Taxing Dividends and Capital Gains

Post on: 16 Март, 2015 No Comment

Taxing Dividends and Capital Gains: Effect on the Super-Rich and Retirees

By Douglas A. Kahn, Paul G. Kauper Professor of Law, and Lawrence W. Waggoner, Lewis M. Simes Professor of Law Emeritus

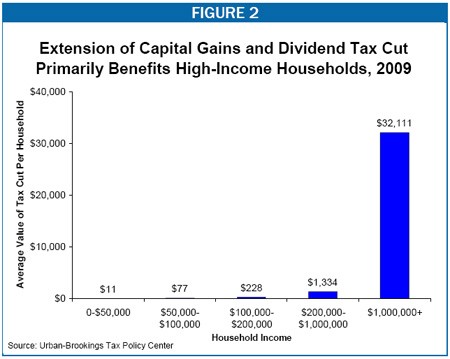

It is now well understood that, unless the president and Congress soon agree on a different course, the 15 percent tax rate on dividends and capital gains will come to an abrupt end on January 1 and will be replaced by the Fiscal Cliff rates. Dividends will then be taxed as ordinary income at a marginal rate as high as 39.6 percent and capital gains will then be taxed at 20 percent. For high-income taxpayers, a 3.8 percent Medicare surtax will be added to the taxation of dividend income, capital gains, interest, and other investment income, bringing the highest marginal rate to 43.4 percent.

In speech after speech, and on the White House website, President Obama has embraced the so-called Buffett Rule: As multi-billionaire Warren Buffet has pointed out, his average tax rate is lower than his secretary’s. No household making over $1 million annually should pay a smaller share of their total income in taxes than middle-class families. The 15 percent tax rate on dividends and capital gains is the reason why Warren Buffett’s tax rate is lower than the tax rate paid by middle-income families (including Buffett’s secretary). The income of middle-income families comes mostly in the form of salary and wages, which are taxed as ordinary income.

The Obama Administration’s formal tax proposals urge Congress to end the current 15 percent rate on dividends and capital gains and allow the Fiscal Cliff rates on those items to go into effect for taxpayers in the 36 percent and 39.6 percent brackets, i.e. for married taxpayers filing jointly whose adjusted gross income (AGI) is more than $250,000, for head-of-household taxpayers whose AGI is more than $225,000, for single taxpayers whose AGI is more than $200,000, and for married taxpayers filing separately whose AGI is more than $125,000. (The administration’s proposals are memorialized in the Middle Class Tax Cut Act passed by the Senate in July.) For simplicity, we treat the administration’s proposal for Fiscal Cliff rates on dividends and capital gains as applying to taxpayers whose AGI is more than $250,000, which is the income figure the president most talks about publicly.

The following table, drawn from IRS data for 2010 (the latest year for which data are available), shows, by percentage, selected sources of income for taxpayers (regardless of marital status) who itemize deductions and whose adjusted gross income is at or above $250,000: