TaxEfficient Investors Look to Asset Location

Post on: 1 Июль, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

BERKELEY HEIGHTS, N.J. ( TheStreet ) — Investors can boost their investment returns by planning for income taxes when designing their portfolios. Let me be clear — I am not talking about an approach in which capital gains recognition is avoided at all costs. The focus here is structuring a portfolio for tax efficiency on the front end.

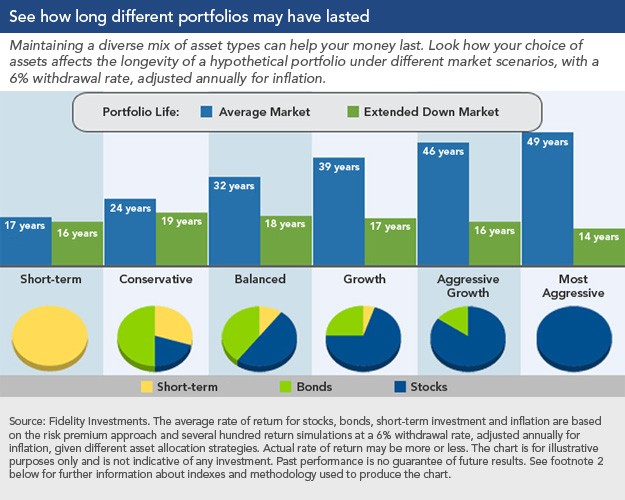

Every investor has heard about asset allocation — how one allocates their portfolio among various asset classes, such as cash, bonds and equities — but far fewer have heard of this.

Asset location focuses on placing asset classes and underlying investment vehicles where they will be most tax efficient within a portfolio. An investment vehicle is simply the underlying investment itself — individual stocks and bonds, for instance, or mutual funds and exchange-traded funds.

The first step investors need to take when implementing a tax-efficient portfolio is to consider their various accounts as one. Typically the investor will have multiple accounts made up of taxable accounts; tax-deferred accounts such as 401(k)s, IRAs and 403(b)s; and tax-free accounts such as Roth IRAs. Instead, the investor should develop a global asset allocation, then put the less tax-efficient asset classes in tax-deferred accounts to lower the tax impact.

For example, a high-yield bond mutual fund would be an ideal candidate to put in a tax-deferred account. Such a fund might yield 7% to 8% in pretax interest income. (Remember, taxable interest income is considered ordinary income for federal income tax purposes. For someone in the 35% tax bracket, holding this fund in a tax-deferred account shelters 2.5% to 2.8% of the return from current income taxes.)

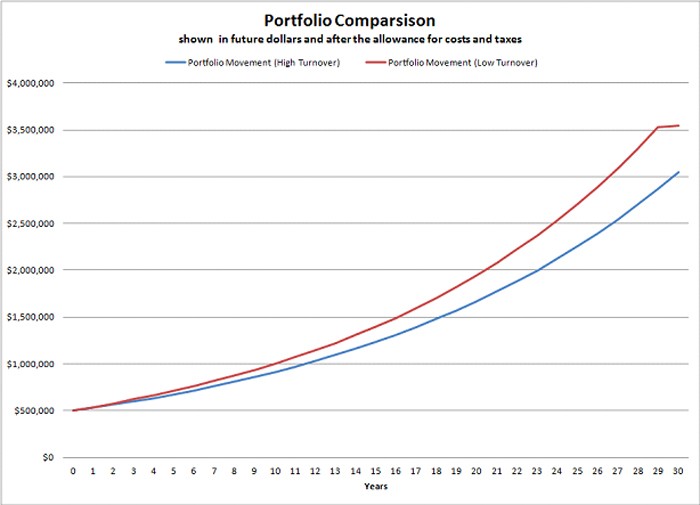

Active mutual funds with high turnover may also be candidates for a tax-deferred account, while a broad-based index mutual fund or ETF would be better put in a taxable account. A broad-based equity ETF, for example, is likely to generate mainly qualified dividends, and qualified dividends are taxed now at a maximum federal rate of 15%. So someone paying taxes at a marginal rate of 35% pays only 15% on qualified dividends.

Another benefit of using ETFs in a taxable account is that the investor generally realizes a capital gain only when they sale their shares. Mutual fund investors can get socked with a capital gain whether or not they sell their shares. This is particularly true of active mutual funds with high turnover.

Investors can use Morningstar to gauge the impact of taxes on mutual funds and ETFs. The firm publishes a tax-adjusted return and a tax-cost ratio for funds and ETFs assuming an individual is in the highest federal bracket. (The tool excludes the impact of state taxes and does not factor the ultimate sale of the investment.) These ratios provide a good guide for high-income taxpayers on the tax consequences of investing in a particular fund or ETF in a taxable account. Funds or ETFs with a high tax-cost ratio would be good candidates for a tax-deferred or tax-free account.

The final takeaway: The only return that really matters is the net return an investor gets to keep after tax.

>To submit a news tip, email: tips@thestreet.com.

RELATED STORIES:

>>Tax Reporting Rules Need $19B Solution