Talking Hedge Fund ETFs InflationProofing And More With Adam Patti

Post on: 24 Июнь, 2015 No Comment

Adam Patti is the Chief Executive Officer and Founder of IndexIQ, a New York-based ETF issuer behind several of the most innovative ETF products to hit the market in recent years. He recently took time out of his busy schedule to discuss commodity investing, ETF options for protecting against inflation, and replicating hedge fund-like returns through ETFs.

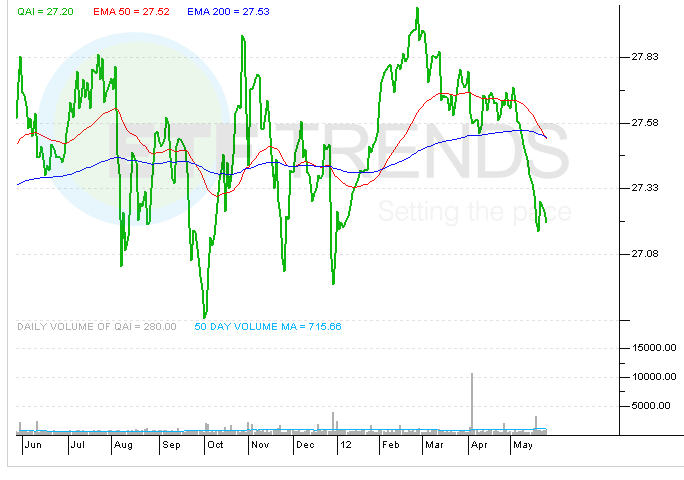

ETF Database (ETFdb) : IndexIQ is perhaps best known for its hedge fund replication ETFs, including the Multi-Strategy Tracker ETF (QAI ) and IQ Hedge Macro Tracker ETF (MCRO ). Why might investors want exposure to a hedge fund-like asset?

Adam Patti (AP): First off, there are some misconceptions about this asset class; many investors think that hedge funds are designed to “shoot the lights out” in terms of performance, because they hear all these fantastic numbers that some of these hedge funds put up once in a while. The reality is that hedge funds, as their name suggests, are designed to hedge, or dampen a portfolio’s volatility and provide diversification. That is exactly why you would want to use these products: for diversification and for evening out the ups and downs in your portfolio.

In 1984, there were approximately 84 hedge funds in existence; now there are more than 10,000. We know that in the mutual fund space, 75% or more of active managers underperform their benchmarks every year. It stands to reason that most hedge fund managers are not really providing the performance or the alpha that they are charging their investors for. In fact, back in the 1990’s, a variety of academics analyzed hedge fund returns and found that in fact hedge funds were providing great value for investors, but not in the form of alpha; most of the returns come from alternative beta. Alternative beta is simply a diversified stream of risk premia across different asset classes. However, this Alternative Beta is different from S&P 500 beta, and it is very valuable for diversification given its low volatility and low correlation to the overall market.

The academics then found that you can actually replicate this alternative beta by using common liquid securities in the marketplace. You can use single securities, you can use derivatives; we use ETFs. Because these risk premia are just simple asset class exposures, ETFs provide inexpensive, liquid tools to act as proxies. By pulling together different asset class exposures in one package, you can mirror the performance characteristics of hedge funds. That is what QAI and MCRO do; they are designed to provide the risk/return characteristics of hedge funds without all the structural limitations of those fundsnamely, the lack of liquidity, the lack of transparency, and the high fees. It is just an efficient way to get diversification.

QAI is designed as a Multi-Strategy fund of funds replacement in that it combines the characteristics of six of the most widely used hedge fund strategies. Investors use it as a core in their Alternative sleeve of their asset allocation, and in fact Hedge Funds themselves have been using it to equitize cash. MCRO incorporates a Global Macro strategy and is designed as a hedge to an investor’s equity allocation.

