The Basics of the Collar Strategy

Post on: 16 Март, 2015 No Comment

Larry McMillan discusses this play and how you can use it to hedge your portfolio.

To learn more about how to use Collars, please go to Play #8 in the online version of The Options Playbook . located in TradeKing’s Education Center or visit Brian Overby’s post The Lowdown on Collars. If you would like to find out more about hedging, please read A Tirade on Terminology by Nicole Wachs.

Collar entry cost: Net cost of zero

Stock price at option entry: XYZ is near $50 per share

Maximum gain: $5.00 (Strike B — current stock price — debit of spread; 55 — 50 — 0)

Maximum loss: $5.00 (Current stock price — Strike A — debit of spread; 50 — 45 — 0)

Break-even: $50 (Current stock price + debit of spread; 50 + 0)

ALL-STAR COMMENTARY

The decision to set up a hedge to protect one’s stock portfolio is never an easy one. When times are good and stocks are rising, investors are loath to spend the money required to hedge their positions. When times are bad, and the market is dropping, the cost of hedging increases.

Hedges can take several forms. In the broadest sense, one can take a macro approach — hedging his entire stock portfolio with one or two index option positions. Or, he can take a micro approach — hedging each individual stock in his portfolio with that stock’s options.

There are benefits and drawbacks to each. The macro approach is the easiest to implement, because one only needs to execute one or two trades to get the protection in place. The biggest drawback to the macro approach, though, is that it the index one selects as the hedge may not track well with the actual stocks in one’s portfolio. This differential between performance of the index and performance of the portfolio is called tracking error.

The micro approach has no tracking error, since one is using the options on each and every individual stock in his portfolio. However, the micro approach is a difficult and tedious one to establish and monitor, for there are apt to be numerous stocks and thus numerous hedges set up in all the stocks’ options.

Regardless of which approach you choose, there are strategies that can be applied in either one. Perhaps the simplest strategy is just to buy some (out-of-the-money) puts to hedge your portfolio in case your stocks decline in price. The purchase of these puts hinders your upside returns a bit, but your stocks are still free and clear to rise as far as they can. The hedge of owning puts does not limit potential gains on the stocks.

However, over the years, sophisticated (institutional) investors grew weary of constantly paying out premium to buy puts as hedges. In a rising market, the cost of those puts becomes a loss and thus a drag on performance of the portfolio. So, some traders figured that they could finance the cost of the puts by simultaneously selling out-of-the-money calls. The premiums from the call sales would offset — partially, or perhaps even in full — the cost of the puts. This strategy — called a collar — has become one of the more popular hedging strategies.

So, a collar consists of both buying an out-of-the-money put and selling an out-of-the-money call. The resulting position has both a) limited downside risk, because the put is owned, and b) limited upside profit potential, since the call has been sold. Typically one would sell the call quite far out of the money, if possible, so as to not cut off the upside profit potential of the stock portfolio unless a substantial rally occurred.

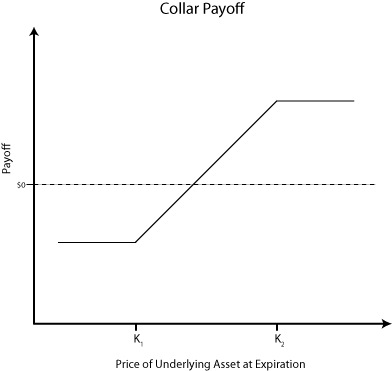

The collar has a profit graph that resembles a bull spread (in fact, the strategies are equivalent — an interesting, but not necessarily important fact). The profit graph in Figure 1 shows the general shape of a collar.

In the figure below, the maximum loss is $500 (below 45), and the maximum gain is +$500 (above 55). In between 45 and 55, the stock moves up and down, controlling the profits or losses in that zone.

Click here for a larger Profit and Loss image.

Collars are very effective and can offer great peace of mind. Usually, one establishes a no-cost collar. That means the proceeds from the sale of calls covers the expense of buying the puts. So there is no initial cash outlay for a no-cost collar. (See the prices in the example provided.)

Once one has made the decision that a collar is necessary, he welcomes the downside protection (stock losses are limited to the striking price of the puts). However, he worries some about the upside (i.e. about the stock rising above the strike of the written call), though.

Ideally, one would like the striking price of the put to be as near the current stock price as possible, while he would prefer the striking price of the call to be as far above the current stock price as possible. It turns out that the best options to use for collars are long-term (LEAPS) options. They afford one the opportunity to sell a call with a strike that can be substantially higher than the current stock price.

In concluding this segment on collars, let’s spend a moment considering the poor timing of a major decision made by the OCC and the option exchanges this year in regard to the introduction of new LEAPS options. Normally, by this time of the year (May, June, and July), LEAPS on individual stocks expiring in January, 2011, would have been listed. But this year, the OCC — noting that band width is a problem (i.e. there are too many options with too many base symbols and strikes already listed), and noting that trading activity in such long-term options is often subdued when first listed — decided to delay the introduction of the 2011 LEAPS until September, October, and November. As luck would have it, the market has been terrible since early May, and many traders who would like to establish LEAPS collars — again, our preferred way to establish collars — do not have the availability of the best possible product (2011 LEAPS) to work with; they are forced to use 2010 LEAPS instead (and there’s a big difference between the two). It is ironic that bear markets seem to find numerous ways to make one’s life miserable; this is just one more example.

In my next post. I will examine several net-credit collars, including one that no downside risk.