Strap Options Strategy Explained

Post on: 6 Август, 2015 No Comment

by Dilip Shaw on November 6, 2014

Though I always promote non-directional strategies. sometimes we as traders want to explore strategies to benefit from a directional movement.

Lets say a news has come in and its a good news. We know for sure that Nifty may move up for sometime at least till people fully digest this news. Strap Options Strategy is good for these times.

Note: Why does a stock or Index gives a knee-jerk reaction when a big news comes in? Because some kind of emotional trading starts taking place. If a good news comes in, most professional traders (who get access to this news much before retail traders) act pretty fast to make a quick buck or two.

Some days dont we see Nifty jumping up 20-50 points in matter of minutes? Well that was news-based trading. Some big news comes in and a few stocks with lots of weight-age in Nifty shoot up, driving the Index too with them. By the time we, the retail traders realize, its too late. Some of us get caught in a trap (buying high) and ultimately lose money.

So how do we participate in this rally with least amount of risk and still make some money? You can try the Strap Options Strategy.

Lets discuss this strategy:

This strategy is to be traded when your view is bullish on Nifty or any stock. That is when you think Nifty/Stock will move up.

Construction of Strap:

1. Buy 2 ATM Call Options

2. Buy 1 ATM Put Option

Risk: Limited

Reward: Unlimited

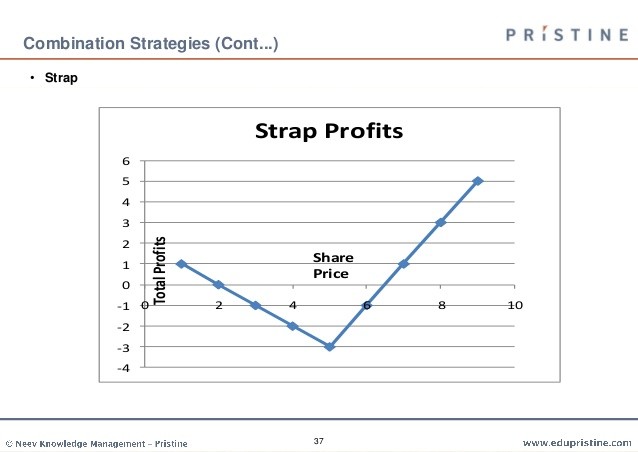

Image of the Strap Option Strategy:

As you can see the call side will move up faster than the put side if the stock appreciates in value.

Can you recall something? Isnt Strap similar to Long Straddle. A Long Straddle is a strategy where a trader has a totally neutral view. There too he buys both ATM Calls and ATM Puts BUT in equal number of lots, whereas in a Strap he buys double the number of ATM calls than puts.

So why should you trade a Strap instead of a Long Straddle when you have a bullish view?

Because if you are right you can make more money from a Strap than a Long Straddle. Calls will multiply 2 folds in profits whereas the Puts will only lose in half that amount. And moreover since option buying involves limited risk, the puts will lose only a limited amount of money and calls will bring in unlimited amount of money. (Unlimited is only on paper – a trader must book profit somewhere.)

You must be surprised to know that Strap is not as popular a strategy than Long Straddle and Long Straddle itself is not as popular as direct buying of options. Do you know why? Because when we have a bullish view we all think we are smart enough and can make money and we really dont need any protection. This is the sole reason why most retail traders lose money. Some lose in lakhs .

Long Straddle is played by many retail trades too. Here the logic is – wherever Nifty goes I will make money down or up. Aha – only if money making was so easy. Everybody would have done a Long Straddle at the start of every series and made loads of money. Unfortunately we all know its not going to work.

In a Strap there is fear. And the fear is – what if Nifty goes down? Therefore he buys one put for two calls. If Nifty actually falls the trader will make less profits from put than his loses from calls, but he will lose money, though less. Only exception is that if Nifty moves down pretty fast – than even 1 lot profit from the put will surpass limited losses from the calls. However it seldom happens.

So when and how should you play Strap?

1. When you view is strong and bullish on Nifty or any stock.

2. When the volatility is low.

Note: Usually when a news is expected volatility tends to increase. Because there is uncertainty in the markets. Unfortunately because of this you may have to pay more for the options. This is where it gets very tricky because as soon as the news comes in the volatility gets crushed and the options shrink in value. The trader then gets frustrated. He thinks even if his view was right – Nifty did go up – why is that he is still losing money?

The trader does not realize that volatility decreased and so his option values. That is why its very important that you buy these options at least 5-6 trading days before the news has to come in. It could be that you are in profit even before the news and you can sell them to make a decent profit.

Or, you can wait for the news to come in and let the volatility shrunk.

Unfortunately the problem with this is that Nifty would have already traveled its path – up or down and trader then feels a missed opportunity.

As you can see in both the situations above you have some pros and some cons but my experience says that it is always better to be prepared before the opportunity arrives. Once the opportunity goes it is very hard to make money in the stock market. Yes Nifty may continue the same path for some time, but the shrunken volatility ensures little or no movement in the options values. Which means neither the calls nor the puts will move significantly in premiums.

After a couple of trading sessions the trader seeing his calls and puts eroding in values sells them at a loss. Whereas had he bought them a few days back, he certainly would have been in profits.

3. When the options you are buying are actually ATM or very near ATM.

This is important because if the nearest ATM strike is where the calls are in the money then you pay more for the calls. This is not required. And if they are out of money, then the Put is in the money and you pay more for the put. This again is not required.

Ideally the premium of the calls and the puts should be the same so that you play a fair game. But if its near expiry and not much time is left for the news – you cannot wait for the stock to come to a nearest option in that case you can buy nearest ATM options.

4. When only 5-6 days are left for the current month expiry you should buy the next months expiry.

You may have to pay more for the options but at least you will have enough time to book your profits or losses. 5-6 days to expiry means you can lose 100% of your premium if there is no significant movement. This is what happens to most retail traders. They wait till expiry and every money they paid to buy these options goes away.

5. Do not put too much capital on risk.

Though this is a limited loss strategy, you can survive the game only if you are losing a limited amount in a trade. One big blow means you are out of the game forever.

Very Important Note: When playing a Strap do write down your profit and loss target. When anyone is hit you should close your trade. Do not trade on hope. When your profit is hit do not believe that more will come and be greedy. A profitable position today can be in loss tomorrow.

Similarly when in loss do not keep the position open thinking that Nifty will reverse or fall further giving you a profit. Nifty owes you nothing. That may happen or may not – a wise trader should take his profit or stop loss and wait for another opportunity.

Hope that will help you to play Strap the right way. And also give enough knowledge to know when to buy options and why you lose money buying options .

Have you ever traded Strap or the Long Straddle? If yes what was your experience?