Taxes 101 Income Gains

Post on: 23 Апрель, 2015 No Comment

Related:

January 27, 2012 Updated Jan 27, 2012 at 12:20 AM EDT

FORT WAYNE, Ind. (Indiana’s NewsCenter) – A local financial expert breaks down why Republican Presidential Candidate, Mitt Romney, paid less than 15 percent in federal taxes.

Republican Candidates for President held their 20th debate Thursday night. Candidates focused on free global trade, illegal immigration, and personal investments. Like in the last debate, Newt Gingrich and Mitt Romney argued over taxes—again. Gingrich has been attacking Romney for not paying a fair share. Romney says he paid less than 15 percent in taxes in 2010, which is less than the average American.

Now, according to the Huffington Post, Romney claims he actually pays more than 15 percent in taxes, and that it’s closer to 40 or 50 percent. Romney publically released his tax returns Tuesday. He claims, in addition, he gave several millions to charities over the past couple years. Romney said in the Huffington Post, “When you add it together, all the taxes and the charity, particularly in the last year, I think it reaches almost 40 percent that I gave back to the community.”

The Huffington Post also says Romney is one of the wealthiest people to ever seek the Presidency, earning $42.5 million over 2010. His tax returns showed he paid 13.9 percent, $6.2 million of the $42.5 million, in 2010 and will pay 15.4 percent for 2011.

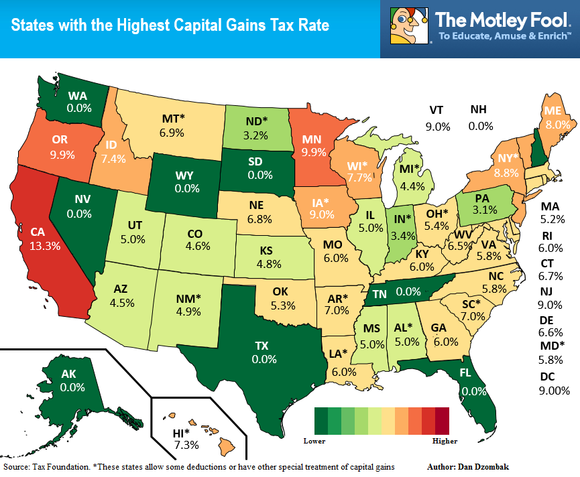

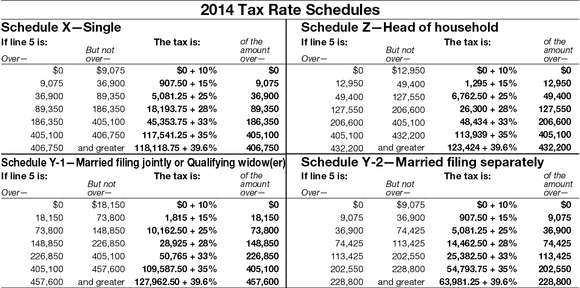

But, Romney claims it’s the difference between paying taxes on investments versus paying taxes on income earned. The familiar ‘income tax’ is based on a person’s income, and can range from 10 to 31 percent plus state tax percentage. According to Dennis Voegele, Sr. Vice President at Stifel Nicolaus, Indiana has a 3.4 percent tax rate. Voegele says Romney’s tax rate is low because his personal income is from capital tax gains, or investments.

Capital gains are investments such as stocks, real estate, or fine jewelry. Voegele says people often buy investments and sell them at a gain. US Code states if an investment is held for more than a year, the holder is taxed at 15 percent or less. If the investment is sold prior, the holder’s taxed at their income level rate, which explains why Romney’s tax percentage is lower compared to most Americans.

“He’s not paid a salary, so he’s not earning any income. He’s basically selling stocks and his investments and because of that he only pays a flat 15 percent,” Voegele said. “So he is obeying the law. People shouldn’t be getting mad at Mitt Romney or any wealthy people. It’s Congress that has passed that law to allow people to pay less in taxes as they make investments.”

Gingrich and other Americans say the tax structure in the US needs to be overhauled—one of the points Gov. Mitch Daniels made in his GOP response to the President’s State of the Union Address Tuesday night.

Voegele says 47 percent of Americans do not pay federal taxes because of capital gains. He suspects that’s why President Obama is proposing people who make more than a $1 million a year should pay at least 30 percent in taxes.

What are your thoughts CLICK HERE to leave us a QUESTION OF THE DAY” comment.

Want to be in the know for the next weather event, the next school closing or the next big breaking news story?

TextCaster alerts from 21Alive.com are your defining source for instant information delivered right to your cell phone and email. It’s free, easy and instant. Sign-Up Now !

Powered by Summit City Chevrolet