Structured products MarketLinked CDs and Registered Structured Notes

Post on: 13 Апрель, 2015 No Comment

Structured products

What are structured products?

Structured products 1 are investment vehicles based on or derived from a single security, a basket of securities, an index, a commodity, a debt issuance and/or a foreign currency. Structured products have a fixed maturity date and are designed to offer specific risk-return tradeoffs, with pre-set formulas for both the potential risk and potential return. However, these calculations are often complex.

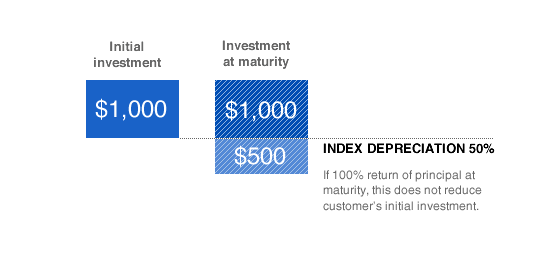

Some structured products offer protection of the principalwhen held to maturity, subject to issuer credit risk, thus offering a lower risk than investing in the underlying asset directly. Others do not guarantee principal, but may provide a partial buffer against loss or offer the potential for enhanced returns.

Principal Protected Market-Linked Certificates of Deposit (CD) from HSBC 2

A Market-Linked CD is a bank deposit product with returns tied to an underlying asset type.

In addition to providing an efficient means of portfolio diversification, the variety of market-linked CDs issued by HSBC Bank USA, N.A. and made available through HSBC Securities (USA) Inc. offer:

- A degree of upside exposure to the potential price appreciation in a variety of underlying assets 3

- A range of terms to match your investing timeline

- 100% principal protection if held to maturity, subject to the issuer’s credit risk 2

- The security of FDIC insurance 4

- Access to various U.S. and international markets 5

To learn more about our Market-Linked CDs and other structured products, call 866.586.4722 or schedule a consultation online.

Registered Structured Notes from HSBC

HSBC offers Registered Structured Notes 6 (Notes), which may be an alternative to traditional investing. Notes may be linked to a broadbased equity index or particular regions, sectors, or individual stocks. Notes have a variety of riskreturn profiles that may address individual wealth management needs and objectives such as risk management, income enhancement, and portfolio diversification.

Registered Structured Notes primarily differ from Market-Linked CDs in that they are not FDIC insured and are registered with the Securities Exchange Commission as a securities product 1. Structured notes are not a liquid investment and are designed to be held to maturity.

To learn more about our Registered Structured Notes and other structured products,call 866.586.4722 or schedule a consultation online.

The information has been prepared for informational purposes only and is subject to change without notice. All investments involve risk including the loss of principal. It is not intended to provide and should not be relied on for financial, accounting, legal, or tax advice. You should consult your financial, tax or legal advisor regarding such matters. We believe the information provided herein is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

Investment and certain insurance products, including annuities, are offered by HSBC Securities (USA) Inc. (HSI), member NYSE /FINRA /SIPC. In California, HSI conducts insurance business as HSBC Securities Insurance Services. License #: OE67746. HSI is an affiliate of HSBC Bank USA, N.A. Third party whole life, universal life and term life insurance products are offered through Insurance Agents of HSBC Insurance Agency (USA) Inc. which is a wholly-owned subsidiary of HSBC Bank USA, N.A. Products and services may vary by state and are not available in all states. California license #: OD36843 .