ETFdb: It is interesting to take a look “under the hood” of these hedge fund replication ETFs and realize that the underlying holdings are not exotic, illiquid assets but rather “plain vanilla” ETFs such as EEM and EFA that are put together in such a combination that they generate a unique return.

AP: And that is because at the end of the day, Hedge Fund managers have access to stocks, bonds, commodities, currencies, real estate and cash. Those are the core asset class exposures. Hedge fund managers do not really have access to any more or different asset classes than any of us do. But the manner in which they combine those asset classes is unique, and it can offer investors a unique type of exposure. ETFs are an inexpensive and liquid way to gain access to these asset classes. Plus, from an investor’s perspective it makes the portfolio very easy to understand. When you look into QAI or MCRO’s portfolio, it’s simply a series of well known ETFs.

ETFdb: Let’s talk about commodities, an area of the ETF space that has become tremendously popular over the last few years. In addition to futures-based exchange-traded commodity products, investors have embraced achieving commodity exposure through equities of commodity intensive companies. What is the investment thesis behind this strategy?

AP: This is an area in the market that scares me for investors; if you look at the commodity ETFs that are out there, there are derivative-based products and equity-based products. If you look under the hood, many of them are significantly overweight in energy regardless of market conditions, so investors are in essence getting an energy fund instead of a diversified commodity fund. With the derivative-based products you have contango and backwardation issues, you have K-1’s, and potential CFTC position limits that could turn these products into closed-end funds overnight.

So investors have been migrating over to equity-based products. But the issue with these products is that when you are investing in equities, whether it is commodity equities or otherwise, correlation to the broader equity markets is going to be high. Usually, investors are buying commodities for diversification, so when you buy a straight equity-based product you are not getting that diversification.

We developed the IQ Global Resources ETF (GRES ), which is designed to solve this overweight energy issue that investors do not necessarily want. GRES is the broadest commodity ETF in the marketplace; it includes all the main commodity classes such as livestock, energy, metals, grains and so forth, but it also includes timber, water, and coal. And instead of blindly market cap or production weighting those equities, they are weighted based on valuation and momentum. There is a lot of momentum in commodities, and because this fund invests in equities, it makes sense to look at the valuation of the sectors. So on a monthly basis, the portfolio is re-weighted to overweight those sectors that have low valuation and high momentum and underweight the sectors with low momentum and high valuation: buy low, sell high.

Then, to solve for the correlation issuebecause again, these underlying holdings are equitiesGRES establishes a 20% short position; we short out 20% of the market beta, half of it the S&P 500. half of it in EAFE. This short position reduces volatility and reduces correlation to the equity markets, giving investors the diversification they want when investing in commodities. The reduction in volatility and correlation has certainly helped GRES given today’s volatile markets.

ETFdb: Another topic that has been on everyone’s mind in the past couple of years is inflation. as governments have pumped these unprecedented amounts of liquidity into the financial system. Inflation readings in recent months have been pretty tame, but investors continue to worry that somewhere down the road all of this extra money sloshing around may lead to a big uptick in inflation. Inflation-protected bonds have been the default option for protecting against inflation. Is this strategy sufficient, or is there something else that investors could be doing?

AP: This is an issue that every investor and every advisor really needs to look at. Many are aware of the issues, but don’t know what to do about it. TIPS have been the only game in town, but these securities have significant limitations. One is the volatility of TIPS because there is duration risk in this product; when interest rates rise investors might see a significant decline in the performance of a TIPS portfolio.

At IndexIQ, our academic research board and internal research team took a look at inflation going back into 1910. What they foundwhich is no surpriseis that short-term bonds are an excellent proxy for the inflation rate. The key of course is generating a real return on top of that. They also found that different asset classes have different sensitivity to inflation expectations, and what the research really bore out is that the most efficient way to protect against inflation is a multi-asset class approach. Weve written a whitepaper summarizing this research which is available on our website. And that is how the IQ Real Return ETF (CPI ) is constructed. Much like our hedge fund replication products, we use ETFs in the portfolio because they are so easy to understand. What you see when you look under the hood is a significant core holding in short-term bonds that will decrease or increase depending on the inflation rate. This core is surrounded with up to ten other asset classes which come in and out of the portfolio on a monthly basis based on the inflationary or deflationary pressures.

