The Benefits of a Fixed Asset Allocation Portfolio

Post on: 7 Июль, 2015 No Comment

The Benefits of a Fixed Asset Allocation Portfolio

I am often asked What is your investment philosophy? or Whats in your portfolio. The best description of my philosophy is that I invest in a low-cost, fixed-asset-allocation, index-fund portfolio that is rebalanced periodically. There are thousands of different portfolios that meet this definition and it is impossible to say a priori which is the best. But nearly all of them are better than those that dont meet this definition.

Any investment philosophy must address four issues- asset allocation, minimizing costs (including taxes), security selection, and market-timing. This philosophy addresses them as follows:

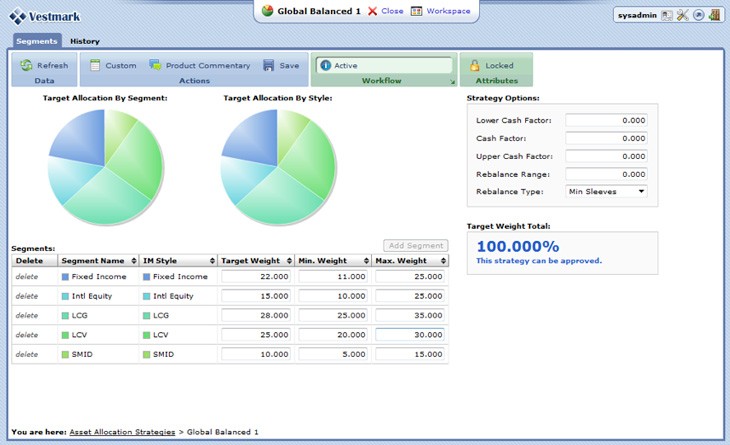

1) Asset allocation- Studies have shown that a high percentage of your investment returns are dictated solely by your asset allocation, rather than your ability to choose securities or time the market. Obviously if youre going to have the same asset allocation (fixed) for decades, you need to put some time and effort in up front to decide what your asset allocation is going to be.

2) Minimizing costs- The market is a huge distraction from investing. Every time you buy or sell a security, Wall Street gets a cut and Uncle Sam may get a cut. Every dollar you spend on investing costs or taxes is a dollar subtracted from your portfolio. Minimizing these costs is a key part of investing, especially in times of low returns.

3) Security selection- Numerous studies show that investment gurus, professional mutual fund managers, and pension fund managers cannot pick stocks that beat the market. If they cant do it with all the time in the world, what makes you think you can? Youd better have an answer to that question (and hope its right) before you engage in the stock-picking game. My investment philosophy is to just buy them all. Thats right. I own nearly all the stocks in the world. This is surprisingly easy to do. For almost nocost at all, I can buy a single index fund or ETF that basically owns the entire universe of investable stocks. I am comforted by the fact that I own the next Microsoft and the next Apple, even if I dont know what they are yet. Critics respond that I also own all the worst companies in the world, which is true. But it turns out that just owning all of them has been a very successful investing strategy over the last couple hundred of years. It turns out that if you engage in the practice of stock-picking that you are much more likely to choose stocks that underperform the market, especially after your expenses.

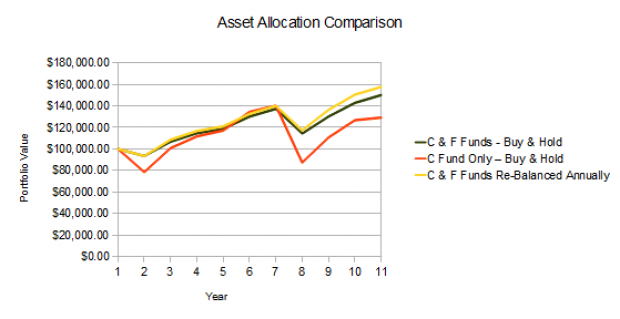

4) Market-timing- I dont know what is going to happen in the future, and Im okay with that. Once you acknowledge that you dont know either, you will feel liberated from the guilt of not switching from tech stocks to bonds in 2000 to REITs in 2002 and to gold in 2006. If you havent yet realized that you cant predict the future, I suggest you buy a $0.50 notebook the next time youre at the supermarket. Every time you have a prediction about the markets, write it down. Be specific. It wont take but a few weeks, months, or years for you to demonstrate to yourself that you have no friggin clue what is going to happen next. Dont feel badly, just realize that you need an investing plan that doesnt require you to predict the future to be successful. That plan is to use a fixed asset allocation. Instead of jumping from hot asset class to hot asset class, buying high and selling low in the process, you simply buy many different asset classes in fixed percentages and then maintain those percentages. This takes the emotion out of investing. As you rebalance you are forced to sell high and buy low. Some of your asset classes will always be doing well. Of course, some of them wont. In fact, if there is a time when you dont have at least one loser in your portfolio, you need to really think hard about whether youre truly diversified or not.

There are other benefits to using a fixed asset allocation portfolio. Your costs are kept ultra-low. By buying and holding a simple index fund portfolio you virtually eliminate costly taxable distributions, expensive management fees, and expensive advice fees. You eliminate several risks of investing including manager risk, market-timing risk, and security selection risk. Perhaps most importantly, you get your life back. You could spend literally hundreds of hours a year researching, managing, and worrying about a portfolio. Or you could spend a couple of hours once a year to rebalance your portfolio, forget about it, and get on with your life. Lower costs, lower risks, and more time to spend on the things you truly enjoy. What about that dont you like?

In future posts Ill discuss some of the more popular lazy portfolios as well as talk about how you can decide on your own asset allocation.