The Absolute Best Dividend Stocks in America_1

Post on: 11 Сентябрь, 2015 No Comment

April 30, 2013

Id bet most income investors know about the S&P Dividend Aristocrats Index.

To be included in this index, an S&P 500 company must have raised its dividend annually for at least the past 25 years.

The standard is brutal: One slip and youre out. Start all over and compile another spotless dividend track record over the next 25 years.

This is an index of the bluest of blue-chip dividend stocks.

But Ive found a little-known sister index that income investors might find even more interesting and profitable.

In a variety of market conditions, this little-known index has been able to match and usually beat the broader markets, while also paying a significantly higher yield.

How can you improve on an index that contains some of the best dividend-payers in history?

The S&Ps High Yield Dividend Aristocrats Index has just the answer.

This index holds companies to a still-lofty standard of at least 20 consecutive years of dividend increases. But it selects companies from the S&P 1500, which includes midsize and small-cap companies. That means the High Yield Dividend Aristocrats are put together in such a way as to balance both growth and income. as opposed to the Dividend Aristocrats Index, which is focused mainly on income.

The two indices have other important differences as well. For starters, the high-yield version is built around a fixed number of companies 84 of them, to be exact. And instead of being equally weighted, each company is weighted according to its dividend yield. The companies with the highest yields exert the most influence on the indexs performance.

To prevent a handful of stocks from having too much influence, however, no one stock can have more than a 4% weighting. Companies in the index must have a market cap of at least $2 billion dollars and have a daily trading value averaging at least $5 million per day.

And since the High Yield Dividend Aristocrats Index includes stocks from any of 10 different sectors, it offers much more diversification than many high-yield indices.

Heres a look at the top 10 holdings of the High Yield Aristocrats:

Despite their yield-touting name, the High Yield Aristocrats are no slouches when it comes to returns either. An S&P study showed that the index outperformed the S&P 500 for a decade in virtually all types of market conditions (150% to 112%, including dividends).

For the past five years, the results have still been great.

As weve said many times before, however, its in bear markets that the role of dividends in cushioning stock market price declines is most important. In 2008, for example, the S&P 500 lost 37%, but the High Yield Dividend Aristocrats Index was off by just 23% roughly 1,400 basis points better.

And from March 2009 to today, which has seen a sharp rally off the bear market bottom, the index has crushed the S&P 500 171% to 146%, including dividends.

Action to Take > Put simply, these stocks perform better in bull and bear markets. Not to mention, they yield far more in dividends than your average S&P 500 stock as well.

Now, there are two ways you can profit from these high-yield stocks. One would be to buy the exchange-traded fund (ETF) designed to mirror the indexs performance, the SPDR S&P Dividend (NYSE: SDY). But if youre looking for even higher yields than that, you might try looking into some of the individual stocks contained within the actual index, like those Ive mentioned above.

- Carla Pasternak

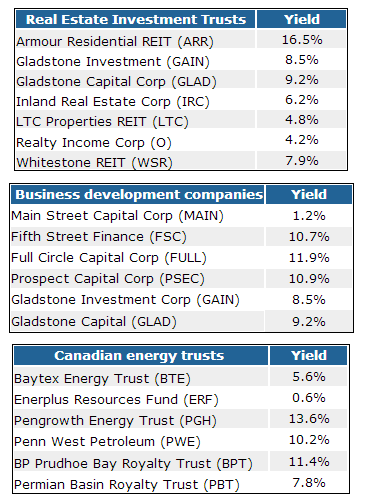

Sponsored Link: While the stocks mentioned in this article are some of the best dividend stocks in America, the valuations on some of them are a little high for my taste. But in the latest issue of my High-Yield Investing newsletter, I found some real bargains that yield from 6.5% on up to 12.6%. To learn how to get the names and ticker symbols of these securities, and gain access to my premium research reports, click here .

Carla Pasternak does not personally hold positions in any securities mentioned in this article. StreetAuthority LLC owns shares of T in one or more of its “real money” portfolios.