The benefits of mutual funds

Post on: 25 Август, 2015 No Comment

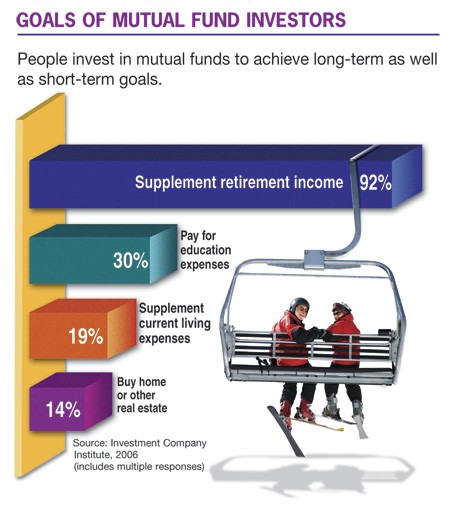

The goal of this post is to go over the basics of mutual fund investing. To start, a mutual fund is a company whose main objective is to professionally invest a pool of money in securities and earn a positive return for shareholders. By doing this, these companies allow you to share the rewards and risks of investing.

So when you buy shares in a mutual fund you are essentially buying stock or bond holdings in various companies, based on the underlying investments. Your shares are pooled together with the other investors’ shares, which allows for a high level of diversification.

Mutual fund investing has a few advantages:

- The funds are managed by full-time money managers . They research market and economic trends, and then use this information to make decisions about buying, holding or even selling securities to enhance returns.

- Diversification is one of the first things that anyone learns about investing. Dont put all of your eggs in the same basket, just in case you drop it you wont lose them all. The folks at Enron learned this the hard way as many of them who were fully invested in the company stock lost all their 401k savings when the company folded. Mutual funds help minimize this risk by spreading your money over a number of investments. By doing this the impact of one poor performer on your entire portfolio is greatly reduced.

- Many mutual fund companies offer convenient features. like automatic reinvestment, systematic payments and no-cost exchanges of funds. If you choose to, you can automatically reinvest any dividends and capital gains (profits) to purchase more mutual fund shares .

- Many mutual funds can be purchased with a low minimum investment . After an initial payment of $250, most mutual funds require as little as $25 or $50 at a time for additional investments.

- Liquidity is another nice benefit of mutual funds. Most funds offer you the ability to sell any or all of your fund shares on any business day the markets are open.

I think mutual funds are a great way for beginners to get started investing, (but even better would be index funds ) Generally the risks are lower than investing in stocks, but of course the reward is more limited as well.

Anyone have any suggestions for beginners purchasing a mutual fund?