The result is a product that is designed to provide a real return of two to three percent over the Consumer Price Index over time with, importantly, volatility that is very similar to the Consumer Price Index itself which is quite low. By using a multi-asset class approach to inflation protectionas opposed to TIPS, which is a single asset class—investors can achieve low volatility without sacrificing the protection from inflation. Investors use CPI as a replacement or as a complement to their TIPS exposure. You can think of CPI as the short-duration portion of your inflation protection while TIPS is your long-duration portion. Recently we’ve also seen investors using CPI as a cash proxy given its low volatility.

Inflation protection is like fire insurance. You should buy it in anticipation of potentially having a problem down the road. Most investors do not think about it until it is too late. We think that people should be protecting their portfolios from inflation now even though, clearly, we do not see it in the cards today. As you mentioned with all of the stimulus and cash flying around out there, we think it is inevitable.

ETFdb: Let’s talk about some of the international equity products that IndexIQ has launched recently, including ETFs offering exposure to small cap stocks in Canada (CNDA ), Australia (KROO ), South Korea (SKOR ), and Taiwan (TWON ). How is the exposure offered by these products different from ETFs that focus primarily on mega cap equities?

AP: When investors are looking to establish exposure to a specific country overseas, what is out there today is primarily large cap products that are overweight in the multi-nationals and mega cap names. So what you are really getting is a product which is not necessarily tied to the actual economy you are trying to access.

Small caps have the potential to give investors a unique exposure by getting them closer to the consumer and providing a sector allocation that is more appropriate for the actual domestic economy. The small cap international equity products from IndexIQ provide access to the bottom 15% of capitalization in the respective countries. If you look at the sector allocation, these funds are very different from the large cap products in the marketplace, which are typically overweight in banks since banks are often the largest market cap companies in those countries. We recommend that investors use the small caps in conjunction with the large caps. You want to get closer down to the ground to complete your exposure, using our small caps. There are also interesting trading ideas related to going long our small caps and short the related large caps.

ETFdb: Lastly let’s discuss your IQ Merger Arbitrage ETF (MNA ).

AP: MNA is the first merger arbitrage ETF. If you are interested in gaining access to global M&A activity there are a few options. 1) a hedge fund, 2) a merger focused mutual fund, or 3) our ETF, ticker MNA.

Corporations are now sitting on over one trillion dollars in capital. Interest rates are low and equity valuations some may say are quite attractive. This is an opportune time for these corporations to buy out competitors or increase their global footprint.

Our research team and academic board analyzed approximately thirteen thousand M&A transactions over the past 10 years and found to no one’s surprise that there are specific characteristics of a deal that either make it successful or unsuccessful. We took those characteristics and built them into a rules-based index process. The index is designed to buy announced deals globally if they meet our criteria and short out market exposure to reduce volatility and correlation to the equity markets. We have in fact written a terrific whitepaper on this topic available on our website.

One of the most attractive features of MNA is that it is an ETF. As you know, ETFs are tax efficient in that they can significantly reduce or in many cases completely eliminate pass through capital gains on portfolio turnover. These capital gains can take a massive bite out of returns for a strategy with high turnover. Merger arbitrage is by design a high turnover strategy, so the most efficient way to gain access to this strategy is through an ETF structure.

Investors have used MNA both in the Alternatives sleeve of their asset allocation or as part of their equity allocation.

ETFdb: Youve given us a lot to think about Adamthanks for chatting with ETF Database!

For more ETF news and interviews make sure to sign up for our free ETF newsletter .

Disclosure: No positions at time of writing.