Takeover Defense Help for Strategy for creating Value

Post on: 16 Март, 2015 No Comment

In business terms a takeover can be explained as a purchase of one company by another. This term also refer to the acquisition of a public company whose shares are listed at stock exchange in contrast to an acquisition of a private company. It is often found that various companies take various steps to prevent hostile takeover s. Most books and articles view this event from the perspective of investment bankers and corporate officers view, much has been written about the impact of hostile takeover s on shareholders of target companies. Even then these shareholders can experience financial consequences which are significant when a companys board activates a defense or it has an intension to do so by adding defense strategies to the corporate charter after the news after the news impending breaks of takeover s. To access the ramifications of a takeover, shareholders need to identify and understand various defense strategies to avoid one. This article will discuss the effect of some typical strategies that the companies follow to defense takeover .

Following are the strategies:

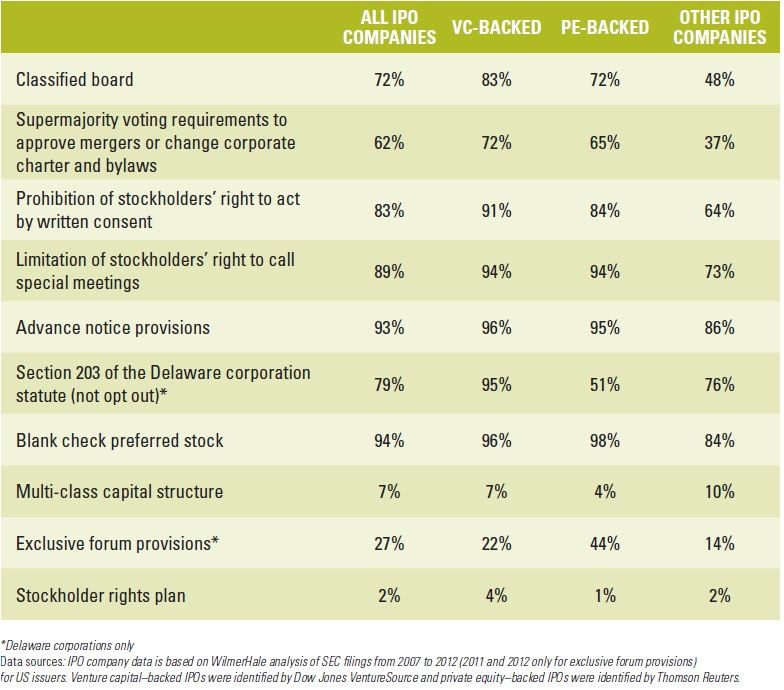

1) Shareholders rights plan-the most common and usually followed form of takeover is the shareholder; right plans which gets activated the moment a potential acquirer announces its intentions. Under such plansshareholders can purchase additional company at an attractive discounted price making it very difficult for the corporate raiders to get control over it. The rights which are issued to the shareholders can be effectively thwart a takeover by diluting the acquirers ownership percentage, proving the takeover much more expensive and delaying or preventing control of the board as well as the company.

2) Voting rights plans-Targeted companies may also introduce a voting-rights plan to their shareholders. which will separate few shareholders from their complete voting powers at some predetermined point. For example, a shareholder who already own 20% of the company may lose their power to vote for such issues as their acceptance or rejection of the takeover bid. The presence of corporate predator may also ask for super majority voting which needs full 80%of the shareholders approval for the merger instead of simple 51% majority. This requirement makes it difficult but not impossible for the raider to get control of the company. It becomes very difficult for the management to convince the shareholder this voting rights plan will benefit them in future.

3) Staggered Board of Directors-Clauses which involves shareholders is not the only possible routes available for the targeted companies. A staggered board of directors, in which different groups of directors are elected at various different times and this, is for multiyear terms, this can challenge those prospective raiders. Now the raider has to win multiple proxy fights over time and deal with successive shareholder meetings in order to successfully take over the company. It’s important to note, however, that such a plan holds no direct shareholder benefit.

These were few strategies which are followed by many companies to prevent them or we can say to defense them from takeover s. The management of the company chooses the most appropriate strategy and follows it very strictly to get protection against takeover .

Transtutors.com provides instant homework help at minimal charges with descriptive answers to your Financial Statement queries so that you can better understand about the topic at home. Our helpline is open to all e-learners for 24X7 and you can query at anytime from anywhere.