The 3 Big Stock Market Crashes October 28 1929; October 19 1987 and October 201 you

Post on: 6 Июль, 2015 No Comment

Submitted by IWB, on October 14th, 2013

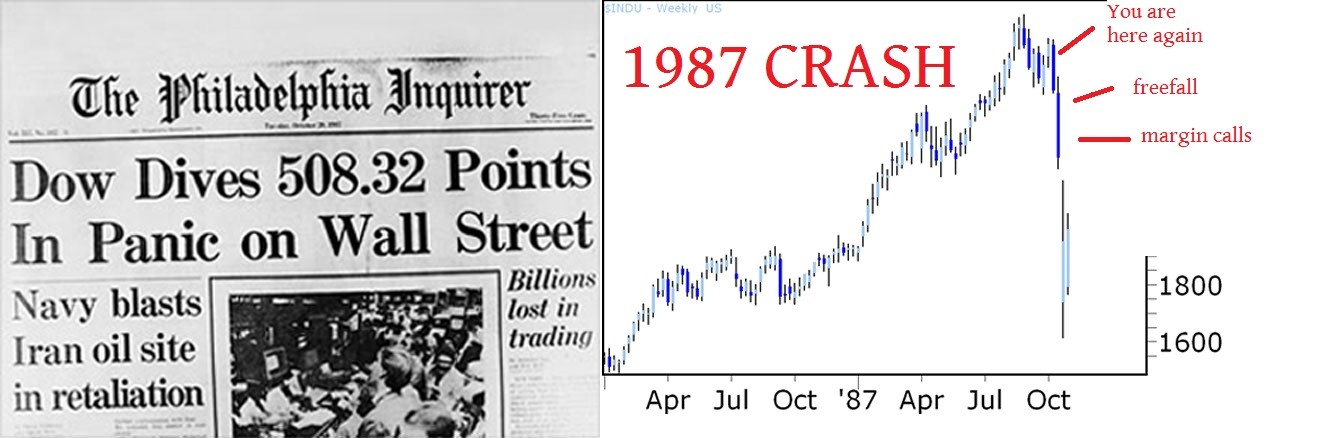

Some of the headlines from the previous 2 crashes:

On Oct. 19, 1987, a day that became known as “Black Monday,” the stock market crashed as the Dow Jones Industrial Average plunged 508 points, or 22.6 percent in value, its largest single-day percentage drop. The crash came after a two-week period in which the Dow dropped 15 percent.

According to the Oct. 20 New York Times, “Business leaders were shaken by the collapse, which wiped out huge amounts of the market value of their companies. And they seemed to have been caught by surprise. But many leaders were confident the panic would pass.”

Public Liquidation Spurred by Bears, Hits Low Market

Scare Orders From All Over Country Halt Ticker an Hour in Feverish Day

By Laurence Stern

With speculative nerves rubbed raw under the persistent hammering of bearish traders, a renewed wave of public liquidation swept over the stock market yesterday, depressing prices severely and hopelessly clogging the quotation ticker…

— The World, October 20, 1929

Headline from 1929:

Over the weekend, the events were covered by the newspapers across the United States. On October 28, Black Monday,more investors decided to get out of the market, and the slide continued with a record loss in the Dow for the day of 38.33 points, or 13%.

The next day, Black Tuesday, October 29, 1929, about sixteen million shares were traded, and the Dow lost an additional 30 points, or 12%

News are covering possible default in full swing. No one knows the outcome. October is that time of the year

More interesting history. An old article from the Times comparing the 1987 crash to the 1929 crash. How will the third crash compare?

STOCKS PLUNGE 508 POINTS, A DROP OF 22.6%; 604 MILLION VOLUME NEARLY DOUBLES RECORD; Does 1987 Equal 1929?

By ERIC GELMAN

Published: October 20, 1987

As stock prices soared this year, a chorus of pessimists warned that 1987 was looking more like 1929, when a stock market crash helped to usher in the Great Depression. Yesterday, after a plunge reminiscent of the worst days of 1929, one pressing question was whether the aftershocks would be as devastating to individuals and the nation.

The quick answer, many economists say, is no. The huge losses on Wall Street constitute a substantial blow to the economy at large. But there are many safeguards in place today -some instituted directly in response to the Depression that would tend to prevent the cascading financial collapse that characterized the crash, impoverishing millions of Americans.

