The Bank Of Japan Nukes The Yen DXJ Wins WisdomTree Japan Hedged Equity ETF (NYSEARCA DXJ)

Post on: 16 Март, 2015 No Comment

Summary

- DXJ owns Japanese stocks, but hedges away the currency risk, leaving investors with the nominal rise in stock prices.

- DXJ was attractive due to Japanese QE; more QE makes DXJ more attractive.

- Japanese policy choices have increased the risk of a rapid yen devaluation, which would be favorable for DXJ.

Back in September, I wrote Japan Hedged ETFs Ready To Shine Again. At that time, yen hedged Japanese equity ETFs looked attractive because the pension funds in Japan were about to begin selling bonds and buying stocks. What was not expected was the Bank of Japan decision to nuke the Japanese yen in order to spur inflation. The case for currency-hedged Japan ETFs has only grown stronger as Japanese policy grows more extreme.

BOJ Does QE

On Friday, October 31, the Bank of Japan announced it would expand quantitative easing. From the BOJ’s policy statement, they are planning to purchase 8 to 12 trillion yen worth of Japanese government bonds (JGBs) each month. Many articles reported the buying as 80 trillion, but there’s room for them to push all the way up to 144 trillion, or nearly 100 percent of all government bonds issued by the Ministry of Finance in fiscal year 2014. Even if they stick to the 80 trillion yen figure, due to the smaller Japanese economy, this amount of QE is closing on three times the size of QE3 at its peak.

BOJ Has Room to Buy

Here’s a look at who owned Japanese debt at the end of Q3 in 2013, from Japan’s Ministry of Finance:

According to BOJ head Kuroda, the BOJ holds about 20 percent of JGBs now, a gain of less than 3 percentage points over last year. This number is not terribly high; Kuroda pointed out that the Bank of England holds roughly 40 percent of England’s government debt. For comparison, the Federal Reserve holds less than 20 percent of U.S. treasuries.

But wait, there’s more!

The BOJ doesn’t only buy JGBs, it also buys smaller quantities of REITs and ETFs. These small purchases will be dwarfed by pension fund buying though. The government has ordered Japanese government pension funds, including the nation’s largest, to sell bonds and buy stocks. Government Pension and Investment Fund of Japan (GPIF) will cut its bond exposure from 60 percent down to 35 percent, while doubling its exposure to Japanese and foreign stocks, as well as upping its exposure to foreign bonds. Nomura estimates this will result in 20 trillion yen of bond sales. which will be soaked up by the BOJ if necessary.

Fallout

The immediate fallout was as expected. The Japanese yen tumbled and the Nikkei surged. Below is a chart of WisdomTree Japan Hedged Equity ETF (NYSEARCA:DXJ ) breaking out to an all-time high.

This chart below is the more important one for the long term. It is the Japanese yen exchange rate, going back to the early 1980s. The yen’s recent move broke through a 15-year support trend and the last line of support may be around the 80 level, which corresponds to 125 yen per U.S. dollar.

The slide in the yen contrasts with the moves in the euro and emerging market currencies. Here’s how the yen looks relative to the euro:

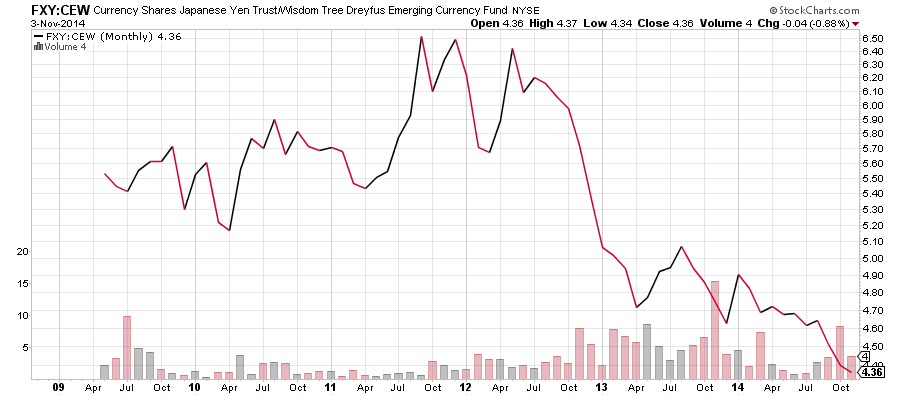

Here’s the yen versus emerging market currencies, as represented by the CurrencyShares Japanese Yen Trust ETF (NYSEARCA:FXY ) and the WisdomTree Emerging Markets Currency ETF (NYSEARCA:CEW ).

