The 4 Key Elements Of A WellManaged Portfolio

Post on: 22 Август, 2015 No Comment

Fund management, portfolio management, active and passive management and, unfortunately, mis management are all familiar to those associated with the field of investment. But what exactly does management mean in a general sense and what is its specific relevance within the investment context? This is an incredibly important question, but one that is seldom (if ever) raised.

According to John Schermerhorn in his book Management (2002), management is the process of planning, organizing, leading and controlling the use of resources to accomplish goals.

Breaking the process down into the above standard four elements is the key to understanding the implications for money management. Any investment process must involve planning, organization, leadership and control to some extent in order to be considered managed. However, any of these four elements can done well or poorly, which will impact returns.

Investment Management vs. Management in General

Definitions of investment management are very different from those of general management. For example, portfolio management is defined as the art and science of making decisions about investment mix and policy, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance. This is a very specific definition of management in the investment context.

However, the four cornerstones of general management still apply in investing and are clearly reflected in the definition of portfolio management. Despite this, there is a tendency for both investment managers and investors to understate or even ignore one or more of the basic general management principles, and this is very dangerous. For investors, however, planning and organizing are less problematic areas to overlook than leading and controlling. Control in particular is the real weak point in managing investments, and the true Achilles’ heel of so many investments.

Leading and Controlling: The Danger Zones

What makes investors so vulnerable to their investment managers’ poor leadership and control of their money is that investors often hand over their money after the planning and organizing has already taken place. So, it is the leading and controlling of these investments that tend to be neglected. If there is never any intention to really manage money in a strict sense, and investors know this and/or even want it, there is no problem. But if people think that they are getting active management, and believe it will protect them from the market and volatility. a lack of effective management is potentially disastrous.

Likewise, from a legal perspective, promises of active management that create an impression of powerful and effective loss control, may (justifiably) lead to awards of damages in court. A look at the fundamental distinction between active and passive management, which is unique to the investment field, demonstrates the nature of the issue and the inherent problem.

Active and Passive Management

It is crucial that investors understand the difference between active and passive investment management. Active managers rely on analytical research, forecasts, and their own judgment and experience in making investment decisions on what securities to buy, hold and sell. By contrast, passive management means that a fund’s portfolio is simply set up to mirror a market index. That is, the fund is only supposed to go up and down with the market. No attempt whatsoever is made to pick good stocks and avoid bad ones. (Find out how to determine whether your actively managed portfolio is performing the way that it should in Active Management: Is It Working For You? )

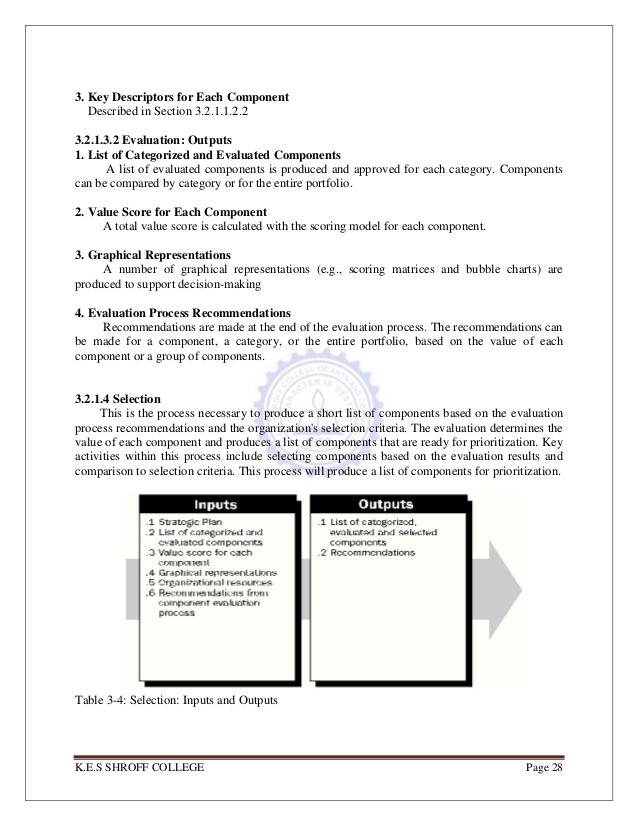

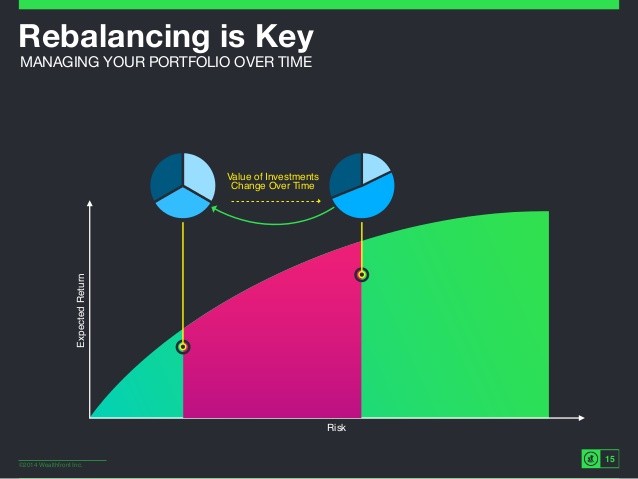

In the investment industry, a passively managed fund is still managed in a limited way. Nonetheless, in the general-management sense, passively managed investments are really un managed, and it is important to understand this. Likewise, a fund or portfolio that is never rebalanced or controlled is also unmanaged, hence the derogatory term closet tracker . Given the very common failure of active stock picking, there is certainly nothing wrong with this so-called passive management, provided nothing more is implied or promised. (To learn more about the pitfalls of active management, read Active Investment Management Misses The Mark .)

What Can Be Done?

Given that active investment management within an equity portfolio is of dubious benefit, a passively managed fund is certainly cheaper and may perform better over time than one that is managed actively.

However, what can and does work, if it is done properly, is to manage a portfolio actively in terms asset allocation, rebalancing and loss-control instruments. Most experts agree that portfolios are optimized by monitoring, controlling and adjusting the mixture of different types of investments within a portfolio, the asset classes. In order words, actively managed diversification is not only worth doing, it is essential.

More controversial are such instruments as stop-loss orders. the use of derivatives and so on to control losses. What is important in the context of this article is that such management is possible, although its effectiveness is another story. Furthermore, churning. excessive buying and selling to generate commission is active all right, but it simply burns the investors’ money to no useful purpose.

The degree to which a portfolio is managed doesn’t matter as much as that people get what they want, expect and have been promised. Furthermore, they need to be informed as to how effective the management is likely to be.

The Implications

Whether you want to try your luck or let someone else try his luck at managing your money is up to you. Likewise, you may or may not believe in stop losses and other means of optimizing an equity portfolio. However, what (almost) everyone needs and wants is for the overall portfolio to generate the best return possible. No portfolio should simply be left to grow on its own like an oak tree; you can choose to tame it any way you like, just make sure you are happy with the result.