Swing Trading_3

Post on: 12 Август, 2015 No Comment

One of the comparatively longer-term trading strategies often adopted by investors is known as swing trading. Swing trading is the process of investing at the top and bottom of previous price movements, striving to profit on the anticipated correction to come, and can take place over days, weeks and even months in so far as is permitted by financing costs. By virtue, swing trading has the potential to generate significant prices on the recovery of a CFD, but is naturally fraught with danger, and high in risk without the right stops in place to limit liability.

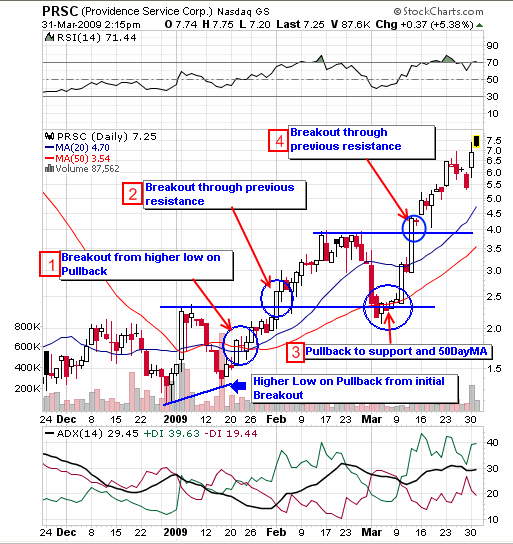

Swing traders generally look to identify instruments and assets that are trading below or above the range at which they legitimately should, taking positions on the correction to capitalise on the return to a price range the market can stomach. This is usually done by interpreting graphs and identifying break-out points with particular stocks that appear to be trading over (or under) the point of their inherent value — thus, swing traders pick up on price anomalies, leverage their position with CFDs and look to ideally profit on the difference.

Swing trading can also benefit from wider market trends, and is often best executed when working with the momentum of a market already in flux. When a correction is due and the markets are working in your favour, it can be significantly easier to capitalise on your positions and maximise your profits than where the markets are working against you. Although the possibilities for profiting are clear in both environments, working with the market does tend to deliver more generous returns, and can even cause swings beyond the point of correction to load up on your earnings.

The main risk associated with swing trading is that you buy on the strength of a false positive indicator, only for underlying prices to continue to fall. Naturally, this can be a devastating position to take, particularly when trading highly leveraged CFDs, and you really can’t afford to absorb too many losses of this kind.

For this reason, it’s important to make sure you’re only investing on the strength of a credible, real price rise, which may mean sacrificing a small amount of profit as you hold off to ensure prices are moving as you expect. Don’t get greedy here — take your time over entering positions to guard against the possibility of a total collapse of asset price, and ensure you have stop losses in place at all times to guard against every eventuality.

Swing trading is but one of many trading strategies that can be applied to CFDs trading, and it’s very much up to you as a trader to find a strategy that suits your trading style and ability. Swing trading is definitely not the easiest strategy to execute, and nor is the lowest risk. But what swing trading does have in its favour is the ability to realise larger profits for those positions that do hit the nail on the head, and provided you take steps to mitigate the risk of a share price collapse, swing trading can prove a valuable strategy to have in your arsenal.