The Behavioral Asset Pricing Model CXO Advisory

Post on: 22 Сентябрь, 2015 No Comment

Do investors price stocks based mostly on rational analysis or feelings? In their February 2008 paper entitled Affect in a Behavioral Asset Pricing Model. Meir Statman, Kenneth Fisher and Deniz Anginer use survey results to investigate both the objective and subjective (perceived) connections between risk and return. Using results of: (1) the 1982-2006 annual Fortune surveys of senior executives, directors and security analysts regarding the long-term investment value of companies; and (2) May and July 2007 surveys of high-net worth clients of a large investment firm, they conclude that:

- Investors prefer stocks with positive images, and these preferences boost the prices and depress the future returns of such stocks. The mean annualized return of a portfolio of stocks deemed Admired (Despised) by Fortune survey respondents, rebalanced every four years during

1982-2006, is 15.1% (19.7%).

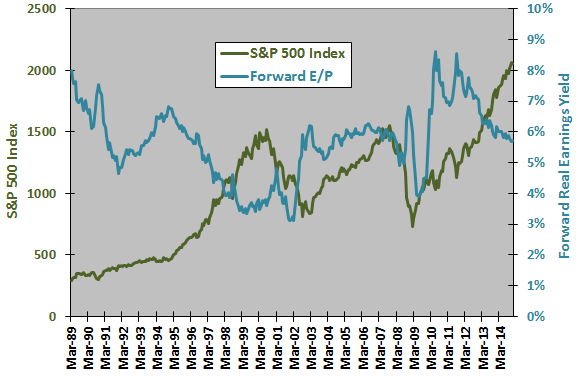

The following chart, taken from the paper, relates the mean relative expected return and perceived risk (both on ten-point scales) of 210 stocks, as determined by surveys of high-net worth investors. The resulting negative correlation (high return scores correspond to low risk scores) indicates that investors view the risk-return relationship emotionally rather than rationally per the Capital Asset Pricing Model. They see stocks that elicit positive (negative, or less positive) emotions as offering both high (low) future returns and low (high) future risk.

In summary, investors on the whole base their (mis)perceptions of risk and return on feelings rather than rational pricing analysis. Contrarians may be able to exploit the underpricing of despised stocks by focusing on small value.

Why not subscribe to our premium content?

It costs less than a single trading commission. Learn more here.