A stock market crash doesnt ripple out into the economy with the same force as it did in 1929, said Geoffrey H. Moore, director of the Center for International Business Cycle Research at Columbia University.

To be sure, there are some unsettling similarities between the current era and the pre-Depression years. Like the Roaring Twenties, the 1980s have seen an astonishing boom Wall Street. Now as then, individual and corporate debt are high, and some sectors of the economy are extremely weak. Trade relations are strained, with protectionist sentiment growing.

But todays economy is better equipped to handle financial shocks. I dont see this decline in the stock market leading to a great breakdown in the economy, said Robert A. Kavesh, a professor of finance and economics at the New York University School of Business. There are still many elements of strength in the economy -profits are strong, for example.

Among the important differences between today and 1929 are Federal deposit insurance, unemployment insurance and Social Security insurance and other elements of what has come to be known as the safety net. These not only guarantee against widespread destitution; their very existence should also help to prevent the kind of financial panic that fed on itself in the Depression.

In 1929, you didnt have insurance of bank deposits, you didnt have the Securities and Exchange Commission, you had much less knowledge of how the economy worked, Professor Kavesh said.

Today the Government is much more willing to intervene to keep the economy growing. All governments, liberal and conservative, have assumed that responsibility, which wasnt the case in 1929, said John Kenneth Galbraith, a retired professor of economics at Harvard University and author of The Great Crash. Huge Federal budget deficits make it difficult for Washington to increase Government spending, however, which has been one response to economic slowdowns. First Line of Defense

As before the other two crashes, the news were filled with tension it seems.

Here is a snip from what is just happening now. Uncertainty and tension seem rampant:

Obama Sounds Alarm on Debt as Senators See a Deal in Reach

“This week, if we don’t start making some real progress, both the House and the Senate, and if Republicans aren’t willing to set aside their partisan concerns in order to do what’s right for the country, we stand a good chance of defaulting, and defaulting could have a potentially devastating effect on the economy,” Mr. Obama said at Martha’s Table, a Washington food bank.

Debt default damage already unfolding

Just when will the threat of a U.S. debt default began to inflict damage on the U.S.economy and global financial system?

Its already happening. And until Congress gets over its temper tantrum and lifts the Treasurys borrowing authority, it will get progressively worse.

Imagine if you woke up tomorrow morning and the U.S. government said $20 bills werent actually worth $20 anymore. Try using one in a New York City cab.

Thats essentially what will happen Oct.18 if Congress doesnt agree to lift the debt ceiling and the government defaults. Only the $20 bills will be U.S. Treasury bonds, the global currency used by governments, investment funds, banks, large corporations and anyone else who deals in very large amounts of money.

Like China. The largest foreign holder of U.S. debt is wondering aloud if its time to move its money elsewhere. With a congressional stalemate forcing the government of the richest country on earth to check behind the cushions for nickels and dimes to pay its debt, Chinas leaders think its time for the befuddled world to start considering building a de-Americanized world, according to the state news agency, Xinhua.

Lets not forget October 2008.

On October 24 (2008), many of the worlds stock exchanges experienced the worst declines in their history, with drops of around 10% in most indices.[12] In the US, the Dow Jones industrial average fell 3.6%, not falling as much as other markets.[13] Instead, both the US Dollar and Japanese Yen soared against other major currencies, particularly the British Pound and Canadian Dollar, as world investors sought safe havens. Later that day, the deputy governor of the Bank of England, Charles Bean, suggested that This is a once in a lifetime crisis, and possibly the largest financial crisis of its kind in human history.

Heres When The US Government Will Really Run Out Of Cash

Some of the latest news about the debt issues. The clock seems to be ticking either way

For Obama, budget fight has high stakes for agenda

Another, perhaps more likely, option: Obama ends up signing short term bills that keep Washington in the never-ending cycle of deadline-driven budget battles. For Obama, that would mean fiscal issues would keep consuming the oxygen in the nation’s capital at a time when he is already watching his window for passing significant domestic legislation close.

‘‘It’s a ticking clock,’’ Julian Zelizer, a political historian at Princeton University, said of presidential second terms. ‘‘He’s already into the red zone in terms of getting things done.’’

NYT: Dont Bet on US Not Defaulting

Conventional wisdom on Wall Street holds that the United States will not default — Washington will raise the debt ceiling, probably at the last minute.

Dont count on it, some experts say.

Ironically, the very fact that few think the government will default makes it more likely. Wall Streets optimism that an agreement will be reached is increasing the odds that one wont be reached.