Tax Considerations for Bond Investors

Post on: 17 Август, 2015 No Comment

One reason stocks are more popular than bonds is that the latter are more complicated. Ironic, considering their risk and returns bonds are easier to judge and predict with confidence.

Adding to the complexity are the differing tax issues affecting bond returns.

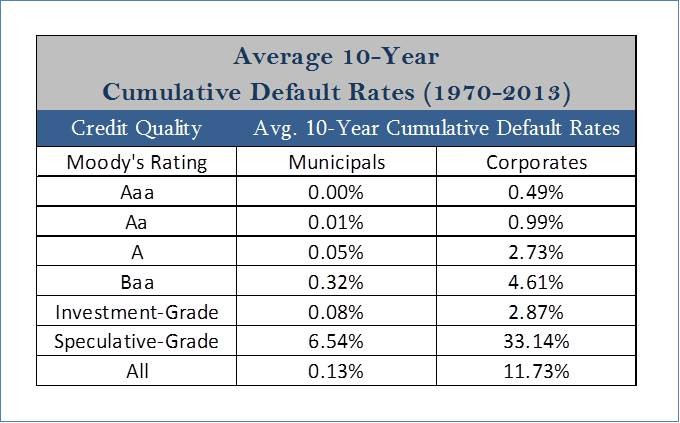

Federal, state and municipal governments issue bonds to borrow money beyond what taxes bring in. Unlike corporations, they can make those (usually) lower yielding bonds more attractive by coupling them with tax incentives. State and local bonds, for example, are generally free of U.S. Federal taxes and are often offered tax-free by those states or municipalities.

A higher yield bond may actually return less after-tax income depending on the investors tax rate, depending on whether the bond is subject to state or Federal taxes and other factors.

For example, assume $10,000 is invested in two different bonds: one Municipal tax-free yielding 4%, another a taxable bond with a yield of 5.5%. $10,000 x .04 = $400, in the first case. $10,000 x .055 = $550 in the second case. The second appears to be a better return. But now assume a 28% tax rate. $550 x .28 = $154 lost to taxes, leaving only $396 ($550 $154). The higher stated yield actually returns less actual yield. A higher tax rate makes the situation even worse. For example, at 33% only $368 of interest is retained after tax.

Remember to factor in all taxes, since a bond can be free of Federal tax but subject to state taxes or vice-versa.

Any calculation of yield on a bond (the actual return over time) is complicated, usually requiring computer help to carry out. Adding tax considerations increases the difficulty, but fortunately utilities are readily available on the Internet to help. A simple search will locate one that allows inputting income tax rate, Federal tax burden, state, coupon rate, etc.

To provide the simplest equation for those interested:

R(te) = R(tf) / (1 t)

where:

R(tf) = the rate paid on a tax-free municipal bond

t = the investors marginal tax rate

R(te) = the taxable equivalent yield for the investor with a marginal tax rate of t

Now lets add yet another wrinkle. Some government bonds are issued as zero coupon. These pay no interest, but sell at a discount to their face value. Profit (one hopes) is realized at maturity when the full, non-discounted principal is repaid.

But, the government is not to be denied its cut. Even though the bond holder doesnt receive any interest, in the US the IRS (Internal Revenue Service) requires imputing an annual interest income and reporting it as income each year. However, when bought for a tax-deferred account, such as an IRA (Individual Retirement Account), the imputed interest doesnt have to be reported as income.

Zeroes tend to be more sensitve to prevailing interest rates, and some investors buy them, seeking capital gains when interest rates drop.

Now lets add one final twist to drive ourselves completely insane. Coupon rates are not always fixed these days, as they have been historically.

There are floating rate coupon bonds and inverse floaters as well. With an inverse floater, as interest rates rise, the coupon rate falls. When short-term interest rates fall, two things happen: (1) The bond price rises, and (2) the yield increases. And that, too, of course has tax consequences

Not to panic! Before moving that mouse to buy another 100 shares of XYZ, search for a bond calculator. Profits go to the fearless.

Enjoyed this post? Share it!