Take the lazy portfolio route to big returns

Post on: 9 Май, 2015 No Comment

Analysis & Opinion

CHICAGO (Reuters) — I have always found that laziness is a virtue when it comes to managing my own money. The less I trade, the better my performance.

Years ago, in an attempt to come up with a hypothetical portfolio that provided low-cost diversification, I created what I called a Nano — small and compact — portfolio as a investment strategy intended to capture returns from the U.S. and global stock, bond and real estate markets. Lazy portfolios are generally passive and rebalanced once a year. The idea is to set the allocations and leave them alone — not try to time the market.

Thanks to MyPlanIQ.com, a useful website that creates and monitors portfolios (I have no connection to it), I have been able to track the performance of my virtual Nano holdings over time. My set-up has done reasonably well, but as with all portfolios, results depend on the period being looked at and on performance relative to the market as a whole.

To see my portfolio on MyPlanIQ, click on link.reuters.com/guv27t

MyPlanIQ updates me once a year on how the portfolio has done relative to other lazy portfolios that it tracks. This year, I was pleasantly surprised to see that my three-year average return through March 29 is in third place behind a portfolio put together by William Bernstein, an investment adviser, neurologist and author of such books as The Four Pillars of Investing, and one by David Swensen, the manager of Yale University’s endowment. Since I admire both men, esteemed professional money managers, I’m humbled to be in their company.

My Nano portfolio returned 9.7 percent annually in the three-year period. That compares with 12.1 percent for Bernstein’s No Brainer Four Fund Portfolio and 11.3 percent for Swensen’s Yale Individual Investor Portfolio.

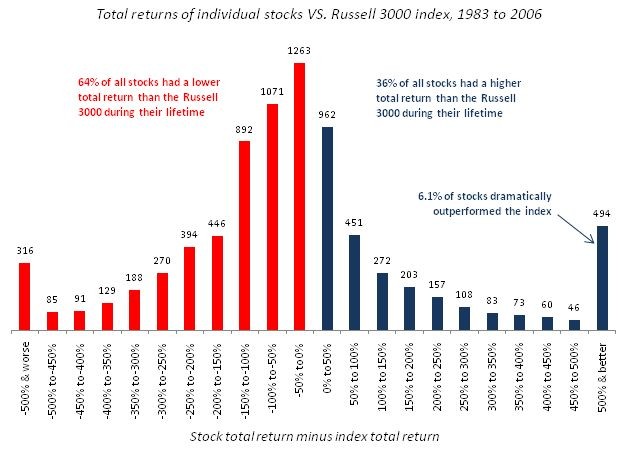

Note that no lazy portfolio, including mine, can match an investment that tracks a hot stock market’s total gains. For instance, if you invested instead in a single, big-stock index fund such as the Vanguard 500 Index Fund, you beat my Nano portfolio by at least three percentage points over the three-year period through April 5; the Vanguard fund was up 13.4 percent.

But note that if you go instead with a strategy like that, you also take on all of its downside risk.

COMPARATIVE DATA

While I’m hardly equating my money-management skills with those of pros like Bernstein and Swensen, my aim is to offer a bare-bones, moderately risky portfolio that you can rebalance to the original allocation once a year if the losses or gains throw the mix out of whack. I picked only five funds, with a 20 percent allocation each, for my Nano portfolio. Their annual returns through March 30 were:

Vanguard Total Stock Market ETF, 14.5 percent

Vanguard Total International Fund, 8.5 percent

Vanguard REIT, 15 percent

iShares Lehman TIPS Bond, 5.4 percent

iShares Lehman Aggregate Bond, 3.7 percent

I picked these funds because they represent the lion’s share of the global stock market, U.S. bonds, inflation-protected securities (TIPS) and commercial real estate. When stocks go south, my 40 percent allocation in bonds provides a cushion. During a stock market rally, I get a broad sampling of U.S. and global stocks. When interest rates rise, my TIPS will perform better because they are indexed to inflation and can offset bond-price losses. I own several of the above funds in my personal portfolio.

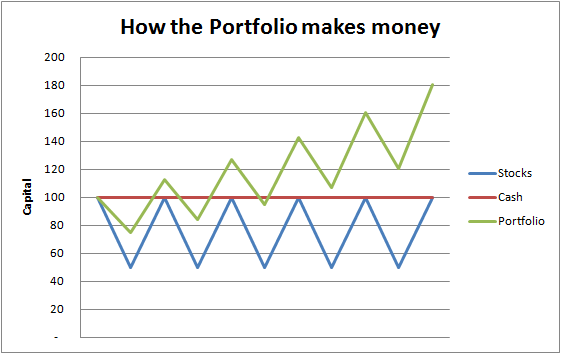

Because I’ve designed this portfolio to temper risk, it won’t reflect overall performance of U.S. stocks, nor will it capture outsized returns from emerging markets, commodities or other alternative investments. It’s a bread-and-butter approach that will still get hurt when stocks tank, although it won’t suffer as much as an all-stock portfolio.

The volatility of My Nano portfolio is lower than that of big U.S. stocks, which means that I’m taking a lot less stock market risk. With this portfolio, you’re not likely to see returns fluctuate as much as they do in a pure-stock portfolio.

Since one of the reasons for creating my portfolio was to provide respectable risk-adjusted returns, I’m happy to say that its volatility rating — standard deviation — was the best of the three top-performing lazy portfolios. Ideally, prudent investing matches the best-possible returns with the lowest-possible risk for investors like me. We’re always trying to get that risk-return trade-off working in our favor.

But no off-the-shelf portfolio can fit everyone’s needs. If you want a higher global-stock allocation, then I suggest Swensen’s portfolio (link.reuters.com/huv27t ), which has a 20 percent allocation in global stocks. If you’re seeking more of a small-company stake, then Bernstein is your man (link.reuters.com/juv27t ), with a 25 percent allocation in small companies.

Still, it’s the philosophy of my approach — risk management over returns — that I think matters most. I ground my teeth and stayed in the stock market during 2008, yet benefited from the rebound that began in 2009. Buy-and-hold still makes sense to me because I’m incompetent when it comes to timing market cycles.

The real beauty of a lazy portfolio is that it can capture nearly all of the returns of most any market at very little cost. If you haven’t been offered the opportunity to build something similar within your 401(k) or other retirement plans, ask for it. The process could make your life simpler, build your nest egg and reduce your anxiety level exponentially.

(The author is a Reuters columnist and the opinions expressed are his own. For more from John Wasik see link.reuters.com/syk97s )

(Follow us @ReutersMoney or here ; Editing by Beth Pinsker and Steve Orlofsky)