The Absolute Importnace of Asset Allocation

Post on: 28 Апрель, 2015 No Comment

I get questions.

I get questions about the Bible and money. questions about debt, and questions about investing.

Did you know that the questions you ask don’t necessarily get you to the solution you need? If you ask the wrong question, you’ll get the wrong piece of advice.

We tend to think the most important investing questions are:

- How much should I be saving for retirement?

- Should I invest in a 401k, Roth, or Traditional IRA?

- What stock broker should I use?

- Which company is best – Vanguard, Fidelity, or …

- Should I invest in mutual funds or index funds?

Yet, none of these are the most important question.

The most important question you must answer is: what should my asset allocation be?

What is Asset Allocation?

Asset allocation is the art (not science) of deciding how you’re going to split up your investment pie.

You can see two sample asset allocations below (neither are recommended for anyone – just an illustration):

In this case, the Friendly Fellow on the left has a more conservative asset allocation than the Young Wippersnapper on the right. This means Friendly has less potential for losses and less potential for gains. Wippersnapper has more potential for gains and more potential for losses.

However, how they decide to cut the pie allowing some pieces to be bigger and others to be smaller will have the biggest impact on their investing. Neither can surpass 100%, but they can mix and match investment types and categories as they wish.

In order of conservative to aggressive assets, I’d categorize them as:

- Bonds (most conservative)

- Large Cap

- Small Cap

- Foreign stocks

- Precious metals

- FOREX Trading (most aggressive)

Note: Not everyone would agree with the listing of how I order the risk you take with each investment. Also, the large and small caps are often known by different names and can also be broken down further into growth funds and value funds.

Why Asset Allocation is So Important?

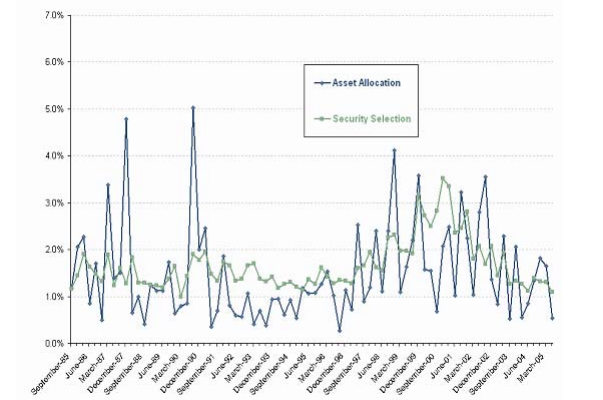

1. Asset allocation significantly impacts your returns.

I’ve heard a lot of people struggling trying to choose the right mutual fund from the right company. Let’s say you have a similar asset allocation; one person is at brokerage Y and the other at brokerage Z. Those two people can expect relatively similar returns. However, two people could both be at the exact same brokerage with one person in 100% large cap and the other 100% foreign, and they’d see very, very different returns.

2. Asset allocation impacts your emotions.

If you are young and willing to invest more aggressively, then your losses might not be as troublesome to you. However, if you’re 65, you don’t want the potential worry of losing a large part of the money you’ve invested. At this point, your strategy has switched from growth to preservation. Your conservative place in life must be reflected in the types of holdings you have.

Lessons from 2008-2009

I remember when the stock market started dropping and the reporters were reporting that many retirees were worried because they had lost half of their retirement. From that statement (assuming it is true), we could conclude that many retirees had their asset allocation wrong (or they had a target retirement fund that had it wrong). If you’re getting close to retirement and still have 100% stock holding, you’re in a riskier position. However, the older you get, the more bonds you should add to your portfolio.

I say all this to say that now is a great time to ask yourself – is my asset allocation right for me?

You may need some help in answering that question.

Unfortunately, I’m not the right person to answer that because I don’t know your personal situation. I’d also avoid anyone (as Dave Ramsey promotes ) who says you should have 25%, 25%, 25%, and 25% in certain stocks. The reason is because a 20 year old and a 60 year old should not have the same asset allocation .

Partly because of my personality and mostly because of my age, I’ve never been interested in bonds. Instead, I own 100% stocks.

Here’s a general introduction to our asset allocation (not as a suggestion):

80% is currently invested according to Sound Mind Investing suggested asset allocation for someone who is in 100% stocks. If you are a subscriber you can access that information in the January 2011 edition. I do own stocks in the following categories: small growth, small value, large growth, large value, and foreign.

10% is given to a more aggressive investing strategy by Sound Mind Investing called the Sector Rotation. Basically, rather than investing across different sectors, it focuses on investing in one sector at a time. It might be real-estate, technology, or oil and gas. Never all of them at the same time, just one sector of the economy as long as it continues to perform well.

10% (this is my favorite 10%) is the wild, follow my gut, blank check, executive, and fancy foot work investments. My wife has a agreed to let me use 10% of our investments to follow my own whims. Since we’re young, we can afford to be involved in some investments that a little riskier.

Moral of the story: Your asset allocation must be your allocation. It must be catered towards your knowledge, your investment strategy, your age, and your risk level. You.

And remember, however you decide to set your asset allocation is the most important investing decision you’ll make.

Do you think there is an investment decision that is more important than asset allocation?

Comments

Darren says

Craig, youre really in 100% stocks? Thats very aggressive. Do you plan to change to a more conservative allocation as you get older? What are your feelings about bonds?

I agree that asset allocation is probably the most important factor when it comes to investing. But the second most important would likely be cost.

Brokerages can vary widely in terms of the cost of investing in the same type of fund.

Bob says

The only thing as important as asset allocation is rebalancing. Even if your allocation doesnt change, your returns will change your allocations, so you need to rebalance at least once a year.

Paula @ AffordAnything.org says

Im also 100 percent in stocks right now, because Im young Ill change that strategy later in life. I agree with Bobs comment about rebalancing, but I wouldnt recommend doing it too often once a year is enough.