Technical Trading Strategies Tail Gap Strategy Revisited

Post on: 4 Август, 2015 No Comment

Simple Technical Trading Strategies That Work

Those of you who follow my trading videos and this blog know that Im a big proponent of simple technical trading strategies. Many traders believe that complex methods are better or have a better winning to losing ratio. I will tell you from many years of trading that this is simply not true. As a matter of fact one of my favorite technical trading strategies, the Tail Gap Method is one of the most profitable and reliable trading strategies I have ever come across.

Lets Revisit the Tail Gap Strategy

For those of you who are not familiar with the Tail Gap Strategy, you can download a free trading report on the front of our web site that goes into the rules and provides some examples of this strategy. I highly recommend you download a copy and familiarize yourself with this trading method. In a nutshell, the method is based on simple trading principles such as trends, gaps and volatility, but provides everything necessary for consistent returns. I know several traders who only trade this one strategy across different stocks and other markets and tell me that it works great for them.

Today Im going to review some past trades so that you can see how the Tail Gap Strategy Sets Up, this way you can get a good feel for this method. The reason why I want to go over this with you is because I have been getting several emails from traders who are learning this method and many traders are making similar mistakes. I want cover the most common mistakes when using this strategy so that you can gain all the benefit from the Tail Gap Strategy.

Make Sure You Follow The Main Trend

The first major problem that I see traders making with the Tail Gap Strategy is taking signals against the main trend. This is a big no and I highly recommend you only take signals in the direction of the main trend. Most profitable technical trading strategies require you to trade with the main trend and this one is no exception.

Avoid Going Against The Trend. Find Stocks That Are Sloping At Least 20% Either Up Or Down

Many traders confuse the Tail Gap Strategy with reversal strategies and go against the major trend. This is highly discouraged and will most likely cause you unnecessary risk of loss.

The Signal Is A Buy Signal But The Trend Is Down

You can see in this example that AGG is in a downtrend. The entry signal should be avoided because the main trend is slopping down. Only short signals should be taken in this case. Since this is a long entry signal, we will avoid it completely.

Cancel Your Order If No Fill Next Day

The second biggest error that traders make with this method is forgetting to cancel the entry order if no fill takes place. Remember, you only get one day after the set up to enter the trade. If the trade doesnt work out the day after the set up, the order has to be canceled. The premise of the Tail Gap Strategy is something happens in the market that causes a short temporary deviation from the main trend. Our goal is to catch the stock or any other market youre trading as the market is correcting the deviation and coming back to its normal trading level within the trend. This is supposed to happen very quickly, thats why I dont give this trade too much time to work out.

The Order Is Triggered The Very Next Day

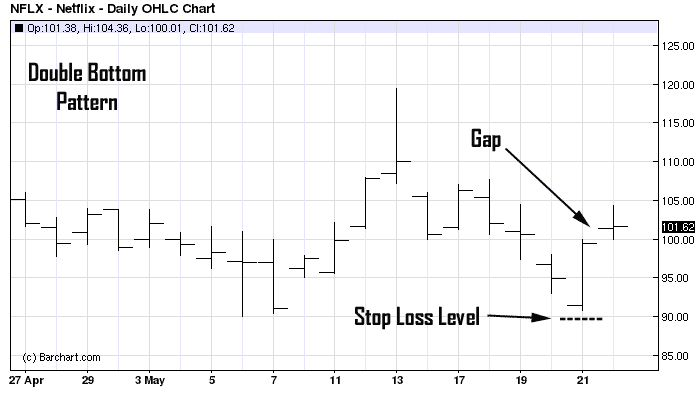

Place Your Stop Loss And Profit Target Order Every Time You Enter Trade

The last issue I see traders repeatedly having trouble with is avoiding placing stop levels and profit target levels.

Statistically, most traders who do not place stop loss orders and profit target orders at the time the order is placed, avoid doing so.

Remember, the biggest cause of losses is caused by avoiding stop loss orders at the time you enter the market. Always write out your stop loss and profit target orders BEFORE you enter the trade. This way you will enter all orders at the same time and make a habit of doing so. This one piece of advice is very important and I hope you follow it each and every time you place an order.

The Stock Almost Got Stopped Out 3 Days After Entry. Going In The Direction Of The Trend Helps Often

Remember The Profit Target is Twice Your Risk Level Added To Your Entry If You Are Going Long