Stocks Playing Defense With An Open Mind About LongerTerm Outcomes

Post on: 11 Июль, 2015 No Comment

Stocks: Playing Defense With An Open Mind About Longer-Term Outcomes

On Friday before the open we commented:

As long as the charts above remain in a similar state, it is prudent to continue to raise cash and manage risk closely. With the Fed in the background, we must keep an open mind about bullish developments. If the charts above improve, we may need to be nimble in terms of backing off our defensive stance. For now, the pressure is on our defensive coordinator – we have given our offensive coordinator some time off pending further developments.

Heading into a new week, we will provide some support for the stance above. From a defensive-minded perspective, weakness is present on the monthly chart of the S&P 500. As mentioned recently, weakness on a weekly chart is more important than weakness on a daily chart. Monthly charts are more important than weekly charts using the same logic (longer time frame/less noise on chart).

The pink trendline (T-2) from the 2009 stock market lows has been broken in a bearish manner. The break becomes more meaningful if it is still in place at the end of the month. The Relative Strength Index (RSI) is shown at the top of the chart below. RSI has violated the T-1 trendline, which confirms the break by the S&P 500 of the T-2 trendline. The confirmation tells us to remain defensive until something changes for the better.

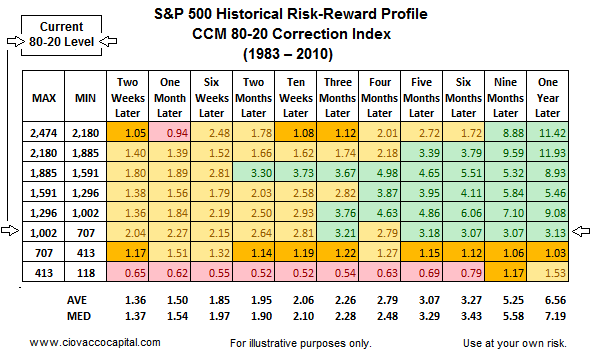

The current reading of the CCM Bull Market Sustainability Index (BMSI ) highlights the following important points from a longer-term, need-to-remain-flexible-and-open-minded perspective:

- We remain in a bull market based on what we know today.

- Stocks have pulled back sufficiently where historical risk-reward ratios are now more favorable. In the upper-right portion of the table below there is quite a bit of green (favorable) and high numbers (favorable).

The “favorable” readings on the CCM BMSI mean very little unless we see some improvement in the market’s fundamental and/or technical profile. The BMSI helps us keep an open mind in the event that the big picture improves over the coming days or weeks. This is a time to be defensive, but not yet a time to throw in the towel on the current bull market. In Cloud Says Stocks May Fall Further. we cover more material related to the current state of the stock market.

This entry was posted on Monday, June 13th, 2011 at 9:32 am and is filed under Risk-Reward. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.