Target Date Funds or LifeCycle Funds Pros and Cons

Post on: 11 Апрель, 2015 No Comment

by Silicon Valley Blogger on 2010-04-12 6

I remember when Target Funds or Target Date Funds were first launched. This particular kind of fund was designed to make asset allocation easier for people, allowing investors to adjust and rebalance their investment portfolios automatically over time, to address specific goals. Target date funds are often also used for college education funds (529 college savings plans ) and are normally referred to as age-based tracks. But, I didnt like them when they were first introduced and have not been convinced to like them now.

What Are Target Date Funds?

Target date funds, which are also given the name lifecycle funds, are retirement plans that combine stocks, bonds and other investments and become more conservative as you approach retirement age or any other goal. These mutual funds take the guesswork out for you by allowing you to choose the year you intend to reach your goal and, based on that, your funds asset allocation gets adjusted automatically. Doesn’t get much easier than that!

Target Date Funds (LifeCycle Funds): The Pros

So who benefits from Target Date Funds? First, let me say that for some people they may make sense. For instance, if someone is just getting started with investing. has a small portfolio and is new to the concept of proper diversification and asset allocation, then target date funds may work out for them. For example, I have seen people with smaller $5,000 or $10,000 portfolios. Since proper asset allocation may require around 8 different mutual funds to achieve, employing this approach (with 8 funds) would split up a pretty small nest egg quite a bit. Plus there would be a need to balance annual contributions and rebalance existing allocations on a regular basis. Without a professional to help out (and many will not help you at this asset level), this can become a daunting task. So, why not put such assets in a target date fund that will give you pretty good diversification and be done with it? Personally, I think it makes sense for beginners and those starting to build their investment portfolio. But frankly, I believe that the majority of investors can do better on their own.

3. If you subscribe to purely passive investing and would like investment experts or professionals to work on rebalancing your asset allocation over time.

Target Date Funds (LifeCycle Funds): The Cons

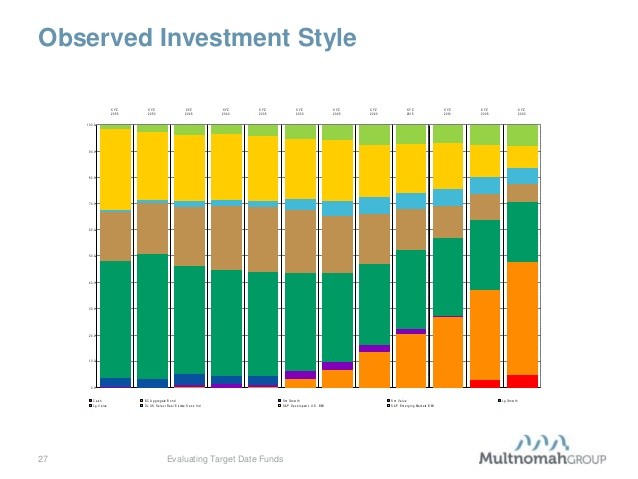

So, what’s my major beef with these funds? To start, I still think that you can get better diversification on your own. For instance, with target date or lifecycle funds, you may get an approximate stock/bond/cash ratio that fits your personal situation, but you cannot control the exact allocation and the sub-asset allocation among small, mid, large, international stocks or different types of bonds within the fund. That’s all left up to the fund manager.

When it comes time to rebalance or withdraw your money, you wont have the flexibility you would have if you instead constructed your own portfolio covering various asset classes. For example, when you are spending from your portfolio, it may be in your best interest to spend from either the stock side OR the bond side of your portfolio instead of from both. It also may make sense, when spending, to take withdrawals from a sub asset class like intermediate bonds or large cap stocks depending on your goals, your age, or a particular assets performance during a given year. But, with a target date fund you are not afforded this opportunity. Those are some reasons why Ive avoided target date funds (as well as balanced or global funds).

Target date funds may not be for you if:

1. You prefer more control over your investment portfolio.

2. You seek flexibility with managing your investments.

3. You would like to follow a spending or withdrawal strategy (against your funds) that is more fine-tuned.

4. You are an experienced investor.

A Deeper Analysis and Look at Target Date Funds

But my misgivings aside, I think that the heat that target funds have taken recently is unfair. You see, as of late, target date funds have not performed as desired. Just as with the stock market, the recession crippled target date funds causing losses averaging twenty-three percent in 2008. And funds set aside for people who want to retire in or around 2010 were dissected as angry investors dreaded the fact that much or their retirement nest egg had been lost.

Consequently, Herb Kohl (D-Wis.), the Chairman of the Senate Special Committee on Aging, announced the introduction of future bills requiring that managers of target date funds accept fiduciary accountabilities—meaning the interests of the investors would have to be placed above their own—and encounter an increase in both lawful liabilities and parameters. Kohl also examined the use of junk bonds as a method of core investment strategy in target date funds. Morningstar reported six out of the nine principal U.S. target date funds finance corporate bonds that are both high-risk and high-yield.

Recently, however, a new study done by Morningstar exposed that the typical fund in 2010 found its way back with a twenty percent return in 2009. According to this study, the best performer rose almost thirty percent! Ultimately, 2010 target date funds have recovered since October 1, 2007. The typical fund from October 1, 2007 through November 30, 2009 lost almost five percent. So, it seems that the political outrage is a bit inappropriate.

Basically, they are saying that many target funds really are too aggressive and losses should be better managed. For instance, the expectation that many have is that funds with a target date of 2010 shouldnt lose money in 2010. But I disagree. Those retiring in 2010 should certainly be more conservative, but becoming too conservative can jeopardize the longevity of any investment portfolio and may affect how the money would last through one’s retirement years. Personally, I would not recommend that someone go all cash or entirely conservative near their retirement target date. Most people will still need a portion invested in growth stocks so that their portfolio minus income still keeps up with inflation (at the very least).

The other part of the problem with these funds and a partial cause of the recent backlash against them, is the lack of transparency. A closer look at some of the 2010 target date funds will yield this finding: the exposure to equities has run the gamut from thirty percent to as high as sixty percent. Sixty percent seems quite high to me unless you arent planning to live off the money for a while and have other income sources. Id assume that most investors looking to retire in 2010 and were using a target date fund were expecting to have a relatively low representation in equities. Seems to me that depending on the fund, you may end up with an equity exposure and risk thats much higher than you expect, which is certainly not a good thing.

So, here we come full circle. While I think legislation is pretty misguided and an overreaction to the recent performance of target funds, the problems I see with these funds are still mostly true: mainly, theres that lack of investment/spending/rebalancing flexibility. And these are only confounded by the recent revelation that the risks and asset representations in these target portfolios arent always as they seem. So, I’m sticking with constructing my own portfolio, but if you do decide that a target date fund is for you, then just make sure you know what you’re getting!

Contributing Writer: Todd Smith, CFP