The Advantages Of Bonds_1

Post on: 24 Август, 2015 No Comment

Key Documents

PIMCO created the Global Advantage Bond Index (GLADI) to provide investors with an investment-grade fixed income benchmark that we believe more accurately reflects the rapidly-changing dynamics of the global investment universe than traditional indices. Employing an innovative investment framework that focuses on GDP rather than market capitalizations, GLADI strategically orients away from the ever-increasing number of economies saddled with heavy debt burdens and serves as a building block for portfolios with the potential for higher risk-adjusted returns.

New Approach to Bond Indexing

The global economy is in the midst of dramatic transformations that challenge the ability of traditional investment approaches to generate sustainable returns while also managing risks. One profound change crucial to bond investing is the explosion of public debt levels in industrialized countries. Traditional bond indexes — by virtue of their market capitalization weighting methodology — have an inherent structural bias to overweight countries with high levels of debt. As concerns about sovereign creditworthiness become increasingly critical to asset allocation, there is greater urgency for an alternative to traditional approaches.

Through its broader coverage and unique construction methodology, GLADI explicitly recognizes the need for investors to position their fixed income portfolios within this changing global environment. Several core features distinguish GLADI from traditional fixed income indices, including:

An innovative GDP-weighting methodology that avoids the disadvantages of traditional indexes based solely on market capitalization weighting.

A continuum in coverage from developed to emerging markets, capturing the fuller set of global investment-grade opportunities and avoiding a lopsided weighting toward developed markets.

Inclusion of inflation-linked bonds in addition to nominal bonds, providing a partial built-in hedge against potential inflationary pressures.

A global beta that evolves with the world’s economic structure, providing broad exposure to a diversified basket of global currencies, especially currencies of creditor countries in the emerging world.

Advantages of GDP Weighting

GLADI weights index components based on gross domestic product (GDP) as an alternative to the market capitalization weights used by most existing fixed income indexes. GDP weighting offers a number of relative potential benefits:

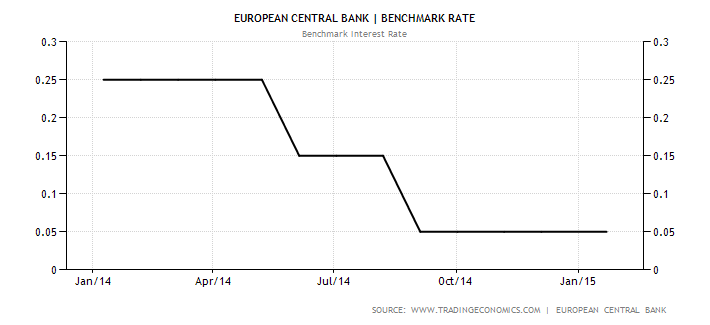

1. Higher Allocation to Low-Debt Countries. Because larger stocks of debt mean higher market capitalization, market capitalization-weighted indexes are at a structural disadvantage as they have a bias to assign greater weights to highly indebted countries, even though the credit quality of those issuers may be eventually compromised by their debt load. In contrast, GLADI’s GDP-weighted approach bases allocation on national income (GDP), which embodies the capacity to repay debt. The income-orientated approach produces a bond beta with an emphasis on countries with lower leverage, or lower levels of debt relative to their ability to service the debt, as illustrated in Figure 1.

20overview%20figure%201.jpg /%

2. Forward-Looking. Fundamental transformations in global capital markets are reshaping the financial landscape for retail and institutional investors. Market capitalization-weighted indexes fail to capture these changes because they are inherently backward-looking, reflecting past patterns of debt issuance. Since rapid economic growth tends to precede the liberalization and deepening of capital markets, GLADI’s GDP weighting is designed to capture the opportunities that exist in the world’s most dynamic economies. By embedding a concept of where capital markets will be in the future – rather than where they have been in the past – GLADI helps investors position their portfolios to reap potential first-mover benefits.

3.Counter-Cyclical Rebalancing. Another well-known disadvantage of market capitalization-weighted indexes is that they assign progressively greater weight to securities as they go up in price, exactly the opposite of the investment maxim to “buy low, sell high.” GLADI not only is designed to avoid this pitfall of market capitalization weighting, but also has the potential to benefit from counter-cyclical rebalancing, since bond prices tend to move inversely to GDP growth over the business cycle, with bond prices rising as economic growth slows, and falling as economic growth accelerates. A GDP-weighted index that increases the relative weight of countries in the expansion phase of the business cycle (when bond prices are low) and reduces the relative weight of countries in the contraction phase (when bond prices are high) helps embed a “buy low, sell high” bias, as illustrated in Figure 2.

20overview%20figure%202.jpg /%