The Benefits Of Diversification

Post on: 3 Май, 2015 No Comment

By Brendan Erne

With Facebook’s (NASDAQ:FB ) much anticipated IPO around the corner, it’s probably a good time to revisit everyone’s favorite topic. No, I am not talking about photo sharing, but rather concentration risk and diversification. In itself, it is not an exciting discussion, but tech IPOs always make it more interesting and, therefore, worth exploring. We all remember that loveable Internet search giant Google (NASDAQ:GOOG ), right? The 2004 IPO turned many of its employees into instant millionaires. More recently Groupon (NASDAQ:GRPN ), Zynga (NASDAQ:ZNGA ) and LinkedIn (NYSE:LNKD ) fattened a few pocketbooks.

The high-flying, attention-grabbing nature of technology IPOs can make them dangerous to participating employees. The main reason is they create instant wealth concentrated entirely in a single position. Granted, there will be many investment-savvy Facebook employees who know how to properly diversify. But most are experts in tech, media, and marketing, not finance. They invest in what they know, and what they know is their own company.

This is true of firms that went public long ago. Many employees continue to hold significant amounts of company stock, but are unaware of the excessive risk it creates in portfolios. Some may hold it for sentimental reasons, others for speculation, or fear of realizing capital gains. Whatever the reason, diversifying out of concentrated positions usually makes sense.

To Sell or Not to Sell

So your company goes public, you exercise options, and you now have 50% of your investment portfolio in a single stock. What do you do? Holding the concentrated position is a big gamble. You may get lucky, but in reality the odds are against you. A study published in the Journal of Finance by Jay Ritter. Professor of Finance at the University of Florida, examined the performance of over 7,400 stocks following their IPOs from 1980 to 2009. While short-term performance was positive (an average first day return of 18.1%), longer-term performance was less than ideal. After three years, post-IPO stocks underperformed broader index firms by almost 20%. Granted, this number was pressured by company shutdowns during the tech boom and bust. But the trend in prior years is the same.

Also consider the performance of stock indices in general. By simple math, the majority of underlying companies underperform the broader index. A few do very well and pull up the index return. But from a pure numbers perspective, there is a higher probability your company will underperform the market.

The Benefits of Diversification

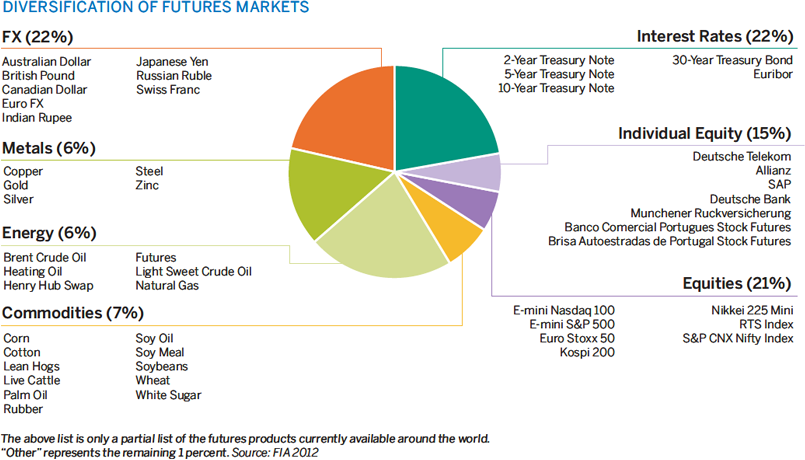

One of the cornerstones of modern portfolio theory is diversification across multiple lowly or uncorrelated asset classes. The reason is simple: it reduces portfolio volatility. Each asset class, be it equities, fixed income, alternatives, or others, behaves a certain way depending on market and economic conditions. Let’s use 2011 as an example. If you were 100% invested in global stocks, using the iShares MSCI ACWI Index ETF as a proxy (NASDAQ:ACWI ), you would have been down approximately -7.8% for the year.

More importantly, your daily standard deviation (a measure of volatility) would have been 1.7%, and the loss from peak to trough would have been over -24%. That’s some serious volatility. But if you added a 20% weight to fixed income, using the iShares Barclays 7-10 Year Treasury Bond ETF (NYSEARCA:IEF ), your return would have been -2.7% with a daily portfolio standard deviation of 1.3%. The peak to trough loss would have improved to just over -17%. This is because equities and fixed income behave differently than one another-having exposure to both creates a portfolio better equipped to weather market turbulence.

Adding an alternative asset class like real estate can also make sense. Using the Vanguard REIT ETF (NYSEARCA:VNQ ), if you created a three asset class portfolio made of 70% ACWI, 20% IEF, and 10% VNQ, your portfolio standard deviation would have remained 1.3%, but your annual return would have improved to -1.0%. This is despite the fact that on its own, real estate was more volatile over 2011 than equities. This is the benefit of diversifying across multiple asset classes. You can reduce portfolio volatility while simultaneously improving expected return. Greater return with less risk is the Holy Grail of investing.

This same concept applies to individual stocks, and to a larger degree given stocks can demonstrate significantly higher volatility than broader asset classes. A properly diversified stock portfolio should have exposure to all sectors, styles, and sizes, and to the extent possible sub-industries. Ideally, each stock should only represent a small percentage of the aggregate portfolio.

When positions get much greater than 5-7%, a portfolio begins to take on meaningful concentration risk. This is amplified even further if it’s in your own company’s stock. Think about it. You’re already 100% dependent on this company for income, why would you put your investment portfolio at risk too?

How to Diversify

Given low odds of outperformance, and the fact that concentrated positions significantly increase portfolio risk, the decision to diversify is the right one. Obviously each situation is unique — it is prudent to seek advice from financial and tax professionals before choosing the appropriate course of action. But be careful who you choose. Not every professional out there has your best interests in mind. With that said, here are a few ways to diversify out of concentrated positions:

- Full Sale — Selling the entire position or paring it down to a less concentrated weight. However, it can result in a higher tax bill if there are large embedded gains and it is held in a taxable account. Depending on one’s situation, selling may still be the best course of action regardless of any tax consequences.

- Staged Selling — Paring down the position in stages to spread the tax bill across multiple years. You can also harvest losses from other portfolio holdings to offset any gains incurred from selling.

- Gifting — You can gift the position to an heir or charity, thus transferring any potential tax liability.

- Hedge — You can neutralize stock specific risk through the use of options. Limiting downside risk can be accomplished through a protective put. This strategy continues to leave unlimited upside potential but protects against downside beyond the strike price. To neutralize almost the entire exposure of a concentrated position one can use an option collar: purchasing a protective put and writing a covered call. Doing this bounds the stock’s value to the strike price range between the put and call-it caps the potential upside and limits the potential downside. However, using options can result in a forced sale of the underlying stock which may or may not have tax ramifications.

So to all the future Facebook millionaires and anyone set to gain wealth, congratulations! It is well deserved, enjoy it. Just don’t let something like concentration risk turn your newfound fortune into a temporary phenomenon. Make it last — diversify.