Successful Venture Investing The Importance Of Understanding Risks And Diversification

Post on: 11 Июнь, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Those of us dedicated to private equity investing in the consumer packaged goods sector love the story of Vitamin Water and rapper 50 Cent. The story is legend ary—how 50 Cent (Curtis Jackson) turned an equity stake in Vitamin Water’s creator Glaceau into a “multi-million dollar payday ” when The Coca-Cola Company acquired Glaceau.

No doubt, private equity returns can be impressive. At CircleUp. where we help investors channel equity investments to consumer packaged goods startups, we remind people daily of the risks of venture investing and of the importance of diversification to help reduce risk.

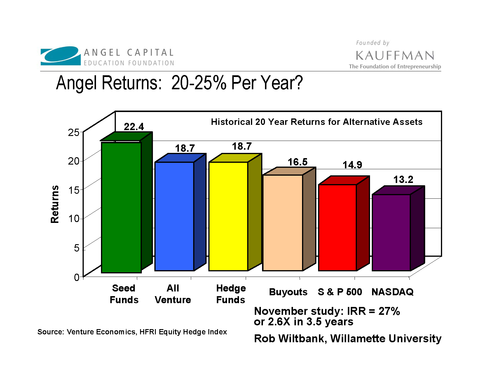

Over the long term, private equity returns have outpaced those for the Russell 2000 and S&P 500, according to the Cambridge Associates LLC U.S Private Equity Index. The exception has come in recent years, when stock indexes have produced stronger gains coming off the bull market of the Great Recession. Even as the private equity index lags, stories of positive results abound. In 2013, 82 venture-backed companies went public. The total value of these IPOs was more than $11 billion, according to the 2013 Exit Poll report by Thomson Reuters and the National Venture Capital Association. There was another $14 billion worth of venture-backed M&A deals in 2013 where the value was publicly disclosed.

Amid the high returns and multi-billion dollar IPOs like Twitter and Facebook, it is easy to lose sight of the risks of venture and angel investing. But you must understand and plan for those risks in your venture investing.

When you start considering venture investing you should first determine your risk tolerance. Investing in startups is high risk. You need to ask yourself, “Am I prepared to lose some or all of my original investment?” If you are not willing or able to sustain financial losses in exchange for the potential greater returns, then you should look for a less-risky asset class.

If you have the risk tolerance for private equity investing, you need to determine your time horizon. You have to consider an equity stake in a startup as a long-term illiquid investment. An investor preparing to pay for a child’s college education in a couple of years has a relatively short investment time horizon. As a result, illiquid angel investments would not be the right option.

Angel and venture investors tend to have both high risk tolerance and a longer-term time horizon. They also understand the fundamental importance of portfolio diversification. Successful investors in startups may use diversification both in their total portfolio among asset classes and within their private equity portfolio.

Diversification is a central strategy of many of the leading investors in private equity, including university endowment funds such as Harvard and Yale’s and public retirement funds such as CalPERS, which, for example, targets 14% of its portfolio for private equity.

As CalPERS says. “The starting point and most important element of CalPERS successful return on investment is our asset allocation—our diversification among stocks, bonds, cash and other investments.”

CalPERS divides its portfolio among various asset classes, such as private and public equity, real assets and liquidity. Here is is CalPERS asset allocation mix by market value and policy target as of October 31, 2013:

Asset Class

Actual Investment ($ Billions)