Technical and Fundamental Stock Analysis

Post on: 18 Апрель, 2015 No Comment

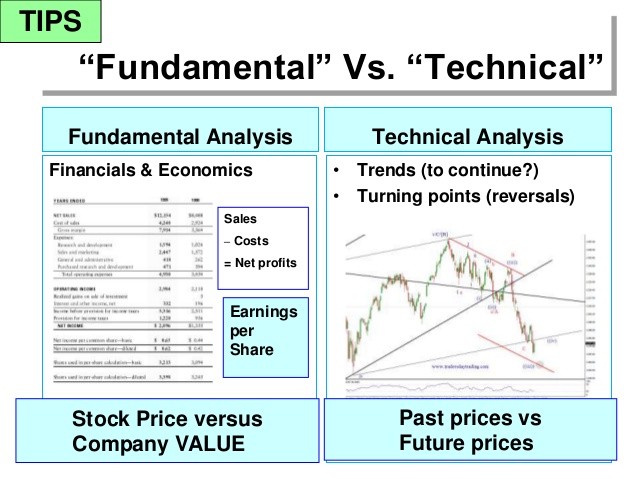

There are a variety of strategies for picking stocks to buy or short and for determining when to exit a position. Obviously this is a topic far beyond the scope of a single short article—shelves, or more accurately libraries, of books have been written on the subject—but we will take a brief look at two broad approaches to stock picking: technical analysis and fundamental analysis.

To understand the divide between the technical and fundamental camps, you must first understand the efficient market hypothesis (EMH). While EMH is not straightforward—there are many hybrids and variations of pure EMH, such as the strong and weak versions—its basic premise is that the market is perfectly efficient, meaning that at any given time, all available information about a company has been priced into the stock.

You might raise an eyebrow at the phrase “perfectly efficient,” since the market is made up of humans and humans are imperfect, but EMH looks at the market collectively. Nevertheless, EMH has plenty of detractors. Yet as it happens, both the technical and the fundamental schools rely on the validity of EMH to some degree.

The fundamental school assumes that the market is not perfectly efficient, which means that at any given time a particular stock might be overpriced or underpriced. This assessment is based on a judgment of the company’s intrinsic value—the true value warranted by its financial performance and other factors.

However, fundamental analysis relies on the assumption that the market is efficient over the long term, which means it will eventually match the stock price to the company’s intrinsic value. Value investors, who look for undervalued companies, are part of the fundamental school. One value investor in particular is reasonably well-known, and you may have heard of him: Warren Buffett. It’s hard to argue with that kind of success.

The technical school, on the other hand, generally accepts EMH. Consequently, this group believes that trying to find undervalued or overvalued stocks is useless, and therefore the only valid selection strategy is to look for consistent price movement patterns and exploit their predictive power. In other words, technical analysts believe they can predict with reasonable certainty when a stock is headed up or down.

EMH can be a bit depressing, as in its purest form it dictates that since all information is priced into every stock, it is impossible for any investor to beat the market over the long term. Clearly some investors do well, and that leads to debate over what is considered “the long term.” The controversy generated by EMH is considerable and well outside the scope of this discussion, however.

Returning to the analysis schools, fundamental analysis looks at the “fundamentals” of a company. It is based on financial and other performance measures derived mostly from the financial statements, as well as more subjective data found in a variety of sources.

The questions answered range from basic ones such as whether revenue is growing or shrinking, whether the company is profitable, how much debt it is carrying, and how efficiently it is using its capital to “fuzzier” questions about brand recognition, market position, competitive advantages and disadvantages, and management team competence.

Because this strategy assumes that the market will eventually boost the price of an undervalued company, it is a long-term strategy best suited to buying and holding. (Warren Buffett is no high-frequency trader.)

Technical analysis, by contrast, looks at chart patterns. It ignores (for the most part) the underlying drivers of price movement to focus on the outcomes they produce.

Potential patterns are back-tested against historical data across a variety of stocks to determine whether they are reasonably consistent in producing a given result. (No pattern is perfectly predictive, so typically chart analysis strategies will have a success/failure rate assigned to them based on this back-testing.)

Such patterns can form across time periods from years to hours, though many common ones form over days to weeks. As a result, technical analysis lends itself more to short-term and day trading.

Both analysis schools have value, as both have been demonstrated to produce trading profits (and to produce losses if handled badly). The key is to understand which school suits your trading style and investment goals and to use the appropriate one. You may even blend aspects from both schools in some cases to capture the best of both approaches.