The 120 Minus Your Age Stock Allocation Formula

Post on: 21 Июнь, 2015 No Comment

by Kevin on August 12, 2008

There used to be a mantra in personal investing that helped define your asset allocation. Essentially, you took 100 and subtracted your current age. The result was how much of your portfolio should be invested in stocks. The remainder would be invested in bonds.

However, times have changed. People are living longer and want to retire earlier. That means your portfolio needs to last much longer its being stretched both ways. The old rules are being replaced.

Its time for a new rule of thumb

If we applied the old heuristic, at my ripe young age of 24 I would have 76% of our portfolio in stocks. 24% of my portfolio would need to be in bonds. That seems absurdly conservative. Correct that, it is extremely conservative.

Ive read in a few personal finance magazines that a new rule of thumb is being applied. Instead of subtracting your age from 100, you subtract from 120. A simple change, but a significant impact. It moves the bar up 20 percentage points.

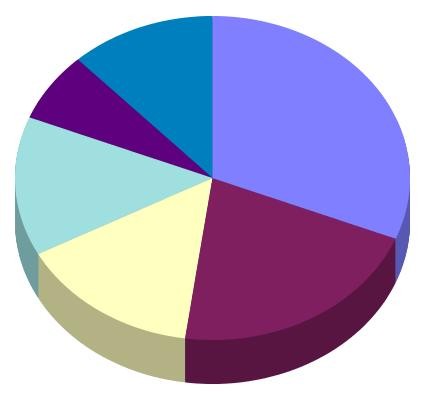

With the new rule of thumb, I should have 96% of my portfolio in stocks. That seems more accurate. Ive got at least thirty year to retirement. I can take the extra risk.

Why stocks are important

You might be thinking So whats the big deal if 16% of your portfolio is in bonds? I thought bonds were safe investments.

It is true that bonds are generally safer than stocks and due to this returns are going to be lower over the long term. Stocks carry a risk premium. As an individual investor, you need incentive to take risk. That incentive with stocks is over the long run higher returns. If you couldnt earn higher returns in stocks then everyone would invest in safe assets like bonds, CDs, and saving accounts. There would be no incentive to take the additional risk.

Stocks provide portfolio growth in the long term. Since my investment horizon is so far out, I need to maximize my opportunities for growth. Stocks should trump other investments over the next 30 years.

A Word of caution

Any heuristic or rule of thumb should be used with a grain of salt. They all will have flaws in different situations. Whether it be the 120 minus your age formula or looking for stocks with a low P/E ratio, dont just use the ideas without any deep thought on your part.

For me, the 120 rule seems to work. Well slowly adjust our portfolio to become more conservative over time. Our target retirement funds will make that pretty easy for us as well.