This latter chart may be the most important and the key to any potential negative consequences from Japan’s move. Exporters such as South Korea and China are directly impacted by Japan’s decision to devalue the Japanese yen. Immediately in the wake of the cuts, the Koreans and Chinese were talking of pressure to cut rates and stay competitive with Japan. Korea is more likely to cut rates than China, which is involved in a major economic reform program and seeking to avoid a reflating credit bubble. It doesn’t take currency devaluation off the table-a change in the asset mix on the balance sheets of central banks could achieve a weakening of the currency. Both the Korean won and the Chinese yuan devalued following the BOJ’s announcement as traders anticipated these countries’ next steps.

The potential knock-on effect in South Korea and China, which would then reverberate around Southeast Asia, is why Japan’s stepped up QE is not simply the passing of the baton from the Fed to the BOJ. If these nations take steps to devalue their currencies, most importantly China, it will add to U.S. dollar strength. This could set up conditions for a major U.S. dollar rally as export nations chase the yen lower.

Conclusion

At best, the yen will devalue and asset purchases by Japanese pension funds and the Bank of Japan will suppress interest rates globally, while pushing up equity prices. At worst, it could set off a round of competitive devaluations that cause a much larger move than anyone would like, outside of traders positioned for such a move.

DXJ has proved to be a solid play since the BOJ began its latest QE policies in late 2012 and it should continue doing well into late 2014 and early 2015, at least until the moves are fully prices into the market. In addition to Japanese pension funds and the BOJ, Japanese companies are also buying overseas companies and expanding abroad. including Japanese megabanks.

This chart shows DXJ compared with the iShares MSCI Japan ETF (NYSEARCA:EWJ ). The chart is a price ratio; a rising line indicates DXJ outperforming EWJ. Behind is the Currency Shares Japanese Yen Trust ETF.

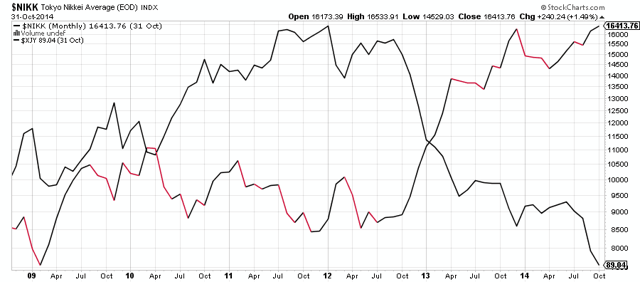

The Nikkei has been inversely correlated with the yen. If the yen moves down to the 120 to 125 area, a 10 percent increase in DXJ is a conservative estimate.

Here’s how the Nikkei has performed versus the Japanese yen.

Another reason to hold DXJ is that the BOJ probably isn’t going to hit their inflation target. Due to demographics and the large public and private debt levels, deflation remains the dominant force. The idea behind these central bank moves is that inflation will eventually starting picking up slowly. That’s probably not how it’s going to happen though. Instead, psychology will probably change rapidly because deflation has been the norm for 25 years in Japan. The market is going to swing from deflation to inflation psychology rapidly and Japan will probably wildly overshoot on its inflation target, likely due to a rapid depreciation in the yen in the currency market rather than demand pull inflation. Holders of DXJ are well positioned if the yen suddenly tumbles and the Nikkei spikes higher as investors rapidly dump cash for assets.

Finally, in case you have a different view, here’s the decision tree on which ETFs are best to hold based on the direction of the USD/JPY exchange rate (up means a weak yen) and the Nikkei.

For speculators who think the yen is the main play, the ProShares UltraShort Yen ETF (NYSEARCA:YCS ), which delivers 2X the inverse change in the yen, is the way to go.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.