different sectors….

Biopharmaceutical company CSL’s share price (which excludes dividends) has increased by a stunning 1,112% in the past decade. Meanwhile iron ore miner Fortescue Metals Group is up a staggering 17,100% over the past decade (Andrew Forest was elected Chairman on July 18, 2003) while diversified services firm Monadelphous has grown by a tidy 1,465%.

Of course, these returns are now truly in the past – and you’ll have to look elsewhere for tomorrow’s winners.

The top ASX pick you’ve never heard of…

Top Motley Fool analysts just identified their #1 ASX pick for 2014, a small cap stock that could be poised for big gains (and offers a fat, fully franked dividend!). Discover all the details now, including the name and code, in this FREE investment report, “The Motley Fool’s Top Stock for 2014 .”