Tactical Weighting

Post on: 16 Март, 2015 No Comment

Which stock will perform better over the next 12 months: Netflix or Comcast?

We don’t know either. But, if you buy an S&P 500 index fund, you are choosing to own about 10 times more Comcast than Netflix. You also get 15 times more Wal-Mart than Whole Foods, 6 times more Financials than Utilities, and almost no small cap exposure. These are huge bets, yet the logic behind them is arbitrary.

The vast majority of Mutual Fund and ETF index investing is done through capitalization weighted indexes such as the S&P 500 or the Total Stock Market Index. We believe the construction methodology of these indexes has inherent flaws which are costly over time and add unnecessary risk. Historical results strongly support our view. Tactical Weighting is our solution to these issues.

Capitalization Weighting

In a capitalization weighted index, the weight of each stock is equal to the total value of the company divided by the total value of all the companies in the index. For example, at the time of this writing, Apple is the biggest stock in the S&P 500, valued at around $500 billion. The value of all 500 stocks is around $12.5 trillion. Apple, therefore, represents about 4% of the index ($500MM/$12,500MM). For comparison, the weight of the smallest 100 companies in the index is just 4.5% combined.

There are two big problems with this approach:

- It guarantees that you buy high and sell low.

- It is random, not strategic.

Problem #1: Automated buying high and selling low.

This is the opposite of what you want. If a stock is overpriced in the market, owners of capitalization weighted indexes will own more than the “fair value”. Conversely, if a stock is currently undervalued by the market, it will be owned at a lower amount than “fair value” would suggest. So as prices revert to long term fundamental values, these indexes suffer.

The following chart uses Bank of America to illustrate how volatility hurts capitalization weighted investors. For illustration purposes, it assumes the current price of $12 is the “fair value”. Bank of America represented about 1.5% of the index at the beginning of the period shown, right before a 70% decline in value. Index investors got hit on the whole amount. At the bottom, the stock was just 0.4% of the index and subsequently increased 100+%. So investors participated in gains, but only off of a small base.

Some academics believe capitalization weighting is optimal because the market efficiently prices all securities at all times. That would be nice, but anyone who has invested their own real dollars knows that markets are often emotional and irrational.

Problem #2: Large Random Bets increase Volatility

If you own a capitalization weighted index fund, you are taking big bets on whatever stocks and sectors happen to be big, for no reason other than the fact that they are already big. This can increase volatility and risk.

These tables show how S&P 500 owners had their biggest sector bets in Technology just before the dotcom bust and Financials just before the sub-prime crisis. Tactical Weighting reduces the risk of these inevitable sector bubbles.

Alternatives to Capitalization Weighting

Academics and institutional investment managers are increasingly recognizing the pitfalls of capitalization weighting. The most obvious alternative is to simply equal weight the stocks. The first major equal weighted ETF was the Rydex Equal Weighted S&P 500 Index ETF (RSP). Since its inception in 2003, it has trounced its capitalization weighed counterparts.

The next logical step was to equal weight economic sectors. Russell Investments conducted a study to measure the impact of equal weighting at the sector level from 1978 to 2010. The results were dramatic. Spanning over 30 years, the study found an investor in the equal weighted sector approach, based on the Russell 1000 universe, finished with roughly double the final portfolio value compared to one who utilized capitalization weighting.

- “Sector equal-weighted indexes provided a better absolute return with lower volatility for the time period tested compared to traditional equal-weighted and cap-weighted indexes.”

- “These results are consistent across the domestic large-cap, mid-cap and small-cap spectrum and the global developed and emerging regions.”

Our Approach: Tactical Weighting – the Complete Solution

For the US equity portion of portfolios under our management, we utilize a methodology we believe is the best available to the average investor: Tactical Weighting.

We start with a look at historical results. Compared to capitalization weighted indexes:

- Weighting sectors more equally performed better with lower risk

- Weighting size more equally performed better with lower risk

- Weighting style more equally performed better with lower risk

- Weighting individual stocks more equally performed better

Therefore, using a sampling of individual stocks, we build a portfolio designed to benefit from all four of these factors. Typically, our Tactically Weighted portfolios contain between 50 and 100 stocks, which we believe is enough to adequately minimize stock specific risk and achieve the desired factor weightings. Within sectors, industry weights are also allocated more evenly.

Stocks are selected based on their ability to play a desired role in the portfolio – we do not attempt to pick big winners. Portfolios are rebalanced periodically to maintain factor allocations and contain stock specific risk.

The ability to implement this type of portfolio for individual investors was only recently made possible due to advances in technology and falling trading costs. To allow even greater precision, we completely eliminated trade commissions for our clients.

Four Main Reasons Why Tactical Weighting Might Be Right for You

We don’t know for sure which parts of the market will over or underperform, and we don’t believe anyone else does either. But we feel very confident we can improve diversification simply by avoiding large, arbitrary bets.

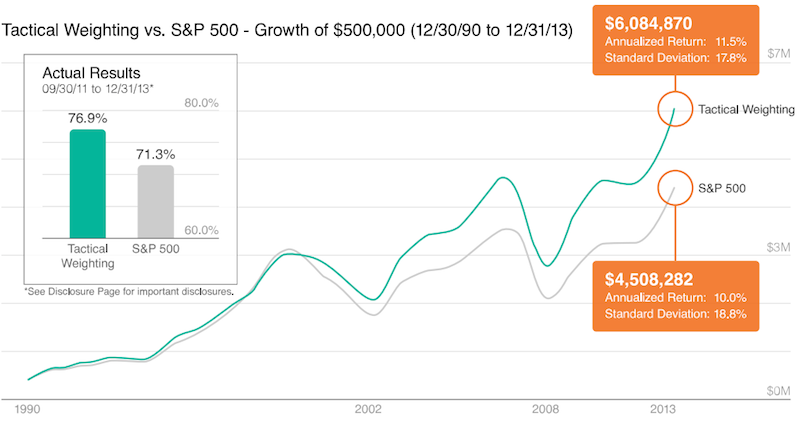

- Historical Results

In a hypothetical back-test of the period from 1990-2012, the Tactical Weighting approach would have outperformed the S&P 500 by 1.5% per year with less volatility.