The Art of Investing in Art

Post on: 15 Май, 2015 No Comment

Art as an investment avenue has been considered an interesting and profitable alternative, but it is also extremely risky.

With uncertain stock market returns and interest rates at their lowest in decades, nervous investors are now considering alternative investment avenues. Some of them are hoping to find solace in alternative investments such as fine art, wine and even stamps.

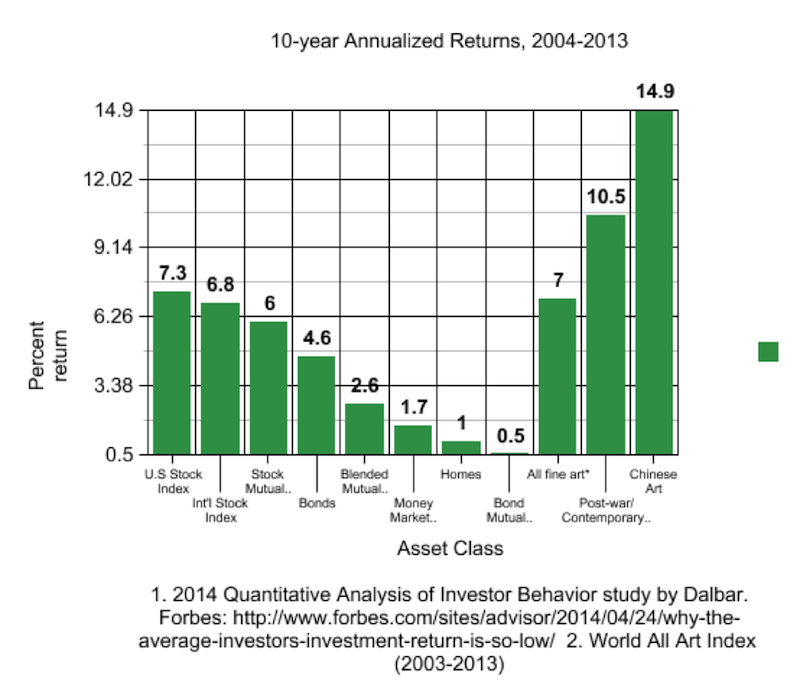

These alternative investments’ performance is alluring. Indices tracking the performance of high-class art have held up well in the recent economic slowdown, while art-auction houses report record prices.

Art as an object of investment has been debated for long. However, in the age of 20% returns on stock markets and a long bull market, the concept of art as an investment option was passed over.

But the corporate scandals, stock market losses and low interest rates have helped it to re-emerge. In one of the niost prominent examples of art investing, British Rail pension fund invested 2.9% of its portfolio in the 1970s earning a return of 40o pa. above inflation till 1999.

Virginia Wilson, an art consultant from Australia, says, Art has been an attractive investment for centuries and is becoming increasingly recognized as it has outperformed more conservative investments over the last few decades. It is an alternative investment earning capital gains rather than a dividend.

Art can never be considered as financial asset. Critics contend that investing in art disregards the traditional yardsticks of financial analysis, since they do not generate income streams that can be discounted. It is a bet on the price appreciation of something whose value defies financial logic.

Bill Muysken, Global Head of Research, Mercer Investment Consulting, feels, Artworks do not generate any income, except to the extent that income can be obtained from lending them to galleries, and they incur negative income in the form of storage and associated costs.

Whilst some artworks have appreciated enormously in value over time, it is difficult to make a case for artworks overall earning a positive net rate of return in real terms over the long run.

But advocates of art investing argue with growing volume of supporting analysis. Prominent among them are from professors Jianping Mei and Michael Moses, at New York University’s Stern School of Business, who found that art has outperformed S&P 500 (excluding transaction costs, since they are not included in stock market indices such as the S&P 500 eitber) in the past 50 years.

From 1875 to 2000 art has outperformed fixed income, but underperformed equities. And in the past two and half years of stock market losses, art has outperformed equities.

For frightened investors this may sound soothing. But art is high-risk investment, riskier than stocks. Prices of art fluctuate more widely than stocks.

Art market is illiquid, opaque and unregulated. Transaction costs are too high, sometimes up to 25% and may in fact wipe out the profits. Further, the money invested in art is at the mercy of erratic public taste and short-lived trends.

Above all, art’s unpredictable value makes it as easy to lose as to profit. However, Wolfgang Wilke, Vice-President, Dresdner Bank’s Economics Department, who has been researching on this topic for the last 20 years, feels, art investment is high risk only if the selected investment period is too short.

In the short-term, market volatility is relatively high compared with other asset classes.

But over the long-term — experience suggests 10 years and more — investment in art provides annual average returns, which top all-coniers. The prerequisite is investment in top-quality art.

Continue to the Next Page