The Active Fund Industry Is Desperate

Post on: 24 Май, 2015 No Comment

The Active Fund Industry Is Desperate

Dan Solin, Director of Investor Advocacy, 3/13/2015

Much of the massive securities industry is based on this false premise: There are gurus or experts who can identify mispriced equities, tell you when to get in or out of the market, pick mutual fund managers likely to outperform and are otherwise endowed with predictive powers.

Investors are getting smarter

In many ways, the Internet has leveled the playing field for investors. Through it, the overwhelming evidence demonstrating that those who purport to have this expertise are really emperors with no clothes has been widely disseminated. This evidence is also set forth in my books and blogs, those of my colleagues (Larry Swedroe, Carl Richards and Tim Maurer) and others, including William Bernstein, Burton Malkiel, John Bogle and Rick Ferri.

Overwhelming evidence

Independent studies, including a seminal paper co-authored by Nobel laureate Eugene Fama and Kenneth French, demonstrate that few actively managed funds produce benchmark-adjusted expected returns sufficient to cover their costs.

Other studies from independent sources have found that, over the past five years, most actively managed domestic and international stock funds failed to achieve returns above their respective benchmarks.

Actively managed funds are losing market share

Investors arent stupid. They are voting with their pocketbooks. And active management is taking a beating. According to the Morningstar Direct U.S. Asset Flows Update. passive U.S. equity funds saw inflows of $166.6 billion in 2014 while active U.S. equity funds lost $98.4 billion last year. Investment in passively managed funds has doubled in the past 10 years.

Active management fires back

The securities industry, and many in the financial media (who need to curry the industrys favor to keep its massive advertising revenues flowing), is striking back. While few are able to cite any credible data supporting their position, they hope to confuse the issue and stop the considerable drain of funds from their own coffers to index-based funds.

A recent article in Financial Advisor magazine is illustrative of the problem. The article notes the underperformance of Wall Streets best stock pickers over the past five years. These stock-picking gurus include Robert DAlelio of the Neuberger Berman Genesis Fund, Donald Yacktman of the AMG Yacktman Fund and the team of O. Mason Hawkins and G. Staley Cates at the Longleaf Partners Fund. All lagged their benchmarks, despite stellar records over the prior decade.

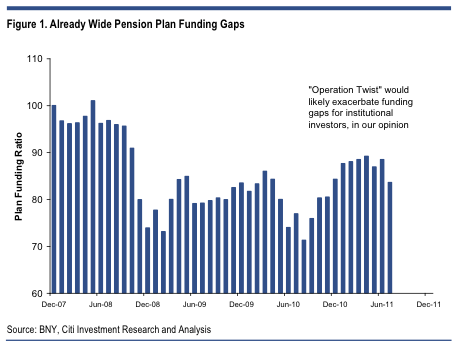

According to the article, managers say they havent changed, the market has. They blame low interest rates engineered by the Federal Reserve, which has artificially inflated prices of lower-quality U.S. stocks, thus punishing active managers who focus on businesses with the best fundamentals.

Really? Isnt the purported benefit of active management its ability to anticipate issues that could impact the price of stocks, like low interest rates?

Others advise investors to switch to active management because the lengthy bull run of stocks may be coming to an end. According to Keith Trauner, co-founder of Goodhaven Funds (which are actively managed): Typically, the time when active managers start to shine is when you get indexes that start to look expensive by historic standards.

This claim has surface appeal. You would think active fund managers, who have the flexibility to get in and out of the market, would have an advantage over index funds in bear markets because index funds are required to track the holdings in their respective indices. The data does not support their claim.

As I discussed in a prior post. the assertion that actively managed funds outperform in bear markets is a myth. A comprehensive study by Vanguard Investment Counseling and Research found the performance of actively managed funds has been inconsistent in bear markets. It also found that success in one bear market doesnt guarantee success in subsequent bear markets, making it difficult to pick actively managed funds likely to outperform in the next one.

Heres the conclusion of the study:

When related data is examined in detail, we find little evidence to support the theoretical benefits of active management during periods of market stress-in fact, active managers have not consistently delivered superior performance relative to a benchmark during such periods.

Dont be fooled

You can expect more misinformation from the active fund industry as its market share continues to decline. Dont be fooled. Heed this observation in The Incredible Shrinking Alpha by Larry Swedroe and Andrew Berkin:

Active management is the triumph of hype, hope and marketing over wisdom and experience. Choosing passively managed funds to implement your investment plan is the winning strategy, and the one most likely to allow you to achieve your goals.

This commentary originally appeared March 3 on TheHuffingtonPost.com

By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

The opinions expressed by featured authors are their own and may not accurately reflect those of the BAM ALLIANCE. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.

© 2014, The BAM ALLIANCE