The Baby Boomer generation and the “lump of labor theory Market Realist

Post on: 16 Март, 2015 No Comment

Is Baby Boomer retirement more good news for stocks and labor markets? (Part 1 of 13)

The Baby Boomer generation and the “lump of labor theory

Age 50 to 68… Retirement begins

The below graph reflects post–World War II population growth rate in the USA. Most noticeable is the collapse of the U.S. population growth rate as we entered the Great Depression, followed by explosive population growth at the end of World War II. The Baby Boomer generation is typically referred to as those born after World War II, from 1946 to 1964. As the below graph suggests, the historical average growth rate—the middle of the trend line—is right around 1.25%. However, the current population growth rate is right around 0.70%—a far cry from the nearly 1.70% population growth rate during the Baby Boomer era. This generation has had a great impact on shaping postwar America and has had a profound impact on the economic landscape of the USA. This series considers the Baby Boomer generation’s impact on the U.S. labor market, with special focus on how the retirement of Baby Boomers contributes to a decline in the labor force participation rate in the USA and how this affects both equity and fixed income markets in the USA.

For a detailed analysis of the U.S. macroeconomic environment supporting this series, please see Must-know 2014 US macro outlook: The crack in the debt ceiling .

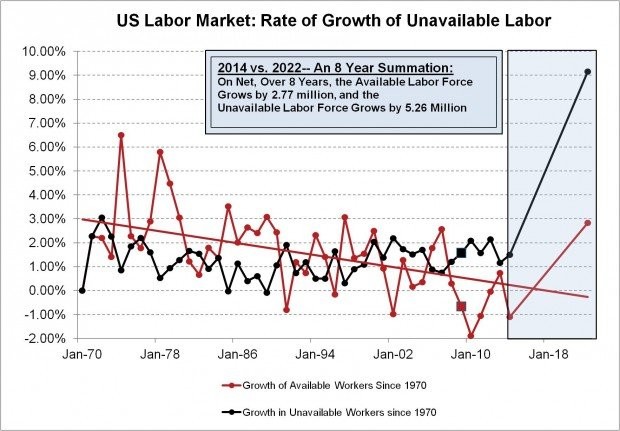

Labor market implications: Is the Baby Boomer generation a clog in the U.S. Labor Market?

Believe it or not, the answer is (sort of) no. The Center for Retirement Research has run the fancy regression analysis on “The Great Recession” and has come to some fairly conclusive results: The male Baby Boomers have had a small positive impact on younger males’ employment and earnings ability. With women, Baby Boomer women have, in fact, had mixed results, as statistical calculations suggest a potentially small negative impact on the employment rate of younger women, offset by a potentially small positive effect on the unemployment rate and hours worked for younger women. Findings for the male workforce are statistically significant and robust—but the findings for women are statistically much weaker, and lacking in predictive reliability. Please see “Are Aging Baby Boomers Squeezing Young Workers Out of Jobs? ” for further discussion and statistical data.

Good news and bad news

So, if you were born after 1964 and still live in your parents’ basement, it will be hard to blame your elderly working parents for taking your job. For Baby Boomers born before 1964 who have their children living at home (boomerang kids), that is good news, because they can now point to fairly robust statistical data that the lack of unemployment is not their fault—underemployment is more of an economic phenomenon than simple labor displacement. As we pointed out in the prior series on the U.S. labor market, the structural unemployment phenomenon is also a bit of an economic myth. As economist Paul Krugman points out. the structural unemployment appellation is really a cover-up term for poor public policy on employment and economic matters. The problem is one of a lack of demand—not of supply. Evidently, Krugman feels that this lack of demand can be cured through the application of specific demand-side policies.

Conclusion

The evidence suggests that Baby Boomers who aren’t willing or not able to retire aren’t having much impact on labor markets, or possibly some small beneficial effect. Plus, the onset of Baby Boomer retirement could also have an ongoing positive impact on tightening labor conditions. The Baby Boomer generation has made a significant contribution to developing a robust economy via contributing to the consumerism economy, which has fueled consumption as a percent of gross domestic product from 60% in 1980 to closer to 70% today .

To see the trend line in the decline in U.S. labor participation rates as a result of the Baby Boomers’ exit from the labor markets, please see the next article in this series.

To see how the “discouraged worker” impacts U.S. financial markets compared to the Baby Boomers generation dynamics, please see Is the discouraged worker a lagging indicator for the S&P 500?

A note on credit: Sprint versus Verizon

Sprint (S) has a market capitalization of $36.17 billion (the value of all its equities), and it’s considered a high yield credit. Its debt is considered below the investment-grade cut-off of “BBB” rating, as it’s in the BB (junk bond or below–investment-grade) category. Reducing the firm’s $33 billion of debt by the $7.47 billion of cash holdings leaves approximately $25.5 billion of net debt, and a 1.29 debt-to-equity ratio. However, given the last quarter profit margin of -8.50%, the firm has seen a negative 18.48% return on equity. Sprint is a large company with $35.49 billion in sales revenue, and it still has $5.47 billion in earnings before interest and taxes (EBITDA) to service its net debt of $25.5 billion.

This is sufficient debt service capability, though a weakening economic environment in the USA could compromise the debt service ability in the future. With $48.57 billion in EBITDA and $42 billion in net debt, Verizon is clearly in a much stronger financial position than Sprint. Unless we see labor and productivity increases in the future, companies with weaker earnings margins like Sprint could face further pressures on their bond prices and higher yields. However, the 2013 Softbank merger or acquisition and capital infusion of $5 billion may also improve Sprint’s credit outlook and operating health going forward. While Sprint is in fairly stable condition, it’s not as strong as its competitor, Verizon (VZ ), with relatively lower debt levels and more cash on its balance sheet. Sprint currently has an August 15, 2007, senior unsecured bond yielding 2.95%, versus Verizon’s February 15, 2008, senior unsecured bond yielding 2.00%, T-Mobile (TMUS ) US’s February 19, 2019, senior unsecured bond yielding 3.00%, CIT Group’s February 19, 2019, senior unsecured bond yielding 3.46%, and Caesar’s Entertainment’s June 1, 2017, senior secured bond yielding around 11.00% (Bloomberg & Capital IQ, December 31, 2013 Quarter).

Equity outlook: Cautious

Should the debt ceiling debate re-emerge after the mid-term elections in November, and macroeconomic data fail to rebound in sync with record corporate profits, investors may wish to consider limiting excessive exposure to the U.S. domestic economy, as reflected more completely in the iShares Russell 2000 Index (IWM ). Alternatively, investors may wish to consider shifting equity exposure to more defensive consumer staples-related shares, as reflected in the iShares Russell 1000 Value Index (IWD ).

Plus, even the global blue chip shares in the S&P 500 (SPY ) or Dow Jones (DIA ) could come under pressure in a rising interest rate environment accompanied by slowing consumption, investment, and economic growth. So investors may exercise greater caution when investing in the State Street Global Advisors S&P 500 SPDR (SPY ) or the State Street Global Advisors Dow Jones SPDR (DIA ) ETFs. Until there’s greater progress on the budget and federal debt issue, and consumption, investment, and GDP start to show greater signs of self-sustained growth, investors may wish to exercise caution and consider value and defensive sectors for investment, or individual companies such as Wal-Mart Stores (WMT ).

Without sustained improvement in economic growth data, there’s little doubt that the debt level issue and tax reform will be a big issue later in the year. Current economic data noted in this series suggests that the probability of the 2013 sequester issue returning—in one form or another—could be higher than many think. The data is simply not that robust—yet.

Equity outlook: Constructive

However, if investors are confident in the ability of the USA to sustain the current economic recovery as a result of the improving macroeconomic data noted in this series, they may be willing to take a longer-term view and invest in U.S. equities at their current prices. With the S&P 500 (SPY ) price-to-earnings ratio standing at 19.65 versus the historical average of around 15.50, the S&P is slightly rich in price—though earnings have been solid. However, with so much wealth sitting in risk-free and short-term financial assets, it’s possible to imagine that a large reallocation of capital that is “on strike ,” including corporate profits, into long-term fixed investments. This could lead to greater economic growth rates and support both higher equity and housing prices as well. In the case of a constructive outlook, investors should consider investing in growth through the iShares Russell 1000 Growth Index (IWF ) or through individual growth-oriented companies such as Google (GOOG ).