Strategic Beta ETFs (AAPL XOM SPY SPHQ LLL CAT DIS SYK OMC SIAL UTX HRL BAX CVS)

Post on: 6 Август, 2015 No Comment

As the financial markets get more sophisticated and arcane with time, the number of different types of investment schemes proliferates. It was only a few decades ago when someone first pooled together various individual stocks to create the first mutual fund. which was seen at the time as novel and perhaps unduly complicated. From there it was a logical jump to exchange-traded funds. which debuted in Canada in the late 1980s and in the United States shortly thereafter. As individual and institutional investors alike continue to look for incremental advantages, investment firms meet demand by offering vehicles that are necessarily more complex than their predecessors. Hence strategic beta ETFs, which do something beyond mindlessly tracking an underlying index. Today, strategic beta ETFs represent some of the most dynamic and potentially lucrative investments available to the ordinary investor.

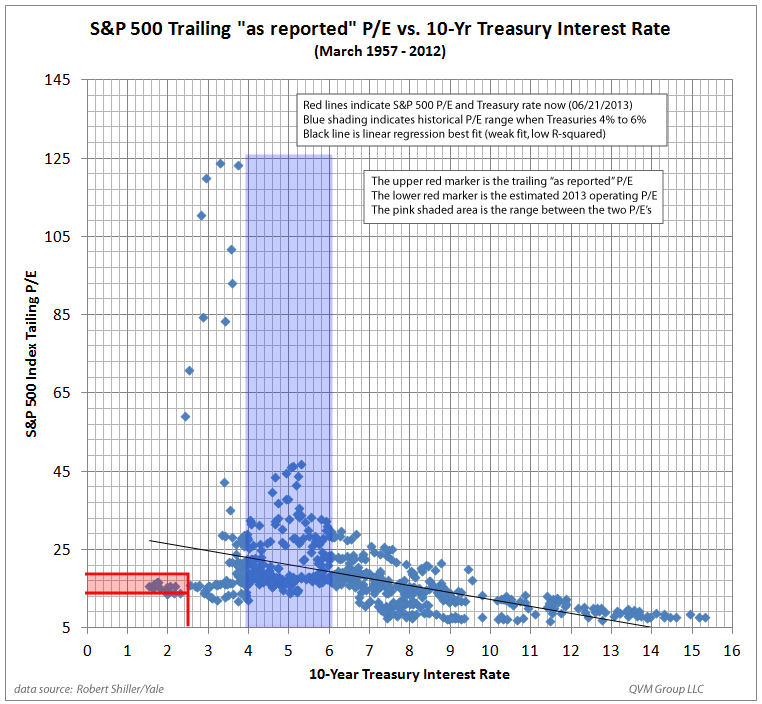

First, for the unfamiliar, a quick explanation on beta (ß). It’s a measure of risk. specifically of the difference between a security’s return and that of a benchmark. For most garden-variety funds, the benchmark is the market as a whole, represented by the Standard & Poor’s 500. The argument for calculating ß is that a fund manager worth his salary ought to be able to beat a broad index comprised of nothing less prominent than the stocks of the 500 largest publicly traded companies.

ß is the movement in the security’s price, in terms of any movement in the benchmark. If the benchmark were to rise 1% while the security in question rises 2%, that’s a beta of 2. Cash and treasury bonds, whose movements have no correlation to any benchmark movements, have a beta of 0.

Strategic Beta ETF Composition

The default setting for an ETF, a non-strategic beta ETF, is to be tied to an index whose components are weighted by market capitalization. What that means is, say you have a simple index that tracks just two stocks — let’s go with Apple (NASDAQ:AAPL ) and ExxonMobil (NYSE:XOM ), the two largest corporations on earth, with market capitalizations of $467 billion and $413 billion respectively. Weighed by market cap, a fund that tracks that index would be invested 53% in Apple, 47% in ExxonMobil. At least until the next trading day, when the relative sizes of the components change and the numbers have to be recalculated. Of course, a typical ETF contains not two, but hundreds or thousands of components.

A strategic (or “smart”) beta ETF, on the other hand, has its components weighted by some other criteria. That could be the aforementioned measure of volatility. dividend payout, cash flow, book value. or even secondary technical metrics. Essentially, strategic beta ETFs represent something of a middle ground between active and passive portfolio management.

Large investment firms commonly categorize their strategic beta funds by particular factors: these include momentum (how quickly an issue’s price, or its volume traded, is accelerating); beta (as a metric, the one defined above, either high or low); “quality” (defined as some combination of growth and stability); and finally, buyback strength. With regard to that last one, the argument goes that the more of its stock a company buys back on the open market, the more desirable the stock becomes for the remaining investors. Subcategories of each of the preceding strategic beta ETF families are organized in a similar fashion to other ETFs, including small-, mid- and large cap; emerging and developed markets; domestic and international, etc. along with categorization by industry sector, commodity, and so on.

A general, all-purpose ETF is necessarily broader and more representative of the market than is a strategic beta ETF. For instance, here are the top 10 components of the largest ETF in existence, the SPDR S&P 500 ETF (NYSE:SPY ):