Stocks at multiyear low prices Bargain buys or value traps Page 2 Economic Times

Post on: 24 Апрель, 2015 No Comment

Many investors buy stocks when they fall, thinking that the decline will stop and they will gain when it bounces back. They are right. The fall in price will eventually stop, but the question is, when, and there is no easy answer for this. It could be 10%, 25% or even 50% below their purchase price. The savage cuts in counters like MCX and Gitanjali Gems did not stop after hitting the 50% mark. The latter crashed from Rs 649.50 to Rs 56.50 in less than four months, before it stabilised. MCX is still stuck in the lower circuit on a daily basis.

All-time lows are not buy signals

Several stocks have hit their all-time lows in recent weeks, but this does not mean they are worth buying. In fact, according to technical analysis, all-time highs are buy signals and all-time lows are sell signals. Even on a fundamental basis, one needs to see why the prices of these stocks are at their nadir. A closer look at the BSE-200 and CNX 200 stocks reveals that most all-time lows are due to the fact that these stocks were listed recently.

It may not be right to compare the current price of a stock with its 2003 price even if it has been adjusted. Don’t look at the price; consider the value that you are getting. Is the intrinsic value of the stock higher than the price at which you are buying it today? asks Udasi. This is because these companies have generated enough profits since then and their net worth has gone up. A better way is to compare the valuation of the stock 10 years ago with its current valuation.

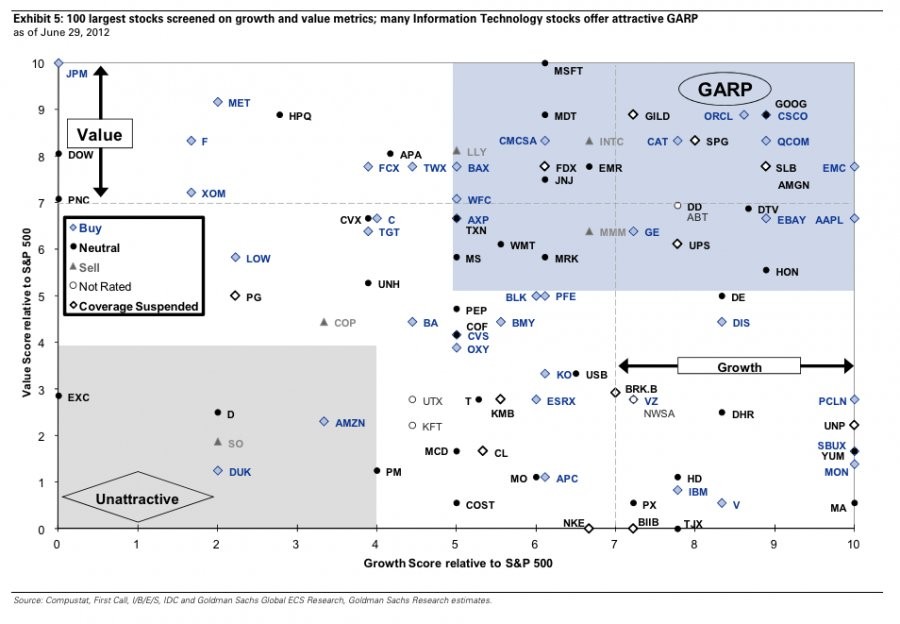

A study of the BSE-200 and CNX 200 universe shows that most of them are still trading at richer valuations compared with their prices 10 years ago (see graphic ). This proves that the downside in the broader market may not be over yet. Though the PE or price-to-book value ratio should help screen the stocks, investors need to use more sophisticated tools like discounted cash flows to arrive at the intrinsic value before they buy them.

Avoid bad businesses

Another way to avoid the value trap is by distinguishing between a cheap stock and a good stock. Though one may not be able to identify a company with a strong business model and high growth rate among the beaten down stocks, investors must steer clear of the outrightly bad businesses. In other words, buy the best company from the worst businesses, and don’t buy any stock just because its price has come down or because it is quoting cheap. Look into the reasons for its low price.

Make sure that its business model has not become unviable due to changes in technology or market dynamics. This is because it may not take much time for a sunrise industry to become a sunset industry. Indosolar, the leading Indian manufacturer of solar photovoltaic cells, is in the doldrums now due to dumping by China.

Management is crucial

Since value picking opportunities usually crop up during bad economic cycles, you should give importance to the management’s capabilities. Avoid a company whose management is incapable of piloting it through difficult times, says Sanjay Sinha, Founder, Citrus Advisors. You should also avoid the firms and promoters with dubious reputations. Investors need to make sure that the company is high on corporate governance and not run solely in the interest of the majority shareholder, says Chetan Sehgal, CIO (India), emerging markets group, Templeton Equity.

Avoid leveraged companies

Also avoid firms that have high foreign debt because their liability will zoom due to the fall in the rupee. Another point worth watching is the leveraging at the promoter level. In certain companies, the promoters are leveraged. We would be very wary of investing in them, says Sankaran Naren, CIO, ICICI Prudential Mutual Fund. Many mid-cap stocks have crashed in the past 1-2 years after the shares pledged by promoters were sold.

Even if you want to get in now, don’t go the whole way. Instead, stagger your investments. In a falling market, one may have made the right stock selection, but the right price may be elusive in an overall bearish atmosphere, says Sinha. Put in only 10-15% right now. And then wait for prices to fall.