The Anatomy Of Trading Breakouts

Post on: 26 Август, 2015 No Comment

Breakout trading is used by active investors to take a position within a trend’s early stages. Generally speaking, this strategy can be the starting point for major price moves, expansions in volatility and, when managed properly, can offer limited downside risk. Throughout this article, we’ll walk you through the anatomy of this trade from start to finish and offer a few ideas to better manage this trading style.

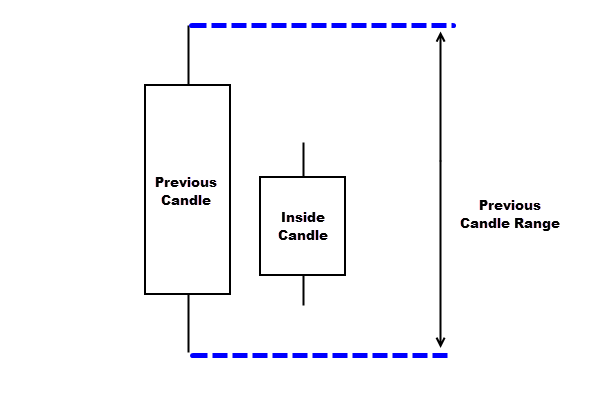

As prices consolidate, various price patterns will occur on the price chart. Formations such as channels. triangles and flags are valuable vehicles when looking for stocks to trade. Aside from patterns, consistency and the length of time that a stock price has adhered to its support or resistance levels are important factors to consider when finding a good candidate to trade. (For more insight, check out Analyzing Chart Patterns .)

Entry Points

After finding a good instrument to trade, it is time to plan the trade. The easiest consideration is the entry point. Entry points are fairly black and white when it comes to establishing positions upon a breakout. Once prices are set to close above a resistance level, an investor will establish a bullish position. When prices are set to close below a support level, an investor will take on a bearish position.

To determine the difference between a breakout and a fake out , it is a good idea to wait for confirmation. For example, a fake out occurs when prices open beyond a support or resistance level, but by the end of the day, wind up moving back within a prior trading range. If an investor acts too quickly or without confirmation, there is no guarantee that prices will continue into new territory. For example, many investors look for above-average volume as confirmation or wait towards the close of a trading period to determine whether prices will sustain the levels they’ve broken out of. (For related reading, see Trading Failed Breaks .)

When planning target prices, look at the stock’s recent behavior to determine a reasonable objective. When trading price patterns, it is easy to use the recent price action to establish a price target. For example, if the range of a recent channel or price pattern is six points, then that amount should be used as a price target to forward project once the stock breaks out (see Figure 3).

Figure 3: Measuring a price target

Another idea is to calculate recent price swings and average them out to get a relative price target. If the stock has made an average price swing of four points over the last few price swings, this would be a reasonable objective.