Swing Trading Entry Strategies

Post on: 23 Апрель, 2015 No Comment

PREVIOUS ARTICLE:

NEXT ARTICLE:

One of my top ways to trade is using a swing trade entry strategy to take advantage of the bigger moves in my chosen market. While many people will swing trade Stocks, Options and Futures, my favorite market is Forex. There are plenty of reasons for this including finding the spread costs too rich for shorter term trading. It has been said that the market trends a smaller percentage of time compared to sideways price action however you can still take advantage of the swings because many times, they run for a large number of pips.

There are many techniques for successful swing trades including cross overs, breakouts, trading pullbacks, market profile and even esoteric methods such as lunar cycles. Inside each of those you need rules for trade management, money management, exit strategies and swing trading entry strategies. Without all of these, it is unlikely you will have any long term success with swing trading.

Many people confuse the word “setup” with “entry” but they are very different. A swing trades setup gives you a potential trade and your swing trading entry strategy gets you into the trade. I like to call all swing trading entry strategies a “trigger”.

What are some swing trading techniques that are successful?

- Trade with the overall trend of the market

- Adhere to a conservative money management plan so a loss does not end your trading career.

- Place your stops in areas where if hit, the market would prove you wrong on the direction of your swing trades.

- Have patience and let the trades play out without you getting the urge to bank profits too quickly.

- Understand that you can’t go wrong taking a profit is incorrect.

- Understand the difference between a trade setup and a swing trade entry strategy.

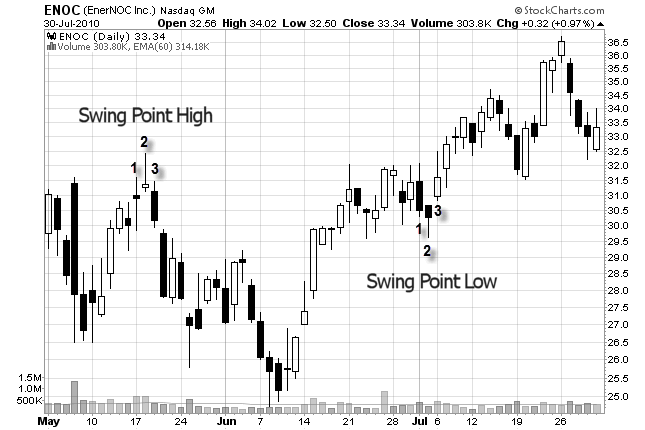

Let’s look at a way of getting involved in a swing trade after a move heading down and highlight the difference between setup and entry. In the following chart, you will see a common method for a setup in a swing trades plan:

You can see the market is in a correction stage after a move down. Of course we don’t know with 100% certainty that it is a correction but all techniques for successful swing trades are built around probabilities and not certainties.

The chart has a pullback into a confluence of Fibonacci levels, both retracements and extensions. As well, there is a previous swing level high on the left of the chart. One of the most popular swing trading entry strategies is a confluence of factors setting up. It could be moving averages with price action, oscillator positions and chart patterns. They will call it an entry strategy only if those teaching it tell you to simply hit the order buttons when price comes into the area. In this example, we are actually going to take it a step further.

In my swing trades, I need a trigger. What this chart shows is only a setup. I need a way to get into the market and the best swing trading entry strategy for me is one which shows the potential for the market to head in my direction. There are many triggers we can use for this and in this example, let’s use a CCI indicator.

The top yellow arrow shows where price topped out in the zone. The bottom yellow arrow is showing where the CCI crossed the 0 line from above the +100 line. For some traders, this may be enough to “trigger” them into all of their swing trades. Others may use a swing entry trading strategy that requires not only the 0 line cross but also the break of the low of the candle which is shown with the red arrow. What they both have going for them is the market is going in the direction of the potential trade.

Some of the best swing trading entry strategies have you getting into the market in a good chart location. A good chart location is one where your stop is placed above a market structure such as a consolidation area or a swing level. Why is that a good thing? If your stop is small, you can generally hold a bigger position size which gives you more bang for each pip, point or tick. I like to get my stop as close to the entry location but far enough away so it is not taken out by the constant ebb and flow of the price. This chart shows two places where you could place your stop.

If we got into the trade at the location on the chart where the CCI is located, we could place our stop just above the consolidation zone which is market by the yellow line. The green line represents a much wider stop but both are decent locations depending on what swing trade entry strategy you use.

Why is a swing trade entry strategy important?

- Allows you take get into a move when the market shows intent to move in your intended direction.

- It can influence how big the risk is on the trade you are intending to take.

- Can keep you from allowing your emotions to dictate when you take a trade.

- Is an essential part of any trading plan.

In my talks with traders, many have issues with deciding on not only their day trading entries but also with a swing trading entry strategy. Many traders make things too complicated and forget that successful trading is simple, just not easy. The suggestion is to make your entry as objective as possible and while there are many techniques for successful swing trades, one very popular one is using 90% mechanical trade strategies . This makes it easier for most people to get into swing trades with the entries and stops plotted right on the chart. Whichever route you choose, just make sure that your swing trades actually have an entry strategy so you can remain as objective as possible and don’t allow your emotions to dictate your actions.

PREVIOUS ARTICLE:

NEXT ARTICLE: