Tech Funds And ETFs To Buy And Avoid

Post on: 20 Август, 2015 No Comment

The information technology sector ranks third out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my neutral rating, which is based on aggregation of ratings of 27 ETFs and 157 mutual funds in the information technology sector as of January 24, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here .

Not all information technology sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 417), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to neutral-or-worse-rated stocks. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here .

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Twelve funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Technology Select Sector SPDR (XLK) is my top-rated information technology ETF and Vanguard World Funds: Vanguard Information Technology Index Fund (VITAX) is my top-rated information technology mutual fund. Both earn my attractive rating.

PowerShares Lux Nanotech Portfolio (PXN) is my worst-rated information technology ETF and earns my dangerous rating. Ivy Funds: Ivy Science & Technology Fund (ISTEX) is my worst-rated information technology mutual fund ands earn my very dangerous rating.

Figure 3 shows that 157 out of the 600 stocks (over 38% of the total net assets) held by information technology ETFs and mutual funds get an attractive-or-better rating. However, only five out of 27 information technology ETFs and five out of 157 information technology mutual funds get an attractive-or-better rating. A very small percentage of the ETFs and funds available in this sector are worth buying, especially compared to the number of good stocks in the sector.

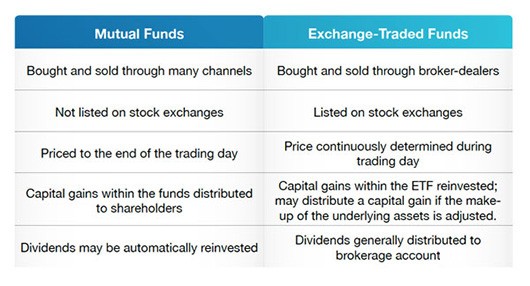

It is good to see that the majority of ETF assets, 63%, are in the attractive-rated ETFs. ETF investors are making good choices. The same is not true for tech mutual fund investors as only 1% of the assets in the sector are in the attractive-rated funds. The rest is in neutral-or-worse rates funds. Indeed, the amount of assets invested in attractive or better stocks by mutual funds is miniscule compared to ETFs, which is further evidence that mutual fund managers are not giving investors their money’s worth.

The takeaways are: (1) tread carefully in this sector as a small minority of ETFs and mutual funds are worth buying and (2) mutual fund investors need to do more research on the quality of stocks held by mutual funds.

Figure 3: Information Technology Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors ”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management .

International Business Machines Corp (IBM) is one of my favorite stocks held by information technology ETFs and mutual funds and earns my very attractive rating. IBM is a great company for steady, long-term growth. The company is a model for successful adaptation to the demands of a constantly changing industry. All the while, the business has generated a NOPAT CAGR of 7% over the last 14 years. And the valuation of the stock (

$204/share) translates into a price to economic book value ratio of 1, which means the market expects zero NOPAT growth forever. No growth for the rest of its corporate life is an unlikely scenario for such a consistent performer.

MasTec Inc. (MTZ) is one of my least favorite stocks held by information technology ETFs and mutual funds and earns my very dangerous rating. MTZ is a prime example of how a company can boost EPS without creating shareholder value. Specifically, it reported EPS of $1.22 last year while actually posting $-0.16 in economic earnings per share. The fact that MTZ has only managed to post positive economic earnings in 2 out of the past 12 years should make investors skeptical of the stock’s valuation. At

$28/share, the current market valuation implies the company will grow NOPAT at 10% compounded annually for nearly 20 years. Those expectations are awfully high for a company with a poor profit growth track record.

518 stocks of the 3000+ I cover are classified as information technology stocks, but due to style drift, information technology ETFs and mutual funds hold 600 stocks.

Figures 4 and 5 show the rating landscape of all information technology ETFs and mutual funds.

The amount of assets invested in attractive or better companies by mutual funds is miniscule compared to ETFs, further evidence that mutual fund managers aren’t giving investors their money’s worth.