Stocks Bonds Politics Mark Hulbert and the Use of the VIX as a Timing Model

Post on: 16 Март, 2015 No Comment

Monday, October 10, 2011

Mark Hulbert and the Use of the VIX as a Timing Model

Fitch downgraded Spain’s debt by two notches on Friday, taking the rating to AA- from AA+. The outlook remained negative. Fitch downgraded Italy’s one more notch to A+. Portugal was kept by Fitch at BBB-, just above junk. We are nowhere near the end of the sovereign debt crisis. The austerity measures by Western governments will likely have further negative impacts on GDP growth and will consequently place additional pressure on the debt ratings of several developed countries.

Some people want to know whether a junk bond is safe. What can you say in response to a question like that one. The mere asking of the question reveals a lack of common sense. If you ask it, and are serious in wanting an answer, then you need to immediately cease from managing your own money. Obviously, no security that fluctuates in value is safe. Is this Bond Safe? To ask whether a junk rated bond is safe indicates a total lack of the most basic and rudimentary knowledge necessary to manage money. It is unfortunate that so many individuals make investment decisions based on so little.

Andrew Bary argues in his Barrons ‘ column that the plunge in junk bond prices over the past several weeks have made them alluring to patient income investors. This assumes, of course, no Lehman like financial meltdown or another deep recession anytime soon. Of the bonds owned in my Junk Bond Ladder Strategy. a few thousand in the red now, one is mentioned specifically in that column, the Texas Industries 9.25% senior bond maturing in 2020. That bond is now trading mostly in the 75 to 79 range recently. FINRA I purchased just one bond in July 2011 at 97.5 which seemed reasonable at the time, but the bond has cratered since then with the rest of the junk bond market. Bought 1 Senior Texas Industries 9.25% Bond Maturing 8/15/2020 at 97.5 As long as Texas Industries survives to pay par value, I have only lost the opportunity to buy that one bond at a lower price.

The Bank of England announced a new quantitative easing program last week. The Bank will create 75 billion in money to buy bonds. The Bank of England’s Governor said the world is facing the most serious financial crisis we’re seen, at least since the 1930s, if not ever. This remark started a debate among staff members here at HQ on whether hedges need to be purchased for a potential upward acceleration in volatility and a waterfall slide in stocks.

The Washington Post reports that Iraq is providing assistance to the Syrian dictator in cooperation with Iran.

This is going to be a long post. I view the topic as important.

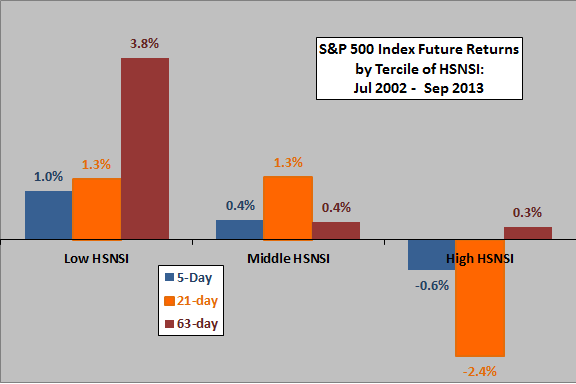

1. Mark Hulbert and the Use of the VIX as a Timing Model for Stock Allocation: I exchanged a few emails with Mark Hulbert about the use of the VIX to time movements into and out of stocks. I sent him several links to my discussions, published over the past three years in this blog, including the one explaining my model in relatively simple terms. Vix Asset Allocation Model Explained Simply

Long time readers are already familiar with that model. In Mark’s columns, he mentioned that a simple allocation model would be to buy stocks when the VIX was below 20 and move into cash when the VIX went over 20. MarketWatch 10/3/11 MarketWatch 9/6/2011 MarketWatch 8/1/2011 I did not notice his first two columns until I spotted the last one. Near the end of this section, I will discuss some of my comments about those two columns found at Marketwatch after I go into more detail about my own Model, first developed in a few minutes in 2007, after looking for the first time at the long term VIX chart and scrolling through the VIX price information. The pattern was both clear and obvious.

Based on historical evidence, an investor using my VIX Asset Allocation Model could have successfully timed movements into and out of stocks over the past twenty one years. A hypothetical investor, desiring to make only one decision, stocks or bonds, would have been able to navigate the last 21 years successfully. That simple minded investor would have been in stocks during the Stable Vix Periods and in bonds during the Unstable Vix Periods. It is just that simple.