Swedroe A Tipping Point For Hedge Funds

Post on: 25 Апрель, 2015 No Comment

In 2014, the HFRX Global Hedge Fund Index lost 0.6 percent, underperforming the S&P 500 Index by 14.3 percentage points. And while the index outperformed foreign equities, which generally lost between about 2 and 5 percent, it underperformed virtually riskless one-year Treasury notes, which returned 0.2 percent. It also underperformed a typical, globally diversified and balanced portfolio allocated 60 percent to stocks and 40 percent to bonds.

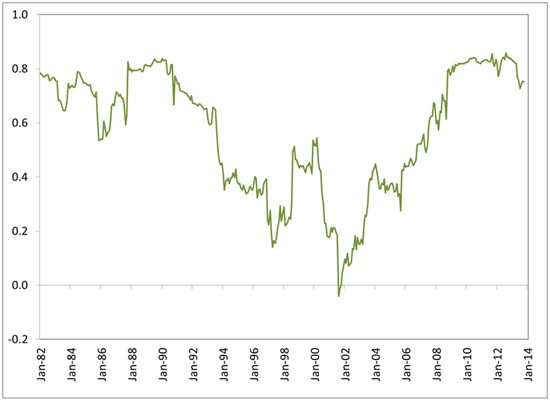

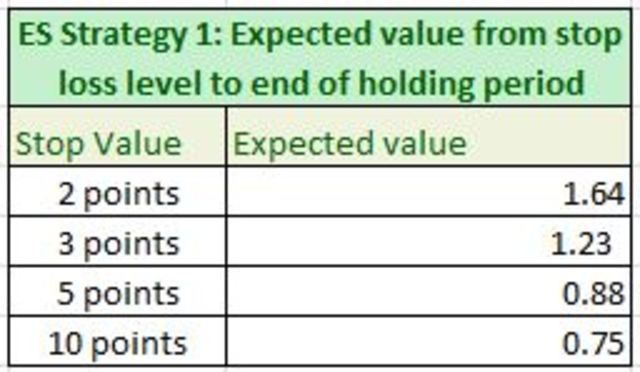

Over the long term, the evidence is even worse. For the 10-year period from 2005 through 2014—which includes the worst bear market in the post-Great Depression era—the HFRX index returned just 0.7 percent per year, underperforming every single major equity and bond asset class. The table below shows returns to various indexes.

Perhaps even more shocking is that during this period, the only year in which the HFRX index outperformed the S&P 500 was 2008. And even worse, when compared with a balanced portfolio allocated 60 percent to the S&P 500 Index and 40 percent to the Barclay’s U.S. Government/Credit Bond Index, it managed to underperform every single year.

Why Do Investors Still Like Hedge Funds?

A key question, which I addressed in a post last month. is: Why do investors, including institutions, continue to ignore the evidence and pour money into hedge funds? Despite their dismal performance, assets under management at hedge funds continue to grow, now reaching almost $3 trillion.

What’s particularly puzzling is that we don’t see this same trend when we look at the fund flows for actively managed mutual funds. In aggregate, actively managed funds persistently underperform, and investors are taking notice and action.

For example, for the 12 months ended August 2014, equity index funds and ETFs attracted $131 billion in net cash inflows. In the same period, actively managed funds suffered outflows of $55 billion. However, perhaps we are seeing the first signs of a turning tide—perhaps a tipping point has been reached.

On Sept. 15, 2014, the California Public Employees Retirement System (CalPERS), the largest U.S. public pension fund, announced its decision to completely eliminate its hedge fund investments. The exit included redeeming from 24 large hedge funds and six hedge funds-of-funds investments totaling $4 billion. That’s out of a total portfolio of roughly $300 billion. Given the evidence, the only question one might ask is, What took them so long?

The Significance Of CalPERS’ Decision

Here’s what Moody’s had to say in its Credit Outlook from Sept. 22 2014:

Large institutional investors have been the primary drivers of flows into alternatives such as hedge funds and CalPERS was at the forefront of this movement. CalPERS’ action is significant for the industry’s growth outlook given the fact that the flow of funds into alternatives has been dominated by large institutional investors. This is in contrast to the early days of the alternatives industry when high-net-worth individuals accounted for the majority of investments. CalPERS started its hedge fund investment program in April 2002. Since 2008, the primary source of funds going into alternatives has been from institutional investors, namely public and private pension plans, endowments and foundations, and sovereign wealth funds (i.e. large, institutional fiduciaries).

Moody’s noted that given CalPERS’ decision, it’s likely that more alternatives programs will come under scrutiny since hedge funds as a group have underperformed traditional benchmarks. Alternatives have the highest fees and greatest liquidity costs–attributes that are at odds with secular trends toward transparency, liquidity and lower-cost investing. Furthermore, the signaling effect of CalPERS’ decision to exit completely is entirely different from one of reducing hedge fund exposure. The question of whether to scale-up or completely exit a hedge fund program is likely to face other plans with similar exposures as CalPERS.

Moody’s last comment certainly seems prescient in light of the Jan. 9, 2015, announcement from PFZW (Pensioenfonds Zorg en Welzijn), the €156.3 billion Dutch health care workers’ fund and Europe’s second-biggest pension fund, that it was stopping all further investments in hedge funds.

PFZW was one of the first Dutch pension funds to invest in hedge funds back in 2003, and it had close to 3 percent of its assets in them. In announcing the decision, Jan Willem van Oostveen, PFZW’s manager for financial and investment policy, stated: With hedge funds, you’re certain of the high costs, but uncertain of the return.

Perhaps institutional investors are finally waking up to all the problems with the hedge fund industry.