Technology ETFs In Focus On Big Earnings Week

Post on: 7 Апрель, 2015 No Comment

The calendar of earnings announcements this week has a notable slant towards large-cap technology stocks. Companies such as Microsoft Corp (MSFT ), Texas Instruments (TXN ), Apple Inc (AAPL ), Facebook Inc (FB ), and Google Inc (GOOG ) are just some of the top names that are set to release their latest quarterly results.

This sector has been a strong area of the market over the last several years and many investors likely have exposure to some of these individual stocks or an associated ETF. In fact, the number of innovative ETFs that offer varying degrees of exposure to these companies has continued to multiply in recent years.

The Technology Select Sector SPDR (XLK ) is still the biggest sector benchmark in terms of total assets. This market-cap weighted index has over $13 billion dedicated to 73 large-cap technology and telecommunication companies. All of the stocks in the list above are represented in XLK according to the size of their share float. AAPL is easily the biggest holding with more than 16% of the total asset allocation.

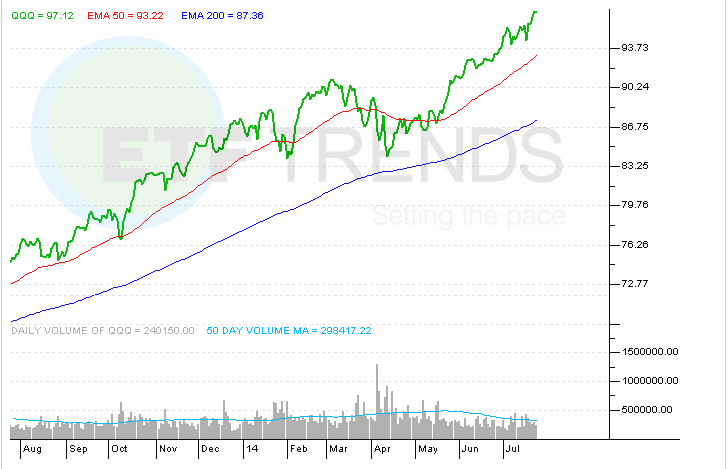

XLK has gained 19.66% over the last year compared to 16.96% in the broad-market SPDR S&P 500 ETF (SPY ). This stretch of outperformance is certainly attributable to the strength of AAPL and MSFT, which have shown tremendous demand and momentum over the last 52-weeks.

While XLK can be an excellent core holding for a technology-oriented portfolio, many investors may be searching for a more exotic asset allocation or index methodology to enhance their returns.

First Trust has several ETFs geared towards the technology space with unique flavors for varying investment objectives.

The First Trust NASDAQ Technology Dividend Index ETF (TDIV ) is one example of a fund that may be attractive for investors looking to add an equity income component to their portfolio. TDIV currently has 95 holdings of technology-related companies with a history of paying dividends. Components within the index are weighted according to their dividend payouts and rebalanced on a quarterly basis.

The end result is a diversified basket of technology and telecommunication stocks with above-average yields. The current 12-month distribution yield on TDIV is 2.80%, based on the past one year of income.

Another strategic fund worth noting is the First Trust NASDAQ-100-Technology Sector Index Fund (QTEC ). This growth-oriented ETF selects 40 technology companies from within the NASDAQ-100 Index and equal weights them. The equal weighting methodology gives smaller companies within the index a larger pull on the total return of the fund rather than putting that control in the hand of a few of the biggest stocks.

Those that want to focus on smaller companies in general should have the PowerShares S&P Small Cap Information Technology Portfolio (PSCT ) on their radar. This ETF selects just over 100 technology stocks from the S&P Small Cap 600 Index and weights them according to market cap. A fund like PSCT can provide outsized exposure to under covered stocks that aren’t necessarily providing the same services or products as large-cap tech companies.

Lastly, you can select individual ETFs based on a specific industry theme as well. The First Trust Dow Jones Internet ETF (FDN ) and iShares PHLX Semiconductor ETF (SOXX ) are two examples of this style of fund. A narrower industry group can provide focused exposure to a specific area of the market that you feel has the opportunity to outperform over time.

The variety of asset allocation available to ETF investors through multiple channels provides the ability to capture a specific investment goal, while still participating through a diversified vehicle rather than an individual stock. The technology sector has shown strong technical and fundamental indicators that will continue to be evaluated through this most recent earnings season.

Note: The author is long TDIV at the time this article was published.