The Basics of Asset Allocation_1

Post on: 7 Июль, 2015 No Comment

One of the most common investment portfolio management strategies in use today is asset allocation. The theory behind asset allocation is that you can create a portfolio that helps you limit risks from the market with the help of the asset classes you include. You use a mix of asset classes to help you create an investment portfolio that grows during good times, and that helps you limit your losses during difficult times.

If you plan to build your portfolio according to the principles of asset allocation, there are two main items to consider:

- Risk tolerance. This includes both your financial and your emotional risk tolerance . If you have a higher tolerance for risk, you can handle more stocks in your portfolio, and maybe even include other asset classes, like commodities or currencies. However, if you have a lower risk tolerance, the stock portion of your portfolio is likely to include index funds, and you are likely to have more bonds and cash.

- Time frame. The second important consideration is your time frame. When you have a longer time frame, it might make sense to take more risks with your asset allocation, since you can make up losses. However, a shorter time frame might mean that its time to start shifting assets to investments considered less risky.

How Asset Allocation Protects You

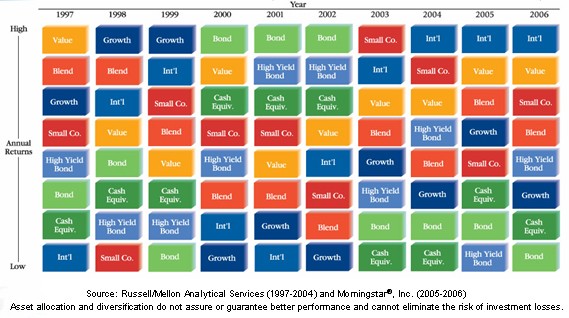

The point of asset allocation is to add diversity to your portfolio. The idea is to build your portfolio in a way that the include asset classes move differently, depending on market conditions. Bonds are supposed to go up while stocks are going down, so if you have a portfolio that includes bonds as well as stocks . you can take advantage of both situations. Additionally, adding other asset classes can help you limit your losses when one of the asset classes in your portfolio is struggling.

Its important to carefully consider your situation and goals . though. Many studies have shown that asset allocation has more to do with long-term success and the ability to meet your goal than attempting to pick the right investments. An appropriately diversified portfolio is more likely to do well for the average investor than stock picking.

Rebalancing

Part of asset allocation, though, is rebalancing. You should realize that the asset allocation you have right now may not be appropriate later. A good example is the retirement account. When you are younger, your asset allocation might favor stocks, with perhaps 60% of your portfolio in stocks, 30% in bonds, and 10% in cash. As you approach retirement, though, shifting that allocation is important. You might move to a position where you have 65% in bonds, 30% in stocks, and 5% in cash. What scenario you end up depends on your own situation and your goals, but the reality of rebalancing is there. Periodically check your portfolio, and determine whether you need to rebalance it so that your asset allocation fits your current risk tolerance and time frame.

Asset allocation can help you see appropriate growth for your portfolio while at the same time limiting some of your risks. Take the time to consider your investments, and your allocation, and you might be surprised at what you can accomplish.

How to manage your asset allocation across multiple accounts: Its important to look at your entire investment portfolio as one large bucket when you balance your investments. An easy way to help perform a asset allocation across your entire investment portfolio is with a free tool called Personal Capital. This powerful tool can help you see how your investments work together. You can learn more in our Personal Capital Review. or sign up for a free account at their site .

Additional resources: SEC Beginners Guide