Synthetic vs Physical ETFs_2

Post on: 12 Август, 2015 No Comment

Get on track

As you consider investing in the financial markets, one key decision to make is whether to back your own judgement and invest directly or to go with a collective, commonly known as a fund. While you may feel comfortable making your own selections one of the biggest advantages of a collective investment is it enables you to create a diversified portfolio, even if you do not have a huge sum of money at your disposal. By investing £1,000 in a fund with say 100 shares in its portfolio, you can obtain a far greater breadth of exposure than you could by investing directly in the markets yourself.

ETFs

Exchange traded funds (ETFs) are a specific type of fund that, as their name suggests, can be traded like individual stocks on an exchange such as the London Stock Exchange (LSE). They can offer an inexpensive, easy and quick way to capture the returns from bonds, shares and commodities.

The first ETF in the UK, tracking the FTSE 100, was issued in 2000. That year, 1,972 trades were struck on the LSE with a value of £403 million. In September 2014 alone 194,979 trades were executed worth £16,339,311,889 and there are now more than 700 ETFs listed in London. In the UK, well known providers of ETFs include iShares, Vanguard, Lyxor Asset Management, owned by Société Générale, db X-trackers, owned by Deutsche Bank, and ETF Securities.

Key advantages of ETFs include:

Transparency — ETFs offer transparency. Unlike traditional funds, which are priced on a daily basis, ETFs trade in the same way as a share. This means they can be bought and sold at any time during normal market hours.

Cost — The Total Expense Ratios (TERs) on ETFs – which reflect the total sum shelled out to cover the costs of fund management and other administrative fees – are significantly lower than traditional actively-managed funds. There are no fund managers’ salaries to pay and transaction costs tend to be more modest, since ETFs are passive instruments that simply seek to match the index.

Flexibility — ETFs are suitable for both long-term investors and short-term traders since they allow for straightforward changes to asset allocation across a portfolio. It is easy to create new positions should you decide, for example, exposure to Asia or energy sources such as natural gas or oil is appropriate for your portfolio strategy, time horizon, appetite for risk and target return.

How to choose the right ETF for you

There are more than 700 ETFs to choose from. For mainstream products covering the major stock market indices heavy competition means costs, performance and the level of risk are unlikely to vary too widely.

How ETFs work

ETFs each hold an interest in a group of assets, such as equities, commodities or debt instruments; and can attempt to replicate, or ‘track’, indices, sectors, stock exchanges both domestic and foreign, currencies and emerging markets, in addition to fixed-income and commodity indices.

For example, an ETF that tracks the performance of the FTSE 100 will represent a small interest in each of the 100 companies on the FTSE 100. The idea being that the ETF’s price moves largely in step with the FTSE 100. With 100 equity holdings in the fund, if share prices in one company or industry sector fall, other companies’ and sectors’ prices should, ideally, remain stable. This can offset the negative effects of isolated price drops.

Physical vs. Synthetic

There are two main types of ETF: ‘physical’ and ‘synthetic’.

Physical, or cash-based, ETFs are those whose providers actually purchase and hold the assets or securities of the index they track. Should the provider go out of business, the investor has direct recourse to a ringfenced pool of assets.

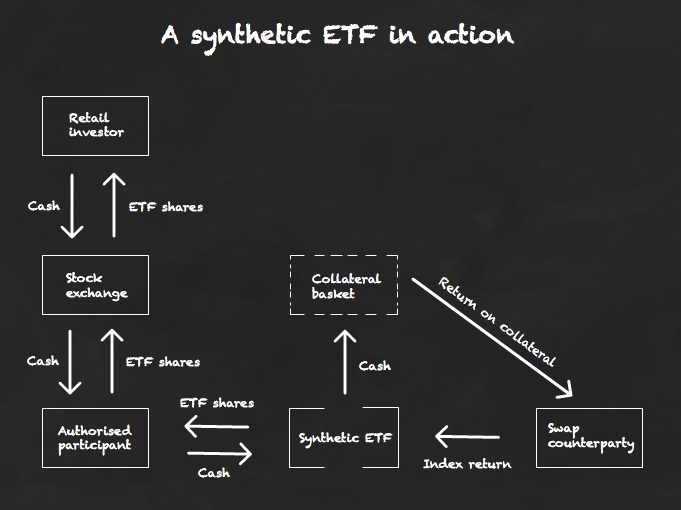

Synthetic, or swap-based, ETFs, by contrast, hold no underlying assets, but are financed by a counterparty, usually an investment bank, and vary in price more precisely equivalent to the return on their respective index, including capital gains and dividends. While a synthetic ETF can be much more accurate than the physical ETF in tracking, you are exposed to the risk of the counterparty hitting financial difficulty.

Since ETFs are regulated there are safeguards in place to protect investors from risks. Exposure by European swap-based ETFs is capped at 10% of the ETF’s net asset value, meaning the maximum loss you could incur from the swap provider going out of business is 10%.

In order to mitigate risk before it gets to that point, providers of synthetic ETFs require their counterparties to put up collateral. This collateral is usually in the form of equities or bonds, and some providers will give explicit detail on what lies behind their synthetic products – although, not all are as forthcoming.

Any given ETF can vary greatly from another, not only in terms of asset type but in complexity: ETFs are not created equal and one size does not fit all. However, it is possible to find details about the underlying holdings of most ETFs so you can avoid the risk of having money in areas where you neither want nor expect to have exposure. After all, you should never invest in anything you do not understand.

Understanding the ETP universe

Exchange-traded funds (ETFs) are just one type of exchange-traded product (ETP), a generic term which covers three types of instrument.

Exchange-traded fund (ETF). Under European rules, an ETF must hold at least five different securities or assets. They can be used to track the performance of a stock market index or bond index for example, while themed ETFs which replicate the performance of a basket of stocks, bonds or commodities are also readily available. It is not possible to buy an ETF that tracks the gold or oil price, as this would mean the instrument owns just one asset.

Exchange-traded note (ETN). ETNs trade on an exchange, just like an ETF, but they can be used to track just one underlying asset. An ETN is actually a debt instrument and it uses indirect replication to generate performance. The advantage of an ETN is it therefore eliminates any tracking error and can make it cheaper to invest in more esoteric or less liquid stock market indices. The risk comes with exposure to the ETN issuer. If it is a bank, for example, a downgrade of that institution’s credit rating could hit the price of the ETN even if the underlying asset does not move.

Exchange-traded commodity (ETC). As its name suggests an ETC is a type of ETN designed to provide a means of accessing the underlying price trend provided by a single commodity, such as lean hogs, wheat, corn or cotton. Some ETCs use direct replication, notably in cases where storage is easy, such as gold or silver. Some use swaps to tackle liquidity or storage and insurance costs. Like ETNs, ETCs can be used to buy or sell exposure to hogs, corn, wheat or uranium, commodities where the physical replication method is not practical owing to issues such as transport, storage and insurance costs and they tend to follow futures (see Jargon Buster) markets.

Jargon Buster — Futures

Futures markets enable investors to trade specified assets of a standardised quality and quantity for a price agreed upon today with delivery and payment occurring at a specified date in the future. Initially used in agriculture to allow farmers to sell their crop ahead of harvest the most actively traded futures contracts today tend to be in crude oil.