Technical and Fundamental Forex Analysis

Post on: 16 Июнь, 2015 No Comment

Various Types of Forex Analysis

In this article we will be looking at the various forms of fx analysis with two main categories that most traders pay attention to. They are Technical Analysis and Fundamental Analysis .

This is the juice that keeps forex traders alive. The more you understand the value of analysis, the better a trader you should become in due time. It is a general fx newbie mistake to ignore these but it is often at their own peril. There are literally hundreds of books covering forex analysis, so if in doubt, pick one up.

Some Traders just stick to Technical Analysis and some Fundamental Analysis. It is best to be fluent in both — which is often easier said than done. With that said, you have to remember that Practice, Makes Perfect. and the more you practice practice practice, the better you develop as a trader. If there is one piece of advice you should ever remember about trading currencies is just that — ‘Practice makes perfect’ . Don’t expect to wake up a millionare by Friday. Learn about these important aspects of trading first and of course Demo Trade First with one of our selected Brokers . Take Baby Steps.

Technical Analysis

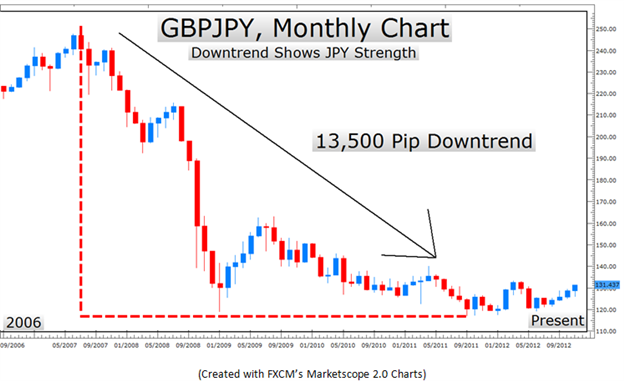

Examples of this include Chart analysis and Trend Analysis . When most traders think of technical analysis, the first thing that comes to mind is Charts.

The basic job of a Technical Analyst in trading is to look for patterns happening and most importantly past patterns. They believe that what happened in the past is most likely to happen in the future. They could be very right, but it is impossible in my view to trade on just this theory. Other factors have to be included. Technical analysts mainly look out for what is known as support and resistance levels and use these to determine whether to buy or sell a currency.

Of course it is not as simple as that. There are many other indicators that Technical Analysts use to determine their trades. Lets’s dive into charts for a brief moment.

Technical Analysts use chart analysis simply because charts are the easiest way to represent historical price movements visually. As the name implies, it is just that. Reading Charts and deciphering what is the next likely move to happen to a currency pair. A lot of traders use charts and similar trading rules and ideas. This makes the market also behave in similar ways therefore assisting techinal analysts make some decent profit from their trades if there predictions were correct.

Because Forex is a 24 hour market . it provides fx analysts with a large amount of data that can be used to measure future activity resulting in an ever increasing significance of statistical data. This makes it perfect for traders to use technical tools like Charts, Indicators and Trend Lines .

Fundamental Analysis

The job of a Forex Fundamental Analyst trader is to evaluate different countries currencies and economic states. This includes social, economic and political factors. News Reports, economic data and social political events coming out are indeed very similar to news coming out about a particular company for stock traders to speculate on.

You could see the relevance of fundamental analysis and why some traders only use this type of analysis to determine whether to make a trade or not. It is highly effective and mostly used by long term fx traders.

There are practically thousands of fundamental strategies that are employed by traders due to the vast amount of fundamental data. Each to their own as they say. Commodity prices are also used as fundamental data to determine future currency activity.

The underline idea of fundamental trading analysis is to determine who’s economy is growing and who’s isn’t. Sounds simple right. It could be if you know everything. But of course this is never the case. Later on I will be going deeper into fundamental analysis and how you can use this to your advantage to execute profitable trades. This is quite handy for news enthusiasts.

Sentiment Analysis

Another form of fx trading analysis which you cannot afford to ignore is Sentiment Analysis . Some say it is easier to read people than machines. You decide. Important thing to know here is, essentially, people just like you run these markets. They make the trades. Okay you can argue that there are automated robots, but just remember that they were programmed by someone just like you. They were not born out of thin air.

As a trader in any markets, you have to Make Decisions . You need to know whether to buy or sell. This decision firmly rests with you. For instance, you might want to short the Euro having read a news article or studied some charts. You firmly believe this will short. You wait and wait and you decide to short it anyway. To your utter surprise, it goes long. You cannot stop it. You are now looking at a red screen and all your monies have vanished into thin air!

This is why it is important to gauge market sentiment. You have to remember that one person or individual cannot control the market. It is a mixture of all the views, ideas and opinions of all participants in the markets. This combo is what is referred to as Market Sentiment. The emotions of all the traders combined explain the current direction of the markets.

In the above scenario, it would have been clearly better to either leave the trade alone or go long because that is what the market sentiment was suggesting against all logic fundamental and technical.

In other markets like stocks and options, traders can look at the overall traded volume as a sentimental indicator. If price has been rising, but volume declining, this could signal that it is time to sell and vice versa.

With Spot Fx, Sentiment Analysis can be a bit tougher since it is traded over-the-counter (OTC) and hence does not pass through a centralised exchange. If you read the previous article on Types of Forex Trading . You may have picked this up. There are weekly reports you can look at to gauge market sentiment, but as newbie, it is not important right now. Later in your forex journey, you will learn about these.

In conclusion, Sentiment Analysis although not as major as Technical and Fundamental analysis, should not be ignored. Understanding Market Sentiment, will help you and will